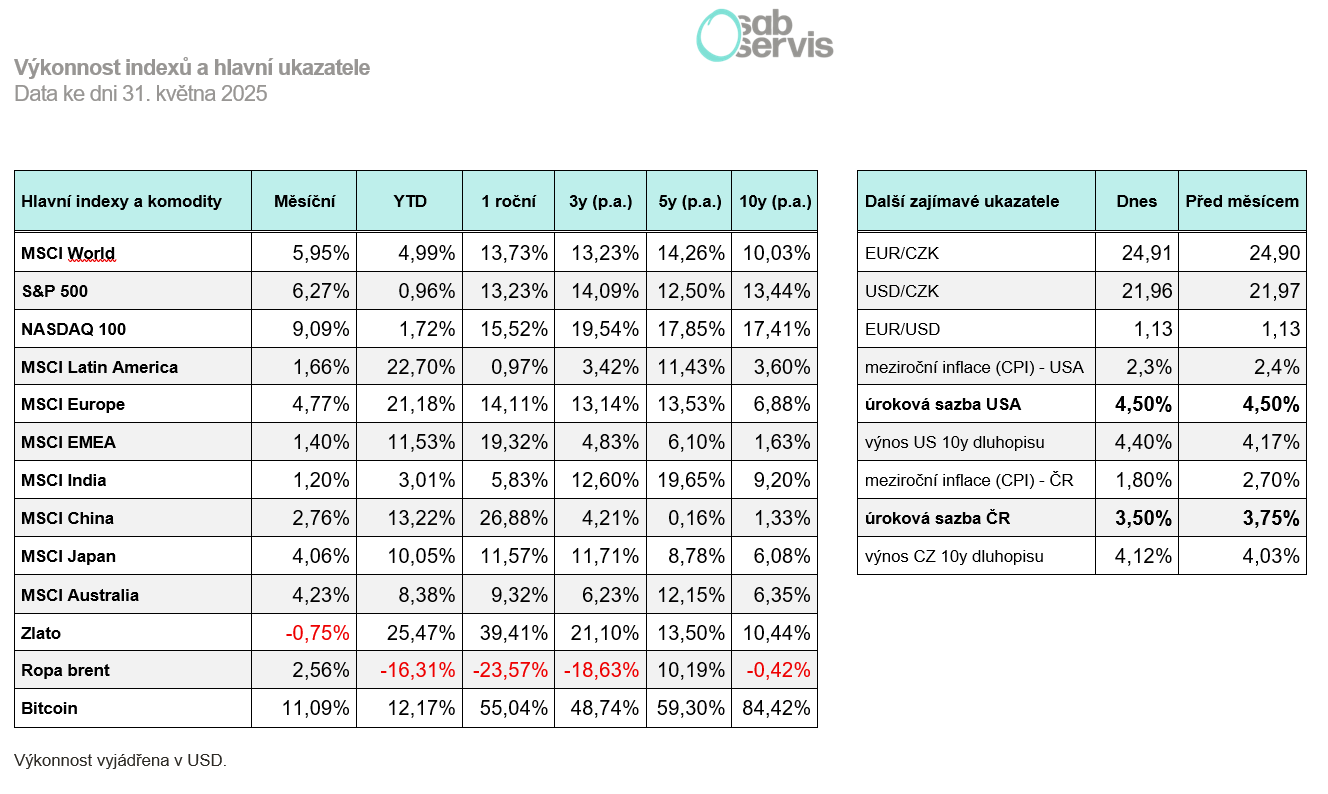

Main Events:

• Easing of tariff wars between the USA and China

• Fed kept interest rates at 4.5%

• CNB continues to reduce interest rates to 3.5%

Summary of the current situation:

May was again a calm month, and even an agreement was reached between the USA and China regarding tariff reduction. The tariffs were reduced by the USA from 145% to 30% and China, on the other hand, reduced tariffs on the USA from 125% to 10%, which might ultimately be considered a success for the USA, but the overall uncertainty and chaos caused by Trump definitely shook investor confidence.

On the other hand, at the end of May, news emerged that even the US Federal Court for International Trade overturned the tariffs imposed by Trump due to his low authority. Allegedly, important decisions such as the imposition of tariffs are within the competence of Congress, not just the president.

