Main events:

• After a year, the Fed cut interest rates from 4.5 to 4.25%

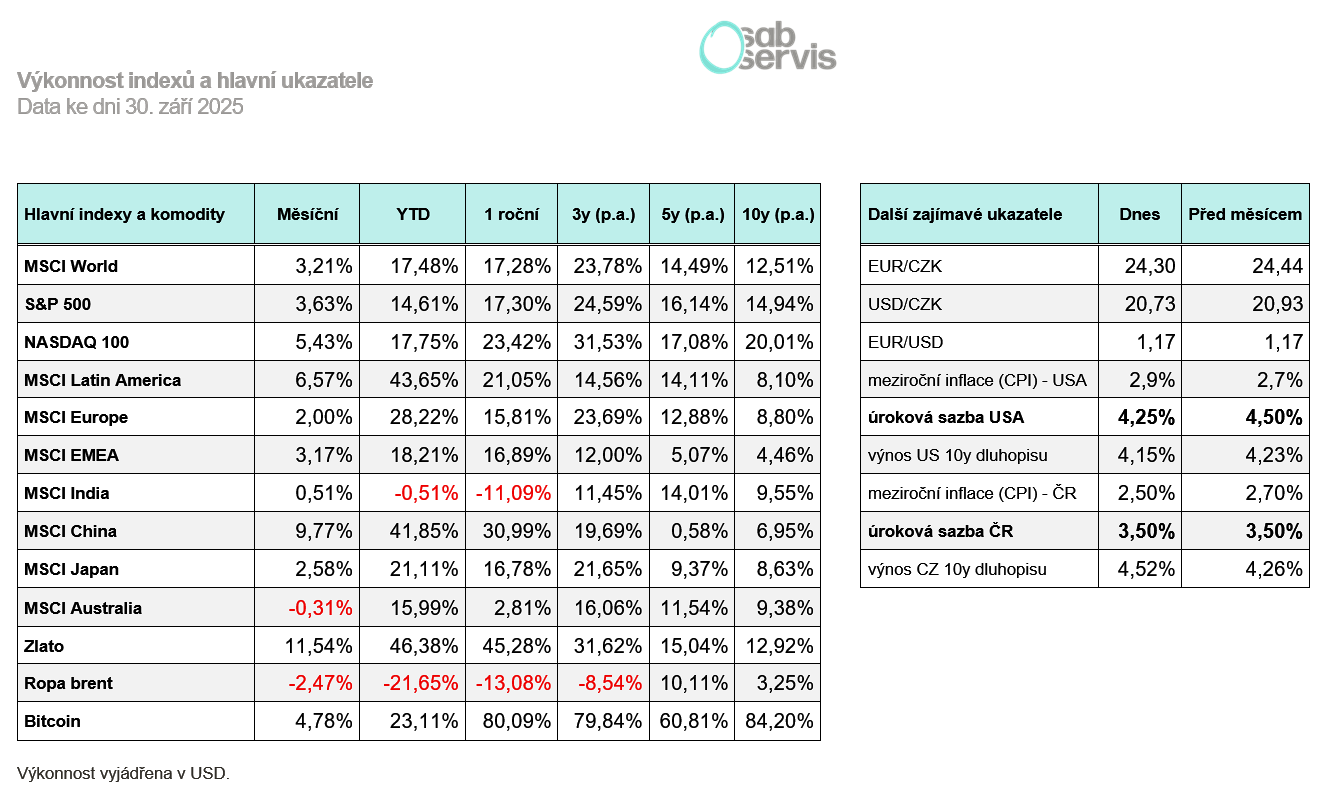

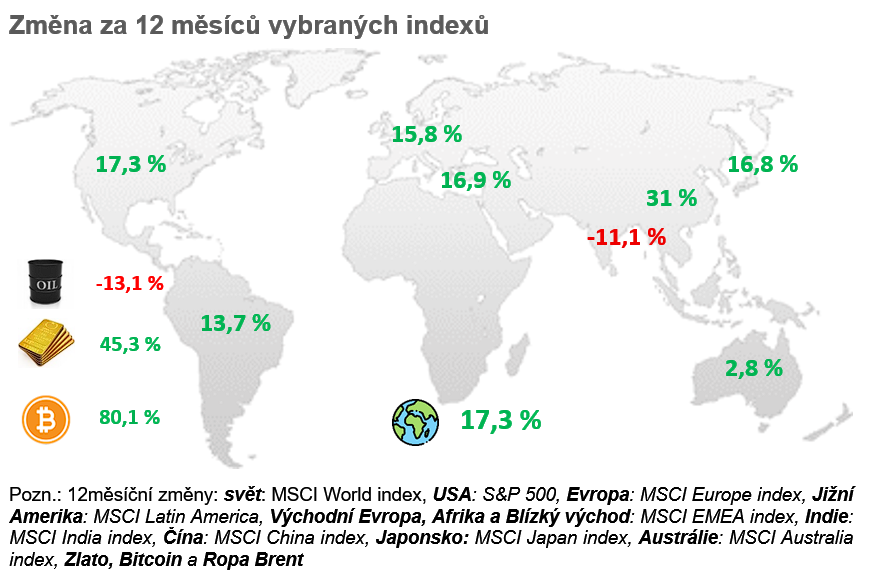

• September ended with positive growth across all asset classes

• The ANO movement won the elections to the Chamber of Deputies of the Czech Republic

Summary of the current situation:

In August, equities continued to rise and the S&P 500 index once again added over 2% in dollar terms, reaching new highs. It is often mentioned that September is historically the worst month and that it brings declines in stocks. This was not confirmed last year, but for example in the years 2021 to 2023 there was a 10% correction in September.

As for important events in August, the earnings season continued, with NVIDIA being the main company reporting its figures. It once again beat expectations and overall confirmed the growing demand for chips for artificial intelligence.

An interesting piece of news at the end of August was that a U.S. federal court ruled that most of the tariffs introduced by Trump are unlawful and should be abolished. Reportedly, Trump exceeded his authority. On the other hand, the court did not cancel them and is giving Trump the opportunity to appeal, and only then could they potentially be abolished.

And how did other assets perform? Gold broke free after a long stagnation and rose from 3,300 up to new highs of 3,600 USD per troy ounce. Bitcoin is holding at levels around 110,000 USD.

Macro summary:

