Main events:

• Peace talks in Ukraine

• Germany has a new chancellor

• CNB continues to lower interest rates

Summary:

Several interesting events took place in February. From elections in Germany, peace talks in Ukraine to the CNB meeting.

First, the peace talks, which have been ongoing more or less since Trump’s inauguration, whether first with Putin and only then with the Ukrainian president at the White House. However, before signing an important agreement on further assistance, a rift occurred between both parties, and no agreement has been reached yet.

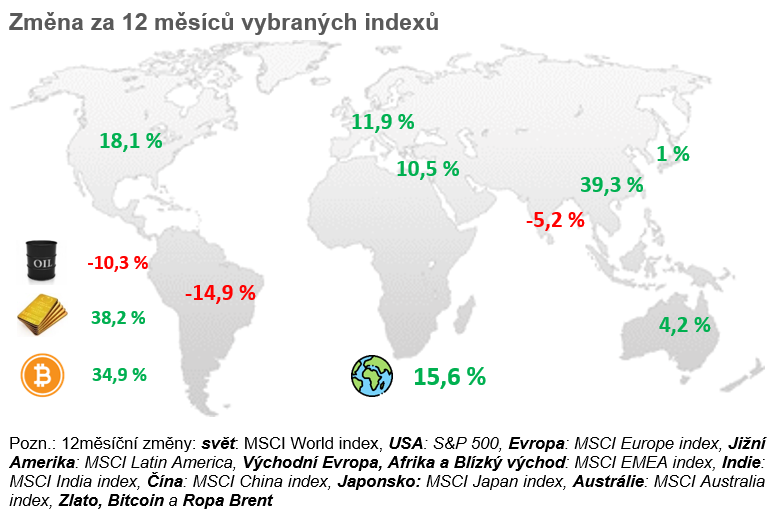

The situation changes every day, and further talks on a possible peace between Russia and Ukraine are likely to take place. On the stock markets, due to tariffs and these events, there is a slight correction, specifically the S&P 500 index by 5% and the NASDAQ 100 technology index by nearly 10%.

Trade wars continue, and the currently imposed tariffs on Canada and Mexico have indeed come into effect, and logically the affected states will retaliate. But we still have to wait for what tariffs will eventually be imposed on Europe.

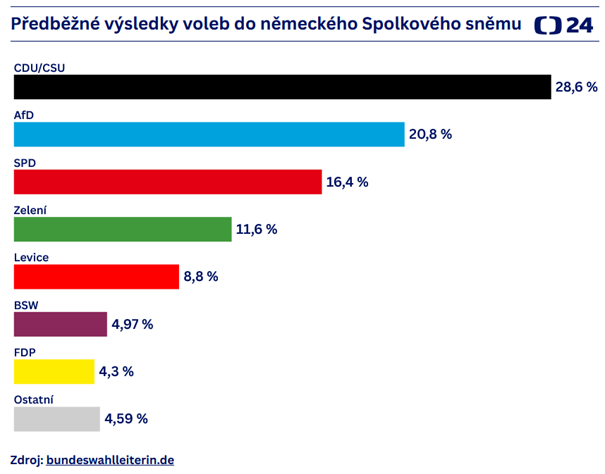

At the end of February, parliamentary elections were also held in Germany, and the CDU/CSU coalition won, and Friedrich Merz is likely to become the next German chancellor.

But let’s move on to macroeconomic figures, where the year-on-year inflation rate for January in the Czech Republic came out at 2.8%, resulting in a slight decrease. The rise was again driven by more expensive food.

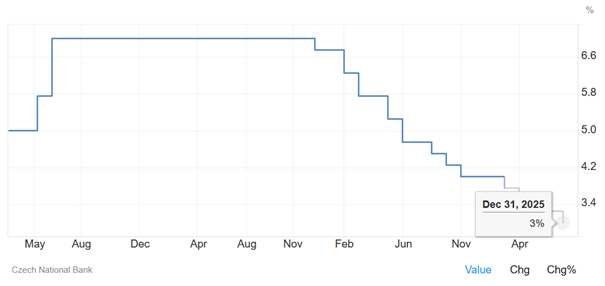

On February 6, 2025, another CNB meeting took place, which, after a December break, continues to lower interest rates from 4 to 3.75%. All 7 members of the bank board voted for the reduction.

The year-on-year inflation rate in the USA for January came out slightly above expectations at 3%. The slight increase is again due to the prices of goods, but also services.

In the coming months, a decrease in year-on-year inflation is still expected, but with the introduction of tariffs on imported goods, inflation could start reaching values above 3% again. But we are still far from that.

