Highlights:

- CNB cuts interest rates from 6.25% to 5.75%!

- Inflation in the US is not slowing down – the Fed will continue to be cautious (so nothing new there)

- Swiss CB first of the big CBs to cut interest rates

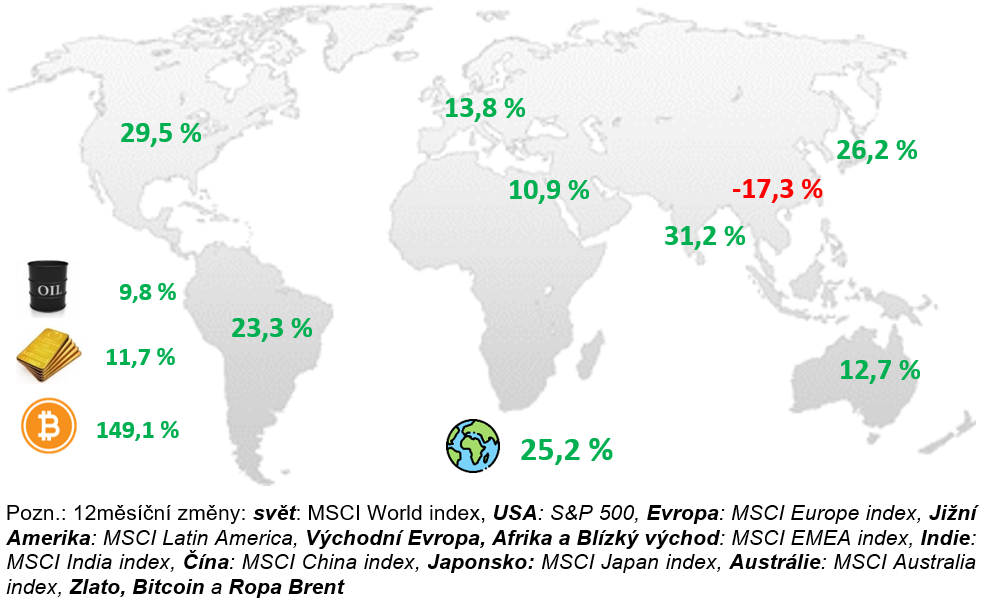

12-month change in selected indices

Comment:

Equity markets in both the US and Europe continue to rise, with the S&P 500 index gaining over 10% since the beginning of the year and surpassing one peak after another. China, on the other hand, has not yet recovered sufficiently since the start of the year and stocks are still posting negative appreciation of over 2%.

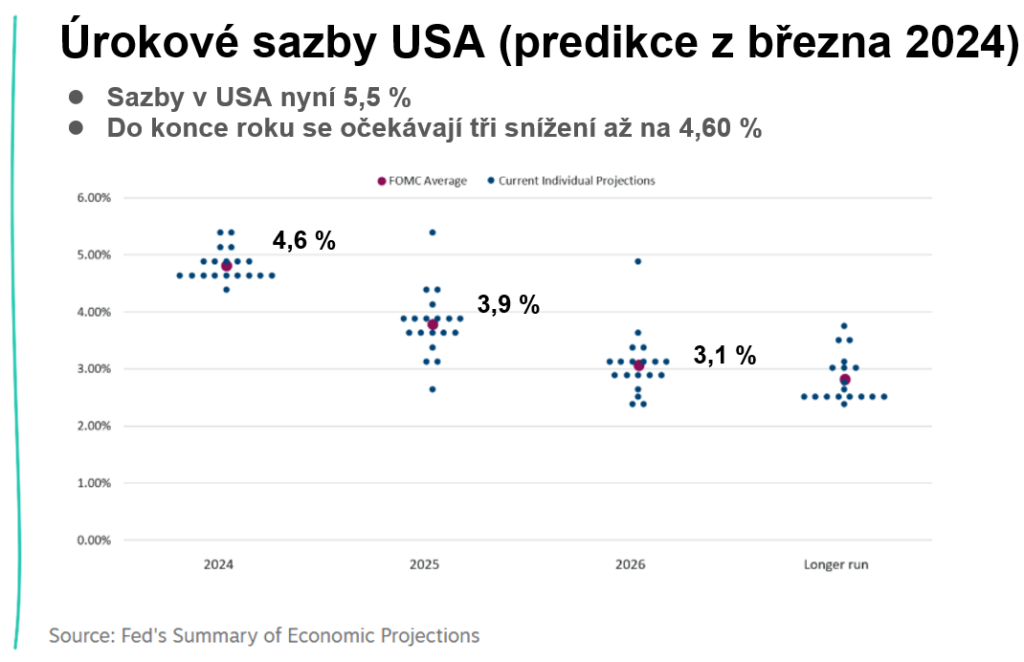

Inflation in the US, although at low levels (3.2% for February), is still unable to be tamed below the targeted 3%. Hence, the Fed remains more cautious for now, preferring to leave rates at current levels for longer. This was said at the meeting held on 20 Mar 2024. However, it is still expected that there will be a total of 3 interest rate cuts already this year, and thus they should be at 4.6% by the end of the year. Unemployment is also still low and GDP continues to grow.

