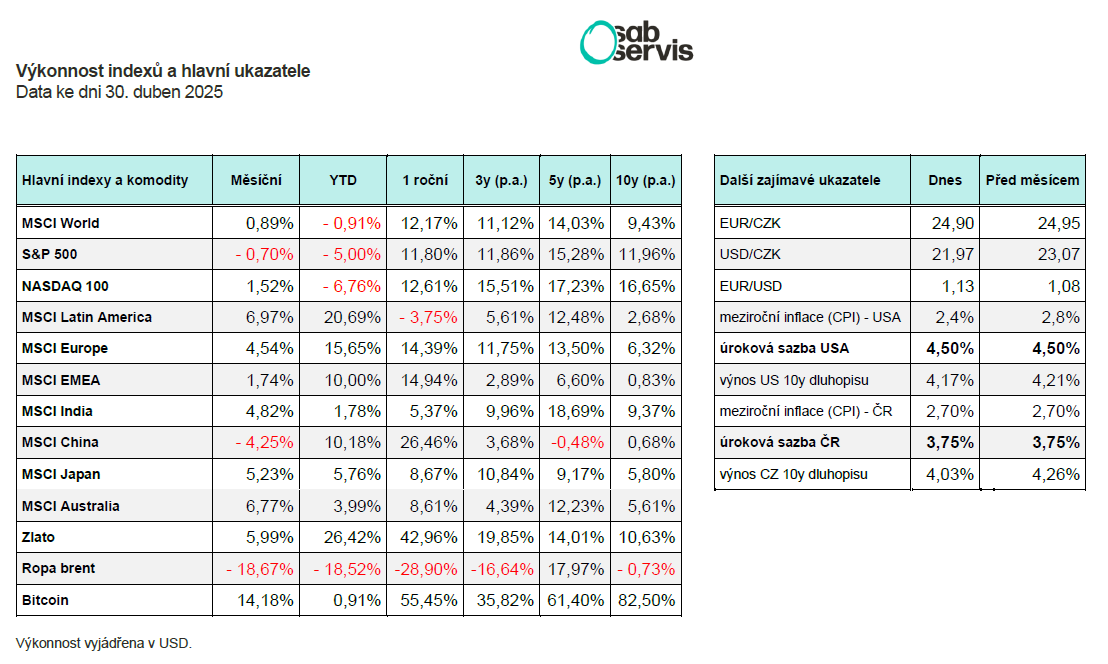

Main events:

• Stock indices are rising again

• Tariff war continues only with China

• ECB continues to reduce interest rates

Summary of the current situation:

After a very turbulent start to April, we saw a calming in the second half, and Donald Trump temporarily moved into seclusion with his surprising statements.

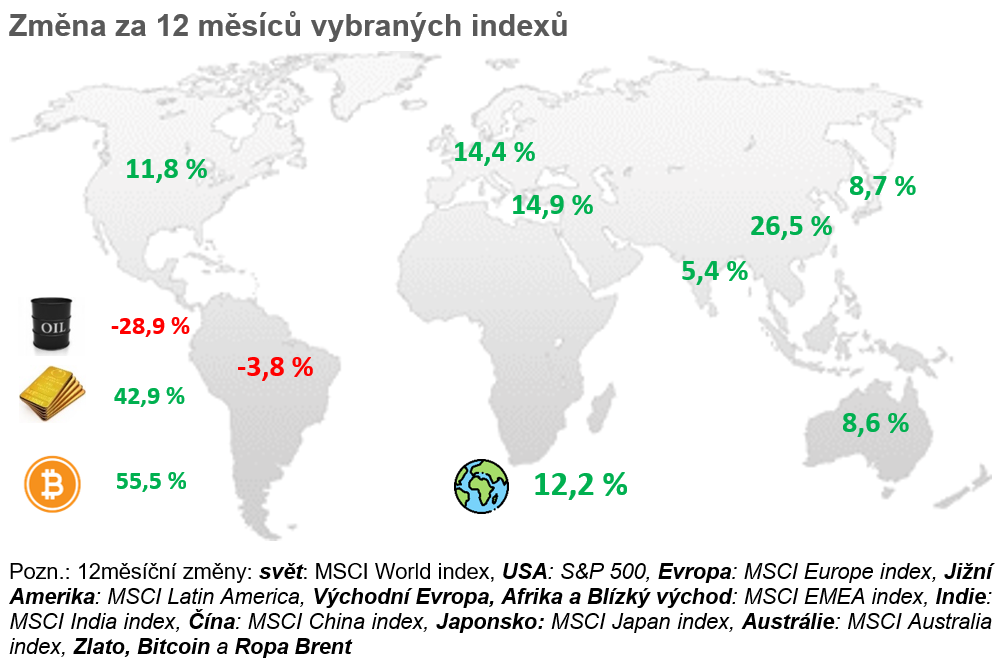

Stock indices worldwide reacted to the introduction of tariffs at the beginning of April with declines, the S&P 500 index fell by more than 20%, and the technology index NASDAQ 100 even by more than 25%.

However, bonds also declined simultaneously, as yields on long-term US government bonds rose, with, for example, 10-year yields rising from 3.8 to 4.5%. And this is definitely not positive for the USA because it means more expensive financing of their debt.

Perhaps for these reasons, Donald Trump reversed on April 9, 2025, and the imposed tariffs on all countries except China were postponed by up to 90 days. Stocks then started to grow strongly, and even in a single day, the S&P 500 index grew by almost 10%.

The strong growth in stocks was also helped by very good results from large technology companies from Microsoft to Meta.