Unemployment for January in the USA remains at 4.0% and so far does not signal problems in the economy. In the coming months, a slight increase to 4.4% is expected, but this is likely due to layoffs and slimming down of government officials.

As for the year-on-year inflation results in Europe, for the month of January in Europe, it came out as expected at a slightly elevated level of 2.5%. For the coming months, however, a return to the 2% level is expected.

And how did other assets perform? Gold initially rose in February and almost reached the historical level of 3,000 USD per troy ounce. However, by the end of the month, it began to decline due to the weakening of the US dollar.

Bitcoin, after months of growth, fell nearly 25% below its peaks and was even briefly below 80,000 USD. This was related to a slight correction of the US S&P 500 index and overall technological and riskier assets.

Czech Republic:

The year-on-year inflation rate for January in the Czech Republic came out at 2.8%, resulting in a slight decrease. The rise was again driven by more expensive food.

On February 6, 2025, another CNB meeting took place, which, after a December break, continues to lower interest rates from 4 to 3.75%. All 7 members of the bank board voted for the reduction.

Interest rate set by the CNB and its forecast

Source: tradingeconomics.com

By the end of the year, however, CNB expects to proceed with further reductions to 3% levels. This is mainly due to lower expected GDP growth. In the previous forecast, the CNB expected GDP growth for 2025 to 2.2%, now it expects only 2%.

And the situation could probably worsen even more because Germany is still economically stagnant, and this will also affect an export-oriented economy like the Czech Republic. Therefore, CNB wants to stimulate economic growth more by lowering interest rates.

USA:

The year-on-year inflation rate in the USA for January came out slightly above expectations at 3%. The slight increase is again due to the prices of goods, but also services.

In the coming months, a decrease in year-on-year inflation is still expected, but with the introduction of tariffs on imported goods, inflation could start reaching values above 3% again. But we are still far from that.

Unemployment for January in the USA remains at 4.0% and so far does not signal problems in the economy. In the coming months, a slight increase to 4.4% is expected, but this is likely due to layoffs and slimming down of government officials.

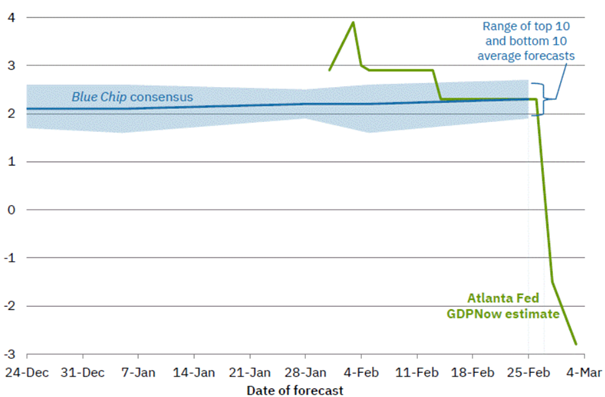

But when it comes to the future prediction of GDP growth, a turnaround is likely, as we are starting to find ourselves in an unstable environment concerning tariffs and other Trump actions.

The impacts of tariffs and overall trade wars are certainly not easy to predict, and it often turns out like other predictions that do not materialize.

Atlanta Fed’s forecast on US GDP growth

Source: tradingeconomics.com

But specifically, the Bank of Atlanta, which is one of the banks that is part of the Fed, showed its forecast for US GDP growth for the 1st quarter of 2025. And the forecast is worsening since January, and according to the latest numbers, they expect a quarterly annualized GDP decline of up to 3%. What the reality will be, we will see.

But how the Fed views the expected GDP growth and trade wars, we will have to wait until March 19, when the next meeting takes place.

The S&P 500 index is now in a slight correction of 5% from the peaks, and the NASDAQ 100 index is nearly 10%.

Europe:

The year-on-year inflation rate in Europe for the month of January came out as expected at a slightly elevated level of 2.5%. For the coming months, however, a return to the 2% level is expected.

However, important and very watched were the elections in Germany, which took place on Sunday, February 23.

• As expected, there was a significant drop for the SPD and former chancellor Olaf Scholz.

• The CDU/CSU coalition won, and Friedrich Merz is likely to become the next German chancellor.

• The AfD saw a significant increase from 10 to 20% and is popular mainly among young voters.

Source: tradingeconomics.com

However, the CDU/CSU does not hold a majority on its own and will again have to form a coalition government. Negotiations will take place in the coming months. It is possible, however, that Friedrich Merz will bring the desired change to Germany, as he wants to fight against illegal migration and also wants to reopen nuclear power plants.

European stocks have once again brought a positive return of over 3.5% for the month of February, and European arms manufacturers have been particularly successful in anticipation of higher state defense spending.