Main Events:

• A longer period of correction in the stock markets (expected recession?)

• Fed to cut interest rates by 0.5% already in September!

• CNB continues to lower interest rates to 4.50%

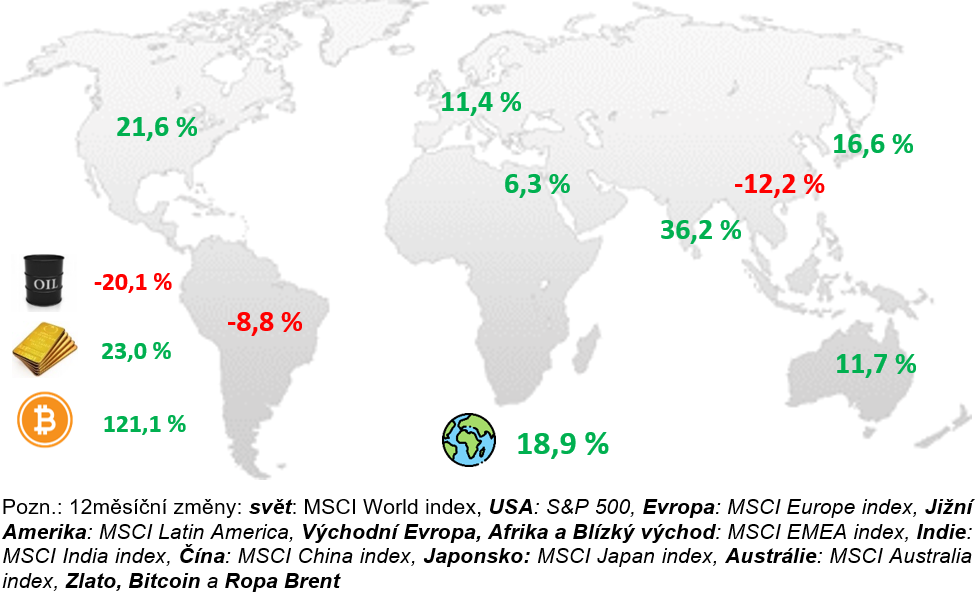

Change over 12 months of selected indexes

Summary:

After a longer period, stock indices experienced a small correction in July, especially technology stocks. Although the S&P 500 index ended July with a slight gain after the Fed meeting, the NASDAQ 100 technology index fell by almost 3% in July.

Larger declines, however, occurred at the beginning of August with the release of economic figures, especially unemployment results. Unemployment itself surprisingly rose to 4.3%, marking a multi-month upward trend. Concerns about an impending recession are re-emerging. The decision by Buffett to sell half of his position in Apple didn’t help either.

The S&P 500 index was then in the largest decline about 10% below peaks due to concerns, while the NASDAQ 100 was even 15% below highs. Since the beginning of the year, however, both indices are still up more than 10%, so it’s just a minor correction.

The Japanese index Nikkei 225 experienced a greater decline, falling up to 12% in one day. The main reason was the Bank of Japan meeting, which at the end of July raised interest rates from 0.1 to 0.25%.

At first glance, a small increase, but it caused the Japanese yen to strengthen against the dollar and other currencies by up to 10%. It also ended cheap financing in Japanese yen for many traders. Both factors caused declines in the Japanese index.

As for the year-on-year inflation results in Europe, it remained at low levels around 2.5% for June. The ECB, however, still signals that there will likely be no significant interest rate cuts by the end of the year, and we will probably see just one cut. But if the Fed starts cutting rates faster, the ECB might follow suit.

In contrast, the CNB continues to lower interest rates and also reduced rates from 4.75 to 4.50% at the last meeting on August 1. The year-on-year inflation rate for June was again at the level of 2.0%.

Inflation in the USA is likely on a definitive downward trend after a longer period, with the year-on-year rate for June at 3.0%. Services and real estate prices are no longer driving growth, and it seems that the era of higher inflation is behind the USA.

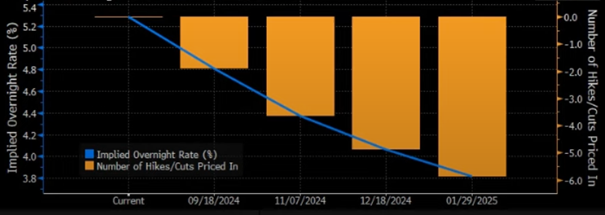

The Fed did not lower interest rates at the July 31 meeting but signaled rate cuts at the September meeting. By the end of the year, it was expected that rates could drop by approximately 0.75%.

However, following unemployment results and the expected recession, the expected rate cuts changed at the beginning of August. By the end of the year, it’s now expected that the Fed will cut rates by up to 1.25%. These are significant changes because just a month ago, a reduction of 0.25 to 0.5% was expected by the end of the year.

