Main events:

• Meeting of central bankers in Jackson Hole

• ČNB left interest rates at 3.5%

• The U.S. federal court stated that most of the imposed tariffs are unlawful

Summary of the current situation:

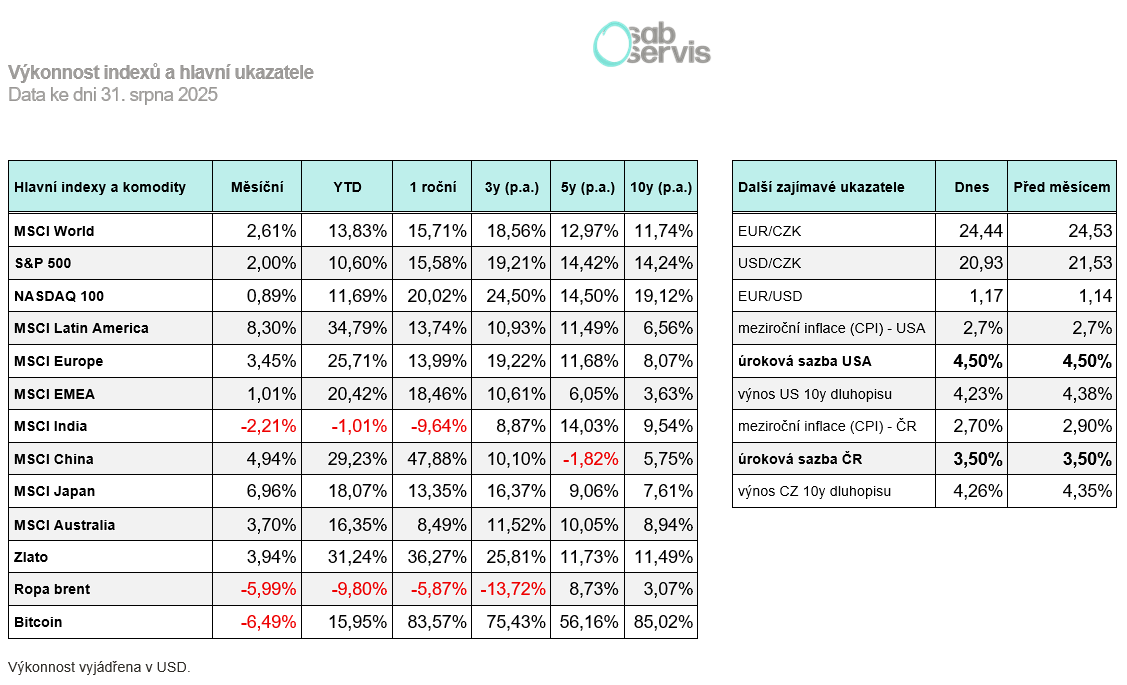

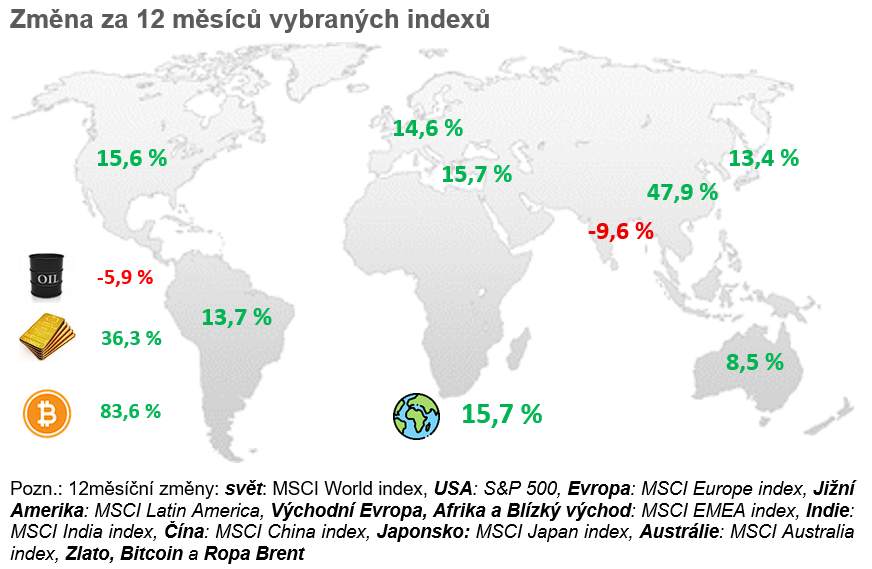

In August, stocks continued to rise and the S&P 500 index in dollar terms added over 2% again and reached new highs. It is often mentioned that September is historically the worst month and that stock declines occur then. Last year that was not confirmed, but, for example, in the years 2021 to 2023 a 10% correction did occur in September.

As for the important events of August, earnings season continued, with NVIDIA in particular reporting its numbers. It once again beat expectations and overall confirmed growing demand for chips for artificial intelligence.

An interesting piece of news at the end of August was that the U.S. Federal Court ruled that most of the tariffs introduced by Trump are unlawful and should be abolished. Allegedly, Trump exceeded his authority. On the other hand, the court did not repeal them and gives Trump the option to appeal, and only possibly thereafter could they be abolished.

