Main events:

- CNB reduced interest rates to 5.25%!

- Year-on-year inflation in the US at 3.4% (finally a little better numbers)

- The ECB cut interest rates before the Fed!

Don’t forget to look at the appendices at the end of the news, where we have prepared a Comparison of equity funds across regions or thematically focused funds for you!

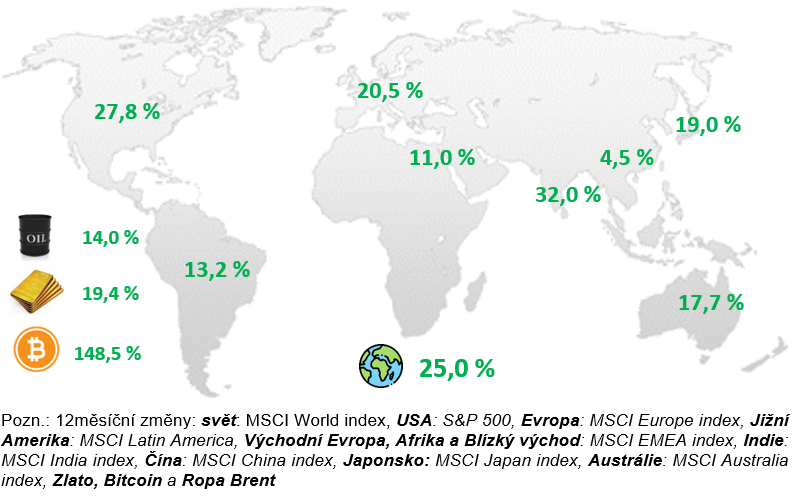

Change over 12 months of selected indices

Comment:

Investors were not frightened by the smaller correction in April, and in May the stock markets rose again and reached new highs. Both the S&P 500 index and the European index gained around 5% in May. China also continued to grow, as the government came with another massive wave of support both for the stock markets and, above all, for the economy as a whole, and the expected GDP growth for 2024 was thus revised to 5%.

At the meeting of the CNB held on 2.5. In 2024, as expected, there was a further reduction of 0.5%, that is, from 5.75% to 5.25%. However, according to the CNB’s new prediction, there will be no further major reduction until the end of 2024, probably only a cosmetic reduction to 5%, but otherwise the CNB wants to be restrictive for a longer period of time and keep rates higher. This direction is also confirmed by inflation data for April, where year-on-year inflation jumped up to 2.9%. This surprised even the CNB itself, which expected 2.5%. The increase was mainly due to energy and food prices, i.e. very volatile items.

The year-on-year inflation rate for April in the US is still around 3.4%, but this time the incoming data was as expected and the important thing is that inflation is not accelerating any further. Unemployment remains stable at slightly below the 4% mark. The Fed thus continues to signal 1 to 2 reductions by the end of the year, the first reduction could come already at the meeting in September, but who knows.

On the contrary, the ECB until the meeting held on 6.6. 2024 really backed up and, according to their predictions and expectations, lowered interest rates from 4.5% to 4.25% for the first time in a long time. Although this is only a slight reduction, it sends a signal that the fight against inflation is probably over in Europe.

And how did other assets besides stocks perform? Both gold and Bitcoin are holding slightly below their peaks, and at the end of May there was another positive news from the crypto world, namely the approval of an ETF for the 2nd largest cryptocurrency, Ethereum. Again, this only applies to funds with an American ISIN, in Europe this change will not really affect us.

CR:

The year-on-year inflation rate for April surprised and rose up to the CNB’s tolerance band to the level of 2.9%. The reason was a slight increase in energy and food prices after a long period of time. These are very volatile items, and if they continue to grow, inflation could exceed the CNB’s tolerance band.

Even before the publication of these data, the CNB at the meeting held on 2.5. 2024 reduced interest rates from 5.75% to 5.25%. All 7 members of the bank board voted for the reduction, making it a unanimous decision after a long time.

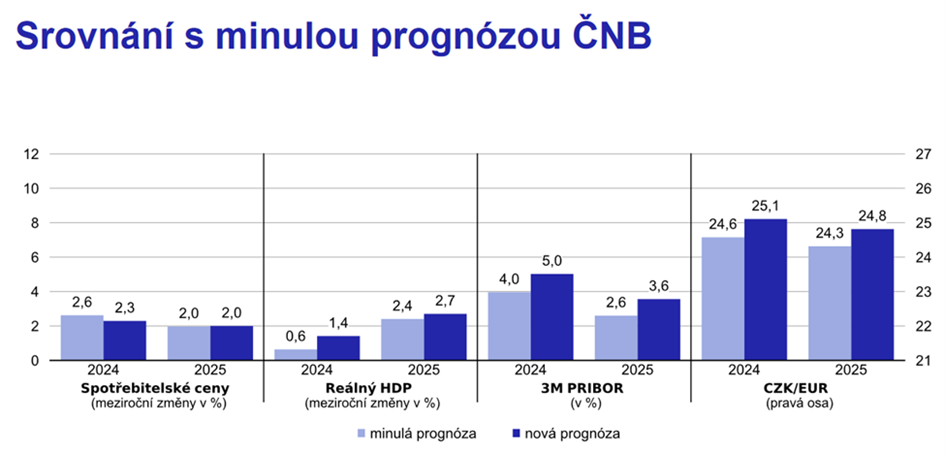

According to the CNB’s new prediction, however, it expects that interest rates could be around 5% at the end of 2024, and thus there would only be a slight reduction, and by the end of 2025, the CNB expects rates to be 3.6%. This is a tightening of expectations and interest rates will probably not fall as fast as expected.