And how did other assets fare? Gold reached new highs, exceeding 2500 USD per troy ounce, and the nervousness in the capital markets is evident. Bitcoin rose again in July, approaching new highs after Donald Trump stated he wants to make the USA the “cryptocurrency capital of the world” if elected. However, at the end of the month, bitcoin became part of larger declines due to poor economic figures from the USA.

Czech Republic:

The year-on-year inflation rate for June remains within the tolerance band and was again at the level of 2%. After increases in previous months, it has decreased again.

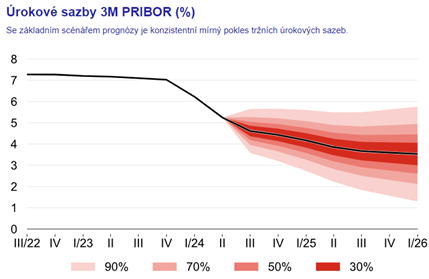

The CNB, following inflation results from recent months and economic developments, reduced interest rates by another 0.25% at the meeting on August 1. Specifically, from 4.75% to the current 4.50%. All 7 members of the bank board voted for the cut.

The interest rate cut was expected and is just a minor reduction.

However, the CNB continues to perceive inflationary risks, especially in the context of renewed real estate price growth, increased demand for mortgage loans, and the expected growth of real wages, which grew by up to 7% year-on-year.

Even 5-year interest rate swaps are falling to as low as 3.4%, and further reductions in mortgage loan rates are likely in the coming months.

Source: CNB, forecast as of August 1, 2024

We also received a new forecast from the CNB for the year 2024 and beyond. By the end of the year, only mild interest rate cuts are expected, and for 2025, only gradual interest rate reductions are anticipated.

GDP in the second quarter grew by 0.3% quarter-on-quarter and 0.4% year-on-year. The growth was mainly driven by household consumption, and GDP slightly exceeded analysts’ estimates. Nevertheless, according to the new forecast, the CNB expects lower GDP growth for 2024 at 1.2% from the originally expected 1.4%.

USA:

Inflation in the USA is likely on a definitive downward trend after a longer period, with the year-on-year rate for June at 3.0%. Services and real estate prices are no longer driving growth, and it seems that the era of higher inflation is behind the USA. For the Fed and financial markets, this is definitely positive news.

At the Fed meeting held on July 31, there was no interest rate cut yet. However, the Fed signals rate cuts at the next September meeting. By the end of the year, it was expected that rates could drop by approximately 0.75%.

Market expectations regarding interest rate cuts

However, following unemployment results and the expected recession, the expected rate cuts changed at the beginning of August. By the end of the year, it’s now expected that the Fed will cut interest rates by up to 1.25%. These are significant changes because just a month ago, a reduction of 0.25 to 0.5% was expected by the end of the year.

Unemployment itself surprisingly jumped to 4.3% and has had a growing trend for several months. The number of newly created jobs was 114 thousand instead of the expected 175 thousand.

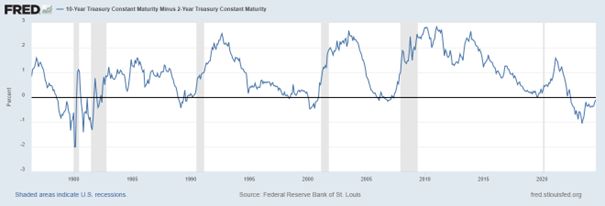

For the past two years, we have also witnessed the so-called inverted yield curve. This is a situation where, for example, a two-year bond yields higher than a ten-year one. Why is that? It is due to the expected recession, during which interest rate cuts will occur, and this inverted state will then straighten out.

When the yield curve is so-called inverted, it is an abnormal state and historically has been a reliable indicator of an impending recession. Whether in the 1970s or in 2008, when the inverted yield curve occurred, historically, in all cases, a recession followed approximately within a year.

Difference in yield between 2 and 10-year US bonds

Today, however, the inverted yield curve has been in place for more than 2 years, and a recession has not yet occurred. It is possible that it will occur when the curve straightens again, and unemployment starts to rise. Both are happening right now.

The S&P 500 index gained slightly over 1% in July, while the NASDAQ 100 fell by almost 3%. However, both indices are declining since the beginning of August.

Europe:

The year-on-year inflation rate for June in Europe remains at the expected 2.5%, and inflation figures confirm again that the episode of high inflation is over.

The ECB meeting in July brought no surprises. Interest rates remained unchanged, and the ECB still signals that there will likely be no significant interest rate cuts by the end of the year, and we will probably see just one cut. But if the Fed starts cutting rates faster, the ECB might follow suit.

Purchasing Managers’ Index (PMI) for the European Union

European industry and the overall economy are still not in the best shape in Europe. Year-on-year GDP growth for the 2nd quarter was at a weak 0.3%. The Purchasing Managers’ Index, known as PMI, is still below the level of 50, indicating a worsening situation in the manufacturing sector.

The European MSCI Europe index slightly grew by 2.16% in July. However, the French index is still in a larger decline, about 15% below peaks.