Main events:

• The Fed further reduces interest rates from 4.25 to 4%

• New trade wars between the USA and China

• Earnings season brought positive numbers and stocks continue to rise

Summary of the current situation:

During October, stocks continued to rise on the positive wave of earnings season, where mainly large technology companies reported. They delivered solid results and the AI boom is therefore continuing for now.

There was also another interest rate cut by the Fed to 4%, and by the end of the year there will likely be one more cut.

However, at the beginning of October it looked like new trade wars between the USA and China were emerging. First, China suddenly introduced stricter controls and rules for rare earth elements, important for semiconductors and the defense segment, and Trump responded by imposing tariffs on China of up to 100%. Stocks reacted with a drop of several percent.

For a while it looked like the situation would continue to deteriorate, but eventually there was a slight calming and markets were waiting for the planned meeting between Trump and Chinese President Xi Jinping.

The meeting did eventually take place on October 30 in South Korea. It was held in a positive spirit and tensions between the USA and China eased. China decided to suspend some of its export measures on rare earths for one year. Trump backed away from additional 100% tariffs and instead somewhat eased the current tariffs that are in place on China.

And how did other assets perform? Gold unsurprisingly rose and almost reached 4,400 USD. Then there was a minor correction and we are currently at prices around 4,000 USD.

Bitcoin was at new highs at the beginning of October, but towards the end of the month it fell and touched the 100,000 USD level. However, a 20% drop is nothing unusual for Bitcoin. It is interesting because stocks, on the contrary, continued to rise.

Macro summary:

The year-on-year inflation rate for September in the Czech Republic came in at 2.3%, which is another slight decrease compared to August.

At the beginning of November, specifically on 6 November 2025, another CNB meeting took place. The Bank Board again voted unanimously to keep rates at the current level of 3.5%. Going forward, the CNB still sees inflationary expectations in rising property prices, greater lending activity and also due to wage growth.

The year-on-year inflation rate in the USA for September came out in line with expectations, specifically at 3%. The reasons were rising fuel prices and the continued impact of imposed tariffs. For now, inflation remains within the Fed’s tolerance band, albeit narrowly.

We do not yet have official unemployment data for September due to a lack of funds for the functioning of the US government. The collapse of public service financing in the USA occurred as early as 1 October and an agreement between Republicans and Democrats is still awaited so that the budget for 2026 can be set.

On 29 October 2025, the much-anticipated key Fed meeting took place, at which it continued to cut interest rates from 4.25 to 4%.

As for the results of year-on-year inflation in Europe, for the month of September it again came out at 2.2%, in line with expectations.

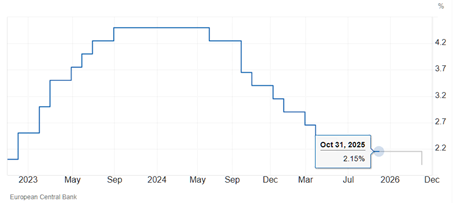

At its latest meeting on 31 October 2025, the ECB decided to keep interest rates at 2.15%. It still sees no reason to continue further rate cuts and instead a slight cut might come only towards the end of 2026.

Czech Republic:

The year-on-year inflation rate for September in the Czech Republic came in at 2.3%, which is another slight decrease compared to August.

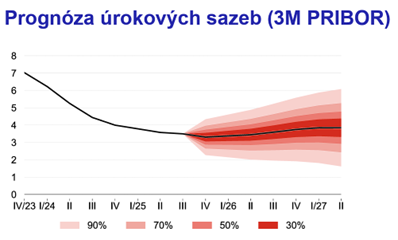

At the beginning of November, specifically on 6 November 2025, another CNB meeting took place. The Bank Board again voted unanimously to keep rates at the current level of 3.5%. Going forward, the CNB still sees inflationary expectations in rising property prices, greater lending activity and also due to wage growth.

Source: CNB

According to the forecast, there could be a further slight reduction in interest rates to 3.25% by the end of the year. However, the CNB rather expects a gradual increase in interest rates up to 2027.

USA:

The year-on-year inflation rate in the USA for September came out in line with expectations, specifically at 3%. The reasons were rising fuel prices and the continued impact of imposed tariffs. For now, inflation remains within the Fed’s tolerance band, albeit narrowly.

We do not yet have official unemployment data for September due to a lack of funds for the functioning of the government. The collapse of public service financing in the USA occurred as early as 1 October and an agreement between Republicans and Democrats is still awaited so that the budget for 2026 can be set.

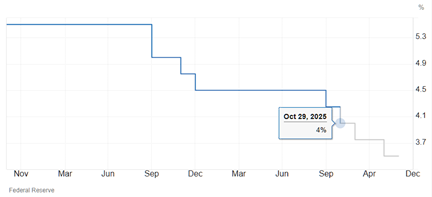

On 29 October 2025, the much-anticipated key Fed meeting took place, at which it continued to cut interest rates from 4.25 to 4%.

US interest rate forecast

Source: www.www.tradingeconomics.org

Looking at what is expected in the future, in December there could be one more rate cut to 3.75%. For 2026, a reduction to 3.5% is expected.

The S&P 500 index is currently at 6,800 USD and for October it recorded a gain of 4.15%.

Europe:

As for the results of year-on-year inflation in Europe, for the month of September it again came out at 2.2%, in line with expectations.

At its latest meeting on 31 October 2025, the ECB decided to keep interest rates at 2.15%. It still sees no reason to continue further rate cuts and instead a slight cut might come only towards the end of 2026.

EU interest rate forecast

Source: www.www.tradingeconomics.org

European indices continued to rise in October, with MSCI Europe, for example, gaining as much as 2.58% in US dollar terms.