Stock growth continued gradually until the end of April, and currently, the S&P 500 index is only approximately 8% from its peaks, and the technology index NASDAQ 100 is only 10%.

However, for us as Czech investors, in CZK terms, the S&P 500 index is still minus 15%. This is due to the significant strengthening of the koruna against the dollar, which strengthened from 24 to 22 USD/CZK. However, other currencies also strengthened against the dollar, so it is not just a peculiarity of the Czech koruna.

However, where the USA continued to impose tariffs was precisely China, which certainly did not take it lightly. It imposed counter-tariffs on the USA. The USA then increased tariffs, and both countries competed over who would impose higher tariffs on whom, like in some poker game.

Currently, tariffs on China are over 100%, and China has also imposed tariffs on the USA over 100%. The tariffs are already in effect, and imports to the United States are declining because of it.

Meanwhile, peace talks continue in Ukraine, and both sides are presenting their proposals and demands. It is therefore possible that after several years of conflict, we will see a truce.

And how did other asset classes fare? Oil has fallen to 60 USD, bringing us to 2021 levels. Bitcoin dropped by 30% from its peaks during the biggest declines and held up relatively well compared to stocks. It is currently only 10% below its peaks.

Gold also fell to 3,000 USD at the beginning of April but started to rise again by the end of April and at one point exceeded the 3,500 USD per troy ounce mark.

Macro Summary:

But let’s move on to macroeconomic numbers, where the year-on-year inflation rate for March in the Czech Republic came out again at 2.7%, and a slight decrease towards the 2% level is expected by the end of the year.

The year-on-year inflation rate in the USA for March came out slightly below expectations at 2.4%. However, a slight increase above 3% is expected in the coming months, partly due to rising prices of goods imported from China.

Unemployment in March remains at 4.2% in the USA and so far does not signal problems in the economy. A slight increase to 4.4% is expected in the coming months.

As for the year-on-year inflation results in Europe, it came out for March in Europe as expected at 2.2%.

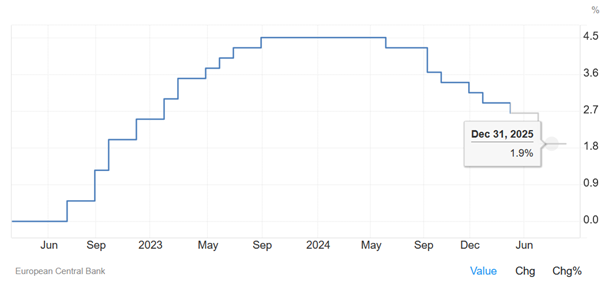

At a meeting held on April 17, 2025, the ECB continued to reduce interest rates to 2.4%. It plans to continue reducing them until the end of the year to below 2%.

Czech Republic:

The year-on-year inflation rate for March in the Czech Republic came out again at 2.7%, and a slight decrease towards the 2% level is expected by the end of the year.

We will have another CNB meeting in the first half of May, and it is currently assumed that the CNB should leave interest rates unchanged at 3.75%.

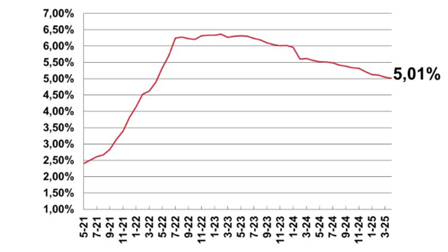

Swiss Life Hypoindex (April)

Source: Swiss Life Hypoindex

The average mortgage interest rate for April is just on the threshold of 5%. With further reductions in interest rates, it should probably soon overcome it and go even lower.

USA:

The year-on-year inflation rate in the USA for March came out slightly below expectations at 2.4%. However, a slight increase above 3% is expected in the coming months, partly due to rising prices of goods imported from China.

Unemployment in March remains at 4.2% in the USA and so far does not signal problems in the economy. A slight increase to 4.4% is expected in the coming months.

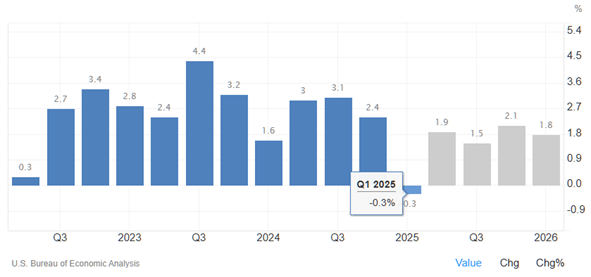

We will have to wait for the impact of tariffs on the economy, but GDP in the USA fell by 0.3% in the first quarter of 2025. Although this is not a significant decline, tariffs will be fully reflected in this quarter, and imports to the USA are likely to continue to decrease.

Development and Prediction of GDP Growth in the USA

Source: www.tradingeconomics.org

If GDP were to decline this quarter as well, the economy would enter a recession.

We will have to wait for the Fed meeting in the first half of May. It is currently expected that it should proceed with further reductions in interest rates to 4.25%.

The S&P 500 index is currently only 8% below its peaks and in CZK terms, approximately minus 15%.

Europe:

As for the year-on-year inflation results in Europe, it came out for March in Europe as expected at 2.2%.

At a meeting held on April 17, 2025, the ECB continued to reduce interest rates to 2.4%. It plans to continue reducing them until the end of the year to below 2%.

Interest Rate Set by the ECB and Its Forecast

Source: tradingeconomics.com

An interesting event was a several-hour power outage in Spain and Portugal on April 28, 2025. The causes of the blackout are not yet entirely clear, but it probably occurred due to a high share of unstable renewable energy sources. The damage is estimated at several billion euros.

European stocks also grew in the second half of April and are currently only a few % below their peaks.