The year-on-year inflation rate for August in the Czech Republic came in at 2.5%, which is another slight decrease compared to July.

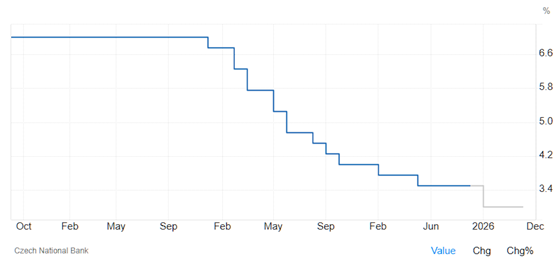

In September, specifically on 24 September 2025, another CNB meeting was held. The bank board once again unanimously voted to keep rates at the current level of 3.5%. Looking ahead, inflation expectations persist due to rising real estate prices and also due to wage growth.

The year-on-year inflation rate in the USA for August was in line with expectations, specifically at 2.9%. The reason was rising housing costs and partly also the impact of tariffs. For September, it is still expected that overall inflation will again rise above the 3% threshold.

Unemployment for August in the USA came in at 4.3%, which is another slight increase compared to the previous month.

On 17 September 2025, the long-awaited important Fed meeting took place, at which, after roughly a one-year pause, interest rates were cut by 0.25%. Specifically, they were reduced from 4.5 to 4.25%.

Why now? The reason is the cooling labor market since the beginning of the year and also the expected slower GDP growth.

On the other hand, inflation in the USA is still hovering around 3% and the U.S. Fed thus has to choose between its two mandates: maintaining price stability and a stable labor market. At this moment, it has rather chosen to react to the weakening labor market, and therefore interest rates have been cut.