It looks like the oft-mentioned soft landing could occur and inflation will fall past 3% without causing any recession and stock market crashes. But those dips often come mostly at times when no one expects it and everything seems rosy, as it has recently.

In March, in addition to the Fed meeting, we also saw other central banks such as the ECB, Bank of England, Bank of Japan raise their interest rates from negative -0.1% to 0% for the first time in about 10 years. Admittedly not much progress, but at a time when the big CBs are about to cut or are already cutting, the Bank of Japan is instead raising rates.

Also, there was a meeting of the CNB, which continues to cut interest rates and cut rates from 6.25% to 5.75%. Year-on-year inflation for February was 2% and appears to be meeting the inflation target for the first time in some time.

And how did other assets besides equities perform? Commodities in particular have fared well, with both oil and gold in particular rising since the start of the year, hitting new highs of $2,270 per troy ounce at the end of March and continuing to rise since then. There could be several reasons for this, fears of a bigger crisis coming or large institutions and countries buying gold into inventory and thus driving up the price.

Bitcoin has also thrived, surpassing its 2021 highs and reaching as high as USD 73,600. But it then corrected and fell by almost 20% and is now around USD 70 000. This is the first time that Bitcoin has surpassed new highs before the expected halving, which occurs once every 4 years and will happen on April 20, 2024. Bitcoin usually rose significantly after the halving, but its price has been pulled up in recent months mainly by the inflow of new money through ETFs.

US:

The annual inflation rate for February was as expected at 3.2% in the US and still fails to tame it below the targeted 3%. This is the same pattern for several months now, with energy prices falling but inflation being pulled up mainly by services, which is certainly not a positive signal. The Fed therefore continued to temper expectations for interest rate cuts at its meeting on 20 March.

At the last meeting, a new Dot chart was also published, where we can see the forecasts of the individual Fed members. From it we can see that rates are expected to be at 4.6% by the end of the year, which means 3 interest rate cuts already this year. However, no more drastic interest rate cuts are expected for the next few years and the Fed wants to keep interest rates around 3% for the long term.

Following the last meeting, 10-year US Treasury bonds have also risen to 4.3%, up from just 3.8% at the start of February, which is certainly not a positive signal for equity markets.

Despite this, the S&P 500 index gained 3.2% for March.

Europe:

The annual inflation rate for the month of February in the European Union was 2.6%, following a gradual downward trend. While the ECB has no reason to cut interest rates quickly yet, it is likely to do so in the coming months. For March, inflation is even expected to fall to 2.4%.

The Bank of England said at its meeting in March that they believe they have managed the battle with inflation and will be cutting interest rates this year.

The Swiss central bank is of a similar mindset, which they say has tamed inflation and even became the first major CB to commit to its first interest rate cut. It should be noted that inflation in Switzerland has certainly not been as high as in the European Union and has kept interest rates lower overall. In fact, the reduction was from 1.75% to 1.5%.

European shares represented by the DAX 40 index or the MSCI Europe are thus rising on the wave of optimism about contained inflation and the expected reduction in interest rates.

CR:

The annual inflation rate for February was just 2%, still within the CNB’s tolerance band, and this chapter seems to be closed for the CNB. But now its view should be more focused on getting the economy kicking again and achieving real GDP growth. For now, the Czech Republic is the only EU country that is lagging so far behind in GDP that it still has not managed to get to 2019 levels.

The CNB therefore decided to cut interest rates by 0.5% on 20 March 2024, bringing the 2-week repo rate down from 6.25% to 5.75%. There was a majority consensus in the vote, with 5 out of 7 board members voting for a cut to 5.75% and two members even voting for a cut to 5.5%.

The CNB then expects to cut interest rates to 4% at the end of 2024 and then to continue the reduction to 2.6%.

CNB forecast (from the February meeting)

Source. CNB

In the context of interest rate cuts, property prices and especially bond prices, which are rising as a result of interest rate cuts, are starting to rise slightly again. The fall in rates is also reflected in the average interest rate on mortgages, which has been falling for several months and is now at 5.6%.