Source: CNB, forecast as of May 2. 2024

On the contrary, the CNB expects the economy to pick up again and higher real GDP growth, which until then was only forecast at the level of 0.6%, today the CNB already expects growth for the year 2024 of up to 1.4%!

USA:

The year-on-year inflation rate for April came out in the US after a longer period of time at the level of 3.4% as expected, and it still cannot be tamed below the targeted 3%. After a long time, however, there was no acceleration in growth, not even surprising data, and it is possible that there will be no further acceleration.

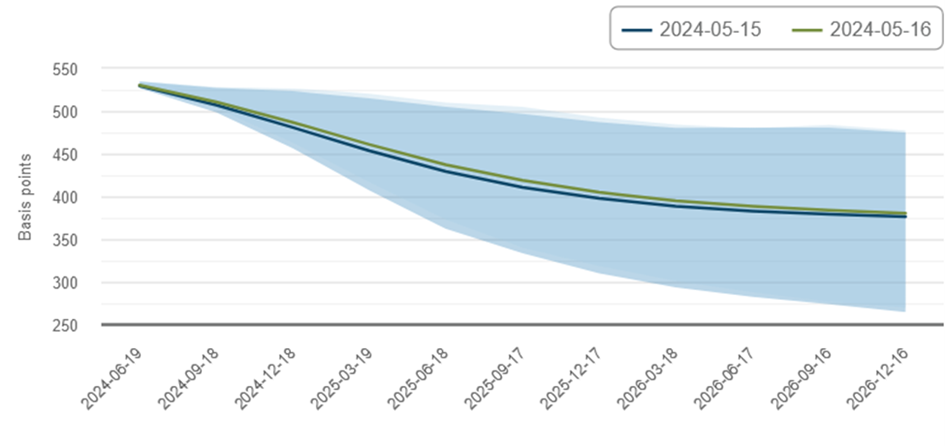

There was no Fed meeting in May, we have to wait until mid-June, when we will learn the latest inflation forecasts and the expected reduction in interest rates. So far, 1 to 2 interest rate cuts are still expected by the end of 2024.

The number of expected Fed rate cuts through the end of 2024

Source: atlantafed.org

Following the latest inflation data, 10-year US government bonds started to fall slightly, and the positive expectations of investors contributed to the growth of the indices to new highs. This was also helped by the good results of the largest technology companies over the last quarter, and especially the results of NVIDIA, which continues to point to the positive sentiment of the semiconductor and technology segment in general.

The S&P 500 index gained less than 5% in May, the NASDAQ 100 even 6.5%.

Europe:

ECB at the meeting held on 6.6. 2024, for the first time in a long time, it reduced interest rates from 4.5% to 4.25%. It is only a slight reduction, but it has come. And it was as expected and according to the predictions of the ECB from previous sessions. Thus, the central bank did not wait for the Fed to come up with the first reduction, but took matters into its own hands.

By the end of the year, however, only one or two further interest rate cuts are expected. The ECB probably doesn’t want to cut rates significantly more than the Fed, because that would eventually have the effect of weakening the euro against the dollar.

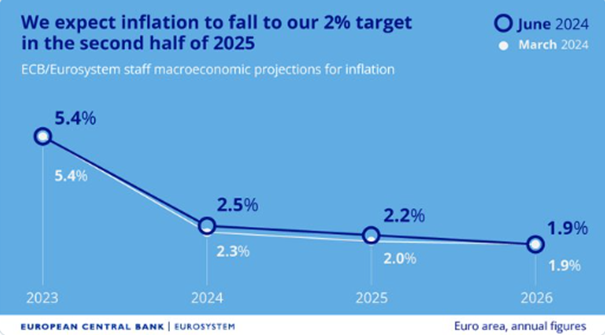

The year-on-year inflation rate for the month of April in Europe remains at the expected 2.4%. But the preliminary data for May points to a slight increase to 2.6% and even the ECB expects, according to the new prediction, that inflation in the future will be slightly higher than they expected so far. But these are only minor cosmetic increases.

Source: ECB, forecast from the 6.6 meeting. 2024

Inflation in Europe has thus been fully brought under control, and from this point of view the ECB and the whole of Europe can relax. Now it is necessary to focus on GDP growth and increasing competitiveness against the USA and China.

Thus, after a minor correction in April, the European index MSCI Europe even gained more than the S&P 500 in May, namely 5.03%. Since the beginning of the year, MSCI Europe has gained just under 8%.