As for the year-on-year inflation figures in Europe, for the month of August they again came in at 2%, fully in line with expectations.

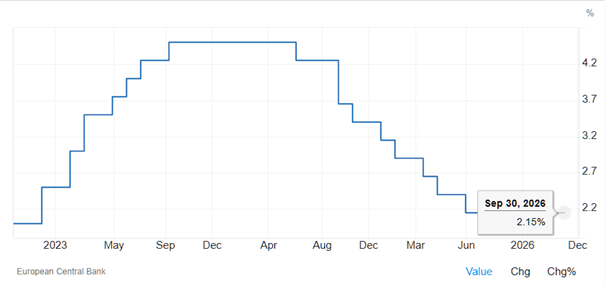

At its last meeting on 11 September 2025, the ECB decided to keep interest rates at 2.15%. It continues to expect inflation around 2% and modest GDP growth going forward.

For these reasons, it intends to keep the interest rate at 2% and does not currently plan to return to a zero-interest-rate policy.

Czech Republic:

The year-on-year inflation rate for August in the Czech Republic came in at 2.5%, which is another slight decrease compared to July.

In September, specifically on 24 September 2025, another CNB meeting was held. The bank board once again unanimously voted to keep rates at the current level of 3.5%. Looking ahead, inflation expectations persist due to rising real estate prices and also due to wage growth.

However, a reduction in interest rates to 3% is still expected by the end of the year.

Interest rate forecast in the Czech Republic

Source: CNB

At the same time, elections to the Chamber of Deputies were held on 3 and 4 October, resulting in a change of governing parties. As expected, the ANO movement won the elections and will likely govern in coalition with SPD and Motorists, but anything can happen.

USA:

The year-on-year inflation rate in the USA for August was in line with expectations, specifically at 2.9%. The reason was rising housing costs and partly also the impact of tariffs. For September, it is still expected that overall inflation will again rise above the 3% threshold.

Unemployment for August in the USA came in at 4.3%, which is another slight increase compared to the previous month.

On 17 September 2025, the long-awaited important Fed meeting took place, at which, after roughly a one-year pause, interest rates were cut by 0.25%. Specifically, they were reduced from 4.5 to 4.25%.

Why now? The reason is the cooling labor market since the beginning of the year and also the expected slower GDP growth.

On the other hand, inflation in the USA is still hovering around 3% and the U.S. Fed thus has to choose between its two mandates: maintaining price stability and a stable labor market. At this moment, it has rather chosen to react to the weakening labor market, and therefore interest rates have been cut.

Interest rate forecast in the USA

Source: www.www.tradingeconomics.org

Looking ahead at what is expected in the future, according to the Fed’s new projection interest rates should fall two more times by the end of the year, to 3.75%. This would correspond to a cut at each of the upcoming meetings. The S&P 500 index is currently at 6,700 USD and for September it has posted a gain of 3.63%.

Europe:

As for the year-on-year inflation figures in Europe, for the month of August they again came in at 2%, fully in line with expectations.

At its last meeting on 11 September, the ECB decided to keep interest rates at 2.15%. It continues to expect inflation around 2% and modest GDP growth going forward.

For these reasons, it intends to keep the interest rate at 2% and does not currently plan to return to a zero-interest-rate policy.

Interest rate forecast in the EU

Source: www.www.tradingeconomics.org

As for the current outlook for the future, the ECB plans to keep the existing interest rates unchanged until next year.

And in France, there is turmoil again because the relatively new French Prime Minister Sébastien Lecornu has submitted his resignation to President Emmanuel Macron. The reason for stepping down is the inability of the individual parties to find a compromise among themselves and reach agreement on reducing France’s high level of debt.

Representatives of the opposition then called for new parliamentary elections and are demanding the resignation of President Macron.

European indices continued to rise in September; for example, MSCI Europe gained up to 2% in dollar terms.