Main events:

• Trump won the election and will become the 47th president of the USA

• Fed, ECB, and CNB continue to lower interest rates

• Stock index S&P 500 surpassed new highs and the 6,000 USD mark

Summary:

Trump won the election and will be elected the 47th president of the USA. In the end, it was not a close election, as Trump won with a clear majority, receiving over 300 electoral votes from the 270 needed for his election. At the same time, the Republicans managed to retain the Senate and thus still hold the majority.

Whether Trump will be able to end the war in Ukraine or will impose tariffs on imports of goods from the European Union is still unknown, but we as investors are interested in what impact his election had and will have on the financial markets and the overall economy?

The initial reactions are as follows: The S&P 500 index, even after the Fed meeting, surpassed new highs and reached a level of over 6000 USD. Other stock indices are also rising, and small caps companies are particularly doing well. His election could likely be positive for stocks in the future as he plans to reduce corporate tax.

For bonds, however, his election was not positive, as especially long-term bond yields rose and reached up to 4.5% again.

This is due to expectations of higher government deficits, higher economic growth, but consequently expected higher inflation. However, we will have to wait some time for the real impacts and implementation of Trump’s promises.

But let’s move on to macroeconomic numbers, where the year-on-year inflation rate in the USA for September came out slightly above expectations at 2.4%. Nevertheless, it is still a declining, and thus positive trend.

Unemployment in the USA, however, again came out at 4.1% for October, but a slight increase to 4.3% is expected by the end of the year.

On November 7, 2024, a Fed meeting was held, which continues to lower interest rates, specifically the so-called Fed funds rate therefore decreased from 5 to 4.75%. Members of the American central bank opted for only a slight reduction in interest rates this time.

The year-on-year inflation rate for September here again came out at a slightly increased level of 2.6%. Further, at the beginning of November, specifically on November 7, 2024, a CNB meeting was held, which again slightly lowered interest rates, this time from 4.25 to 4%.

Regarding the year-on-year inflation results in Europe, it remained below the 2% threshold for September, specifically at 1.7%. A slight increase above 2% is expected for October and the coming months.

On October 17, another ECB meeting was held, which lowered interest rates from 3.65 to 3.4%. After the previous significant reduction, only a slight reduction followed.

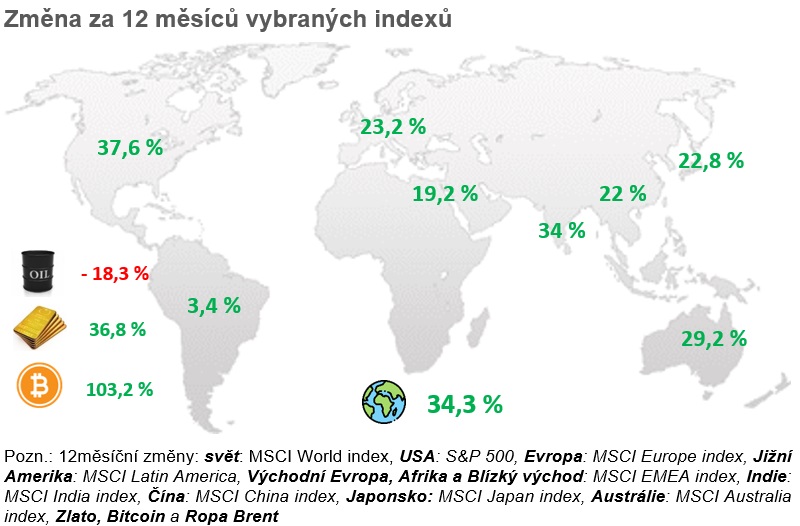

And how did other assets perform? Oil experienced a slight growth of 3% for October. Gold, however, again surprisingly reached new peaks at the end of October, specifically up to 2,800 USD per troy ounce. After Trump’s election, it fell by a few %, probably due to the strengthening of the dollar against other currencies.

Bitcoin, along with Trump, became the winner of the election and reached new peaks up to 76,000 USD. Trump was a strong supporter of Bitcoin during the campaign and even plans to purchase it for the US strategic state reserves.

Czech Republic:

The year-on-year inflation rate for September here again came out at a slightly increased level of 2.6%. It still remains within the CNB’s tolerance band.