However, the appeals court has already reinstated the tariffs imposed by Trump, and there is now a legal battle over the legitimacy of the imposed tariffs. If the courts were to actually ban the imposed tariffs, it would be very positive for investors.

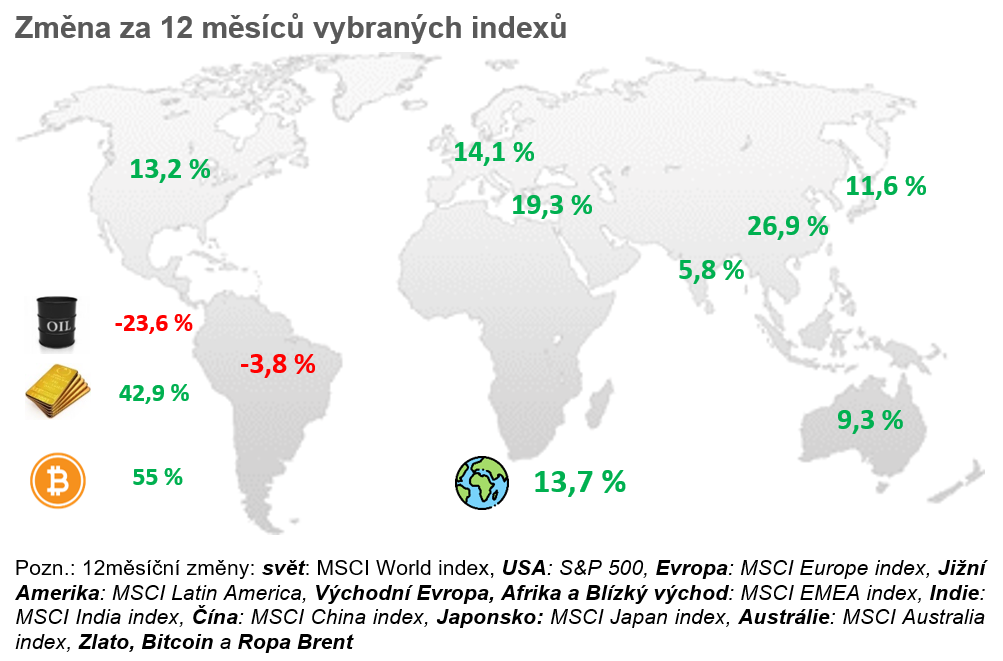

Therefore, stocks continued to grow in May, and the S&P 500 index is almost at its highs. The growth was also helped by again excellent results from NVIDIA, which more or less confirmed that the AI and datacenter boom is not ending yet.

And how did other assets fare? Gold is holding at levels around 3,300 USD per troy ounce, and bitcoin surpassed new highs and reached almost 112,000 USD. Compared to American stocks, it is again at its peaks and has been delivering positive results since the beginning of the year.

Macro Summary:

But let’s move on to macroeconomic numbers, where the year-on-year inflation rate for April in the Czech Republic surprisingly came out below 2%, specifically at 1.8%, and in the coming months, it is expected to stay slightly above 2%.

On May 7th, the CNB met, which again reduced interest rates from 3.75% to 3.5%. 6 out of 7 members of the bank board voted for the reduction.

The year-on-year inflation rate in the USA for April again came out slightly below expectations at 2.3%. In the coming months, a slight increase above 3% is still expected, partly due to the still rising prices of goods imported from China.

Unemployment for April in the USA is still holding at 4.2% and so far does not signal problems in the economy. In the coming months, a slight increase up to 4.4% is still expected.

On May 7, 2025, another Fed meeting took place, but the Fed kept interest rates at the current level of 4.5%.

As for the results of year-on-year inflation in Europe, for the month of April, it again came out as expected at 2.2%.

At the same time, on June 5, 2025, another ECB meeting took place, which continued to lower interest rates to 2.15%. Thus, it adheres to its plan of a gradual reduction to below 2%, which is the opposite of how the Fed has been behaving in recent months.

