Main events:

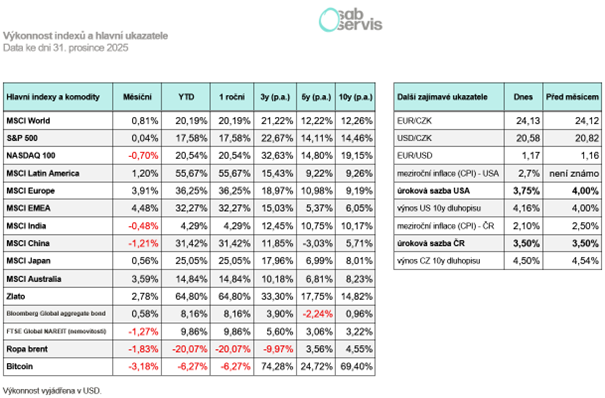

• Another positive year for the S&P 500 index

• All asset classes grew except Bitcoin

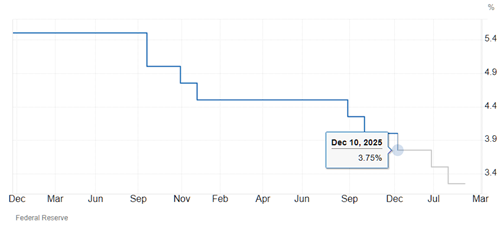

• The Fed continues cutting interest rates to 3.75%

Summary of the current situation:

2025 was a year in which almost all assets performed well again. Whether it was stocks, real estate, gold, silver, or—after a longer time—bond funds, especially foreign ones. On the other hand, it was not a very positive year for Bitcoin—it lost more than 6%.

But why was 2025 successful for stocks and other asset classes? The main drivers of growth were declining interest rates in the US, GDP growth, and the continuing AI boom. The weakening of the US dollar also had an impact.

Overall, the US stock index S&P 500 gained just under 18% in dollar terms in 2025, thus continuing its 3rd successful year in a row. Historically, this is not an unusual situation; the index often rises for several calendar years in a row. It does not necessarily mean that a bad year will come. However, of course, anything can change and happen at any time. A new war, the end of the AI boom, or another reason.

However, for CZK investors the total return of the S&P 500 index was only just under 3%, because the dollar weakened across currencies by as much as 15%. Sometimes the exchange rate helps us, other times it reduces returns; in the long run, however, it stays within a certain range and ultimately does not have too large an impact on our investment.

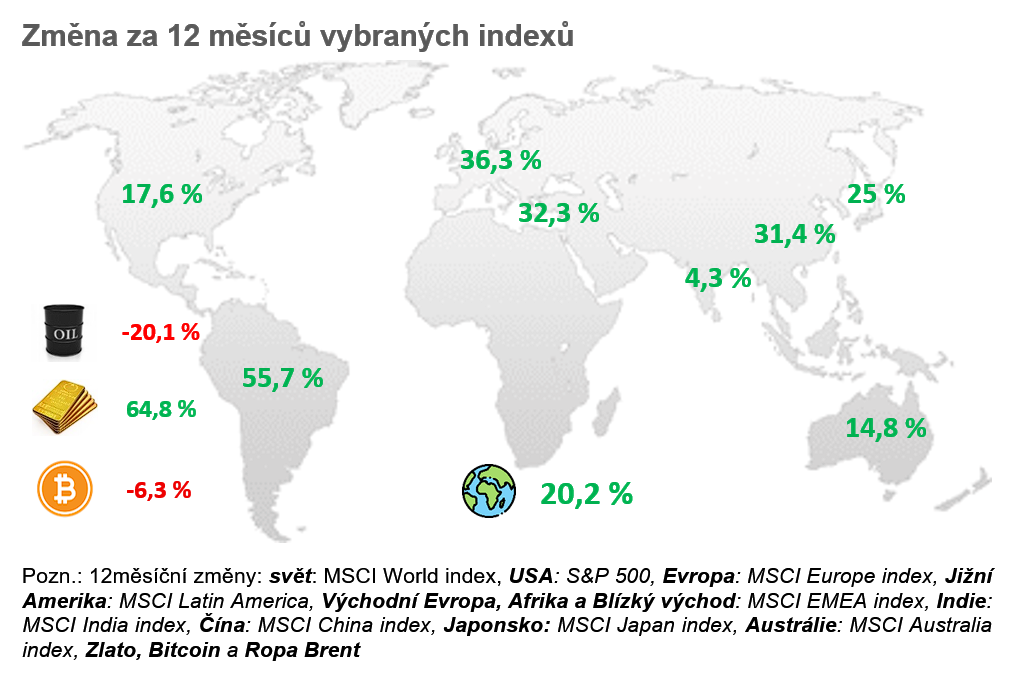

Along with the US, other regions such as Europe, China, or emerging markets overall also did well. Europe achieved a return of up to 36% in dollar terms last year; China and emerging markets overall also achieved returns above 30%. Only India lagged, not reaching even a 5% return.