At the beginning of November, specifically on November 7, 2024, a CNB meeting was held, which again slightly lowered interest rates, this time from 4.25 to 4%.

For this decision, five members of the bank board voted, one member voted to keep the rates at the current level, and one member voted for a decrease of 0.5%.

Source: CNB.cz

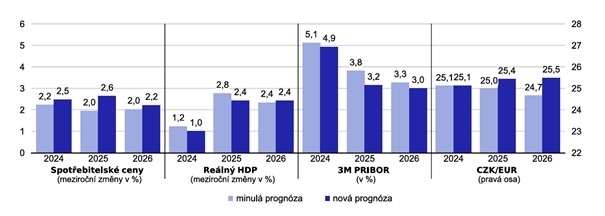

According to new forecasts, the CNB expects a temporary increase in inflation in the coming months due to rising food prices. In addition, core inflation remains elevated, especially in the services category. Therefore, the bank board will approach further monetary policy easing very cautiously in the future, or may completely halt rate cuts.

At the same time, the CNB expects smaller GDP growth either for the end of 2024 or for 2025, where it originally expected real growth of 2.8%, but according to new data, it lowered expectations to just 2.4%.

The yield on 5-year Czech government bonds rose again in October and currently brings 3.7% annually. This rate is particularly important for banks and 5-year mortgage fixations and the interest that banks offer on loans should be derived from it. However, they are not in a hurry to lower mortgage interest rates too much.

USA:

The year-on-year inflation rate in the USA for September came out slightly above expectations at 2.4%. Nevertheless, it is still a declining, and thus positive trend.

Therefore, the Fed and investors are focusing more on unemployment data for the next month, which again came out at 4.1% for October. However, a slight increase to 4.3% is expected by the end of the year.

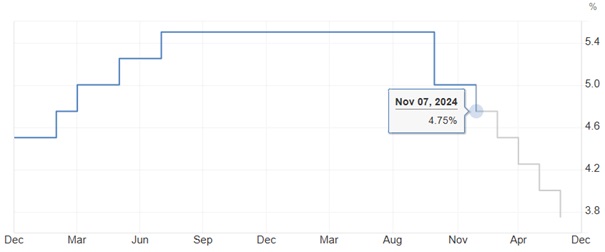

On November 7, 2024, a Fed meeting was held, which continues to lower interest rates, specifically the so-called Fed funds rate therefore decreased from 5 to 4.75%. Members of the American central bank opted for only a slight reduction in interest rates this time.

Forecast regarding interest rate cuts in the USA

Source: tradingeconomics.com

At the same time, according to the forecast, it is still expected that by the end of the year, the interest rate in the USA could fall to 4.5% and the Fed is thus counting on a milder reduction in interest rates than last month. This is probably due to better unemployment figures.

For 2025, further interest rate cuts to around 3.5% are expected.

The S&P 500 index for October only slightly decreased, specifically by 0.92%. But after Trump’s election as president and after the Fed’s interest rate cuts, the S&P 500 index surpassed new highs and reached a level of over 6000 USD.

Europe:

The year-on-year inflation rate for September in Europe remains below the 2% threshold, specifically at 1.7%. A slight increase above 2% is expected for October and the coming months.

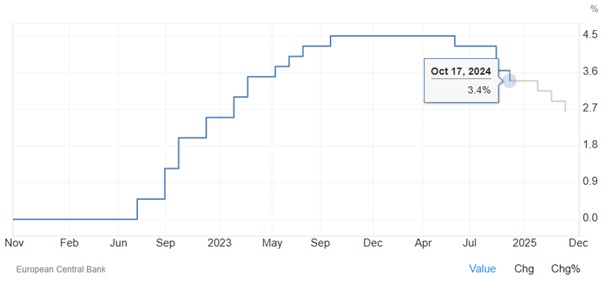

On October 17, another ECB meeting was held, which lowered interest rates from 3.65 to 3.4%. After the previous significant reduction, only a slight reduction followed.

ECB Forecast regarding interest rate cuts

Source: tradingeconomics.com

In the future, the ECB still expects to gradually continue with interest rate cuts, and by the end of 2025, they should be below 3%. In the long term, the ECB wants to keep interest rates at approximately 2.5%.

The European MSCI Europe index fell by 5.87% in October. The decline is likely due to the decrease in shares of the two largest European companies, specifically ASML and Novo Nordisk.