Czech Republic:

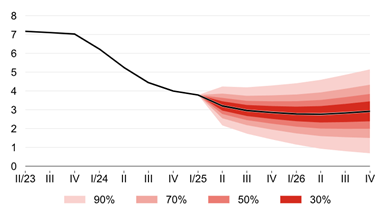

The year-on-year inflation rate for April in the Czech Republic surprisingly came out below 2%, specifically at 1.8%, and in the coming months, it is expected to stay slightly above 2%.

On May 7th, the CNB met, which again reduced interest rates from 3.75% to 3.5%. 6 out of 7 members of the bank board voted for the reduction.

By the end of the year, the CNB plans to reduce interest rates to below 3%. The CNB is increasingly aiming to kickstart and support the economy and GDP growth.

Forecast of Interest Rates in the Czech Republic

Source: CNB.cz

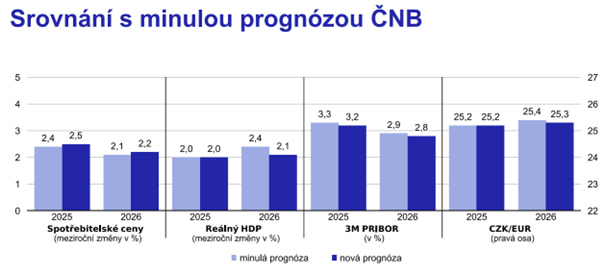

However, according to the new forecast, the CNB expects a lower expected GDP growth in 2026 and at the same time a slightly higher inflationary pressure.

Source: CNB.cz

USA:

The year-on-year inflation rate in the USA for April again came out slightly below expectations at 2.3%. In the coming months, a slight increase above 3% is still expected, partly due to the rising prices of goods imported from China.

Unemployment for April is still holding in the USA at 4.2% and so far does not signal problems in the economy. In the coming months, a slight increase up to 4.4% is still expected.

On May 7, 2025, another Fed meeting took place, but the Fed kept interest rates at the current level of 4.5%.

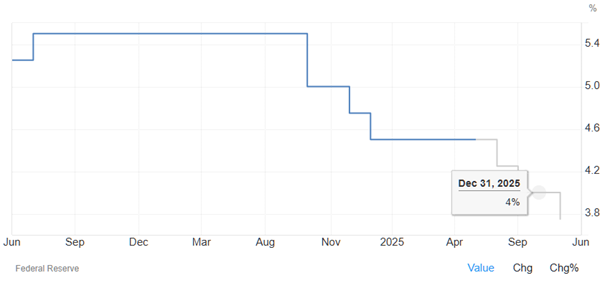

Prediction of Interest Rates in the USA

Source: www.www.tradingeconomics.org

In the coming months, according to Fed officials, we will likely see two interest rate cuts to a level of 4%. However, it is still a very gradual reduction and rather, according to the words of the Fed chief, they want to be more restrictive.

The reason is also the easing of tariff wars and the continued growth of long-term yields on government bonds, which signal expected higher inflation in the future.

The S&P 500 index is currently only 3% below its peaks and for May it records a gain of over 6%.

Europe:

As for the results of year-on-year inflation in Europe, for the month of April, it again came out as expected at 2.2%.

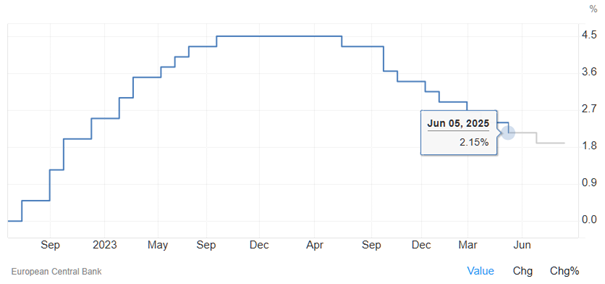

At the same time, on June 5, 2025, another ECB meeting took place, which continued to lower interest rates to 2.15%. Thus, it adheres to its plan of a gradual reduction to below 2%, which is the opposite of how the Fed has been behaving in recent months.

Interest Rate Set by the ECB and Its Forecast

Source: tradingeconomics.com

The problem of the European Union is still low GDP growth and also low expectations of growth in the future.

However, European indices across regions continued to grow in May and are reaching new highs. Since the beginning of the year, for example, MSCI Europe records a gain of up to 21% in dollar terms.