And how did other assets perform? Gold pretty much broke loose and, after a longer stagnation, rose from 3 300 to new highs of 3 600 USD per troy ounce. Bitcoin is holding at levels around 110 000 USD.

Macro summary:

But let’s move on to macroeconomic figures, where the year-on-year inflation rate for July in the Czech Republic came out at 2.7%, which is a slight decrease compared with June.

In August, specifically on 7.8. 2025, another ČNB meeting was held. Here the Bank Board voted unanimously to keep rates at the current level of 3.5%. Looking ahead, it sees inflation expectations due to rising real estate prices and also due to wage growth.

The year-on-year inflation rate in the USA for July again came in above expectations, specifically at 2.7%. The reason was an increase in housing costs, which are rising by as much as 3.8% year-on-year. For September it is even expected that overall inflation will rise again above the 3% threshold.

GDP in the USA grew in Q2 at a very solid pace of 3.3%, which beat expectations of only 3% growth. The economy is thus still running at a very solid pace.

Unemployment for July came out in the USA at 4.2%, which is a slight increase compared with the previous month.

An important event was also the meeting of central bankers at the end of August in Jackson Hole. Representatives from approximately 40 countries around the world took part and gave speeches on the current situation in the world and the outlook for the future.

There, the Fed chief, Jerome Powell, emphasized that the central bank makes decisions based on economic data and not under political pressure. He admitted that in September there could indeed be another cut in interest rates, and by the end of the year it could happen again.

As for the results of year-on-year inflation in Europe, for the month of July it came out at 2% in line with expectations.

Czech Republic:

The year-on-year inflation rate for July in the Czech Republic came out at 2.7%, which is a slight decrease compared with June.

In August, specifically on 7.8. 2025, another ČNB meeting was held. Here the Bank Board voted unanimously to keep rates at the current level of 3.5%. Looking ahead, it sees inflation expectations due to rising real estate prices and also due to wage growth.

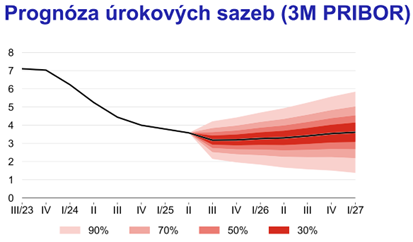

Source: CNB

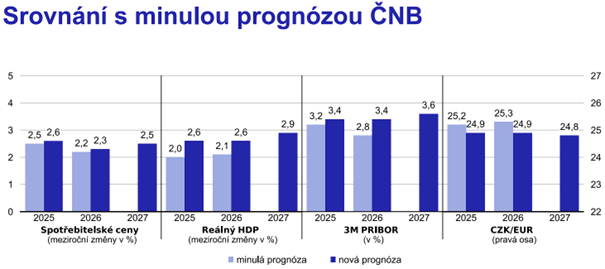

By the end of the year, however, the ČNB still expects a slight reduction in interest rates to 3%. At the same time, however, it sees inflationary pressures going forward in connection with rising wages and also with the introduction of the ETS2 system, where the impact of higher prices is unclear for now.

According to the new forecast, however, the ČNB again expects a slight increase in interest rates for 2026 and 2027.

Source: CNB

At the same time, the expected GDP growth for 2025 was revised up to 2.6%, and for 2026 a similar revision took place.

USA:

The year-on-year inflation rate in the USA for July again came in above expectations, specifically at 2.7%. The reason was an increase in housing costs, which are rising by as much as 3.8% year-on-year. For September it is even expected that overall inflation will rise again above the 3% threshold.

GDP in the USA grew in Q2 at a very solid pace of 3.3%, which beat expectations of only 3% growth. The economy is thus still running at a very solid pace.

Unemployment for July came out in the USA at 4.2%, which is a slight increase compared with the previous month.

An important event was also the meeting of central bankers at the end of August in Jackson Hole. Representatives from approximately 40 countries around the world took part and gave speeches on the current situation in the world and the outlook for the future.

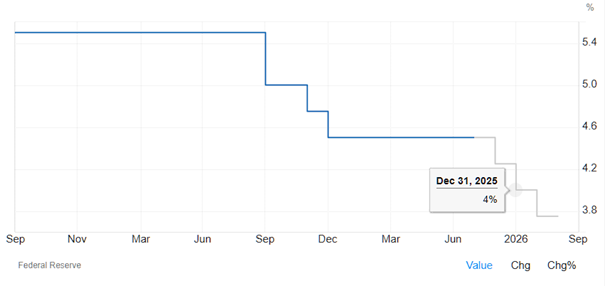

There, the Fed chief, Jerome Powell, emphasized that the central bank makes decisions based on economic data and not under political pressure. He admitted that in September there could indeed be another cut in interest rates, and by the end of the year it could happen again.

Interest rate forecast in the USA

Source: www.www.tradingeconomics.org

The S&P 500 index is currently at 6 480 USD and for August is up 2%.

Europe:

As for the results of year-on-year inflation in Europe, for the month of July it came out at 2% in line with expectations.

The ECB has another meeting in the first half of September, where the central bank should for now leave interest rates at 2.15%.

European indices continued to rise in August, with, for example, MSCI Europe gaining as much as 3.45% in dollar terms.