Bonds performed well again after a longer time thanks to interest-rate cuts, and as measured by the Bloomberg Global aggregate bond index they posted a return of over 8%. The most successful were emerging-market bonds. In the Czech Republic, bond funds delivered on average a lower return around 4 to 5%, due to lower interest rates.

And how did other assets perform? Commodities rose the most, except for oil. Gold rose by 65% and even crossed the threshold of USD 4,500 per troy ounce. Silver also delivered an extremely positive year with returns of up to 150%. The growth was driven rather by speculative capital.

And Bitcoin was the only one to experience a year-on-year decline of over 6%. During the year it reached a new high of USD 126,000, but ultimately it fell toward the end of the year and finished at approximately USD 88,000.

Macro summary:

If we move to the Czech Republic, the year-on-year inflation rate for November came in at 2.1% and for now it does not look like it will rise.

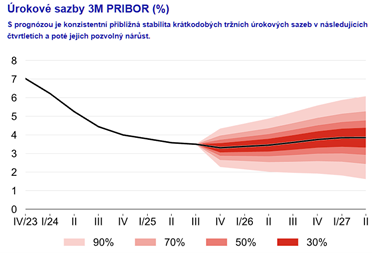

A CNB meeting took place, specifically on 18/12, when the CNB kept interest rates at 3.5%. Nothing has changed since the previous CNB forecast and further interest-rate cuts are probably not going to happen. Over the whole year, the CNB thus reduced the repo rate from 4 to 3.5%.

A Fed meeting also took place, when on 10/12 it cut interest rates from 4 to 3.75%.

Overall, the Fed cut in 2025 from 4.5 to 3.75% and will probably continue to do so in 2026.

November unemployment data in the US ultimately came in at 4.6%. This is a slight increase and it looks like the labor market in the US is gradually starting to run into problems.

The year-on-year inflation rate for November in the US even fell to 2.7%, although it was expected to reach the 3% level. The impact of tariffs was somewhat lower than originally expected.

As for the year-on-year inflation results in Europe, for November it again came in at 2.1%, in line with expectations.

The ECB kept interest rates at 2.15% at its December meeting and it looks like we have reached the so-called terminal rate for the European Union. This means a neutral interest rate that the central bank will try to maintain over the long term.

CZ:

The year-on-year inflation rate for November came in at 2.1% and for now it does not look like it will rise.

A CNB meeting also took place, specifically on 18/12, when the CNB kept interest rates at 3.5%. Nothing has changed since the previous CNB forecast and further interest-rate cuts are probably not going to happen. Over the whole year, the CNB thus reduced the repo rate from 4 to 3.5%.

Source: cnb.cz

Going forward, at most a 0.25% cut is expected, but rather toward the end of 2026 there should again be a gradual increase in interest rates.

The average interest rate agreed on mortgages is still slightly below 5%. However, in recent months 5-year interest-rate swaps have risen, so further interest-rate cuts are probably not going to happen. In addition, in 2026 a record number of mortgages totaling CZK 400 to 500 bn will be refinanced.

USA:

The year-on-year inflation rate for November in the US even fell to 2.7%, although it was expected to reach the 3% level. The impact of tariffs was somewhat lower than originally expected.

November unemployment data in the US ultimately came in at 4.6%. This is a slight increase and it looks like the labor market in the US is gradually starting to run into problems.

A Fed meeting also took place, when on 10/12 it cut interest rates from 4 to 3.75%.

Overall, the Fed cut in 2025 from 4.5 to 3.75% and will probably continue cutting in 2026.

US interest-rate forecast

Source: www.www.tradingeconomics.org

A major change will likely occur from May, when the term of the current Fed chair Jerome Powell ends, and Trump will probably appoint his own person to lead it, who will push for further rate cuts.

The reason is, among other things, a large portion of US debt that will be refinanced in 2026 from near-zero interest rates to the current level. This will ultimately increase financing costs and the government deficit.

The S&P 500 index is currently at USD 6,900 and ended the whole year up 17.5% in dollar terms.

Europe:

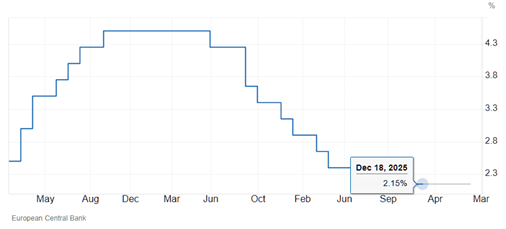

As for the year-on-year inflation results in Europe, for November it again came in at 2.1%, in line with expectations.

The ECB kept interest rates at 2.15% at its December meeting and it looks like we have reached the so-called terminal rate for the European Union. This means a neutral interest rate that the central bank will try to maintain over the long term.

EU interest-rate forecast

Source: www.www.tradingeconomics.org

European indices had a successful year last year; for example, the MSCI Europe index gained up to 36% in dollar terms.