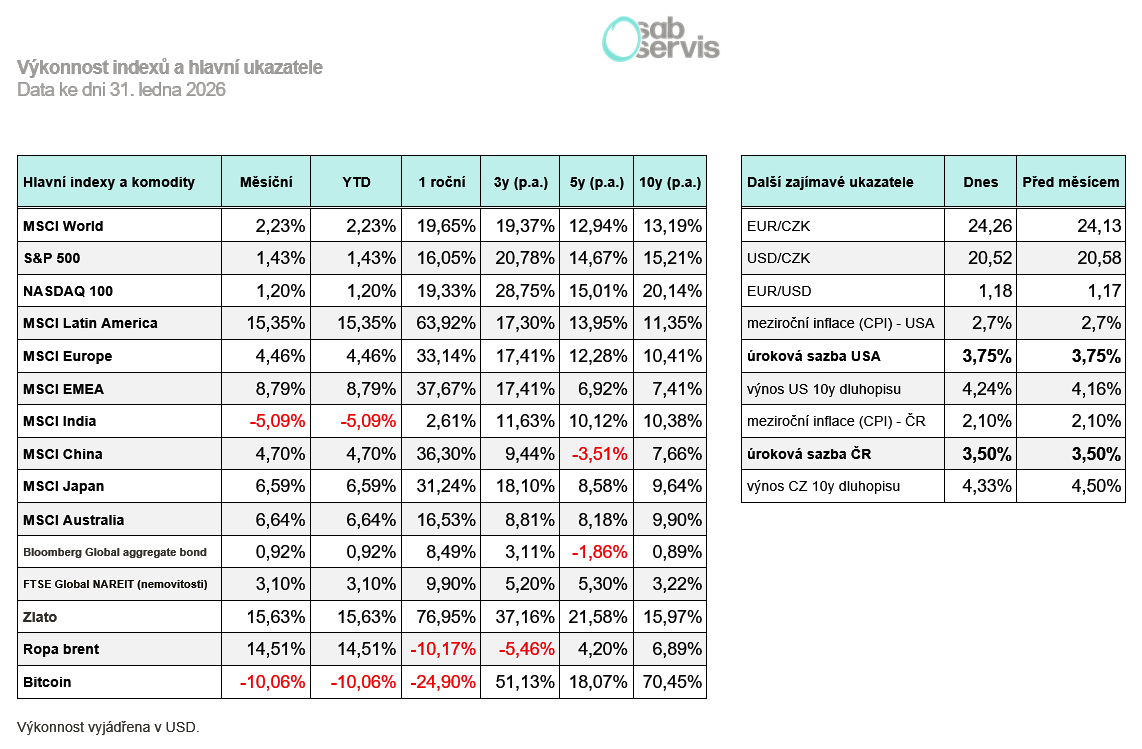

Main events:

• The Fed kept interest rates at 3.75%

• Mania in precious metals

• Rotation into defensive companies

Summary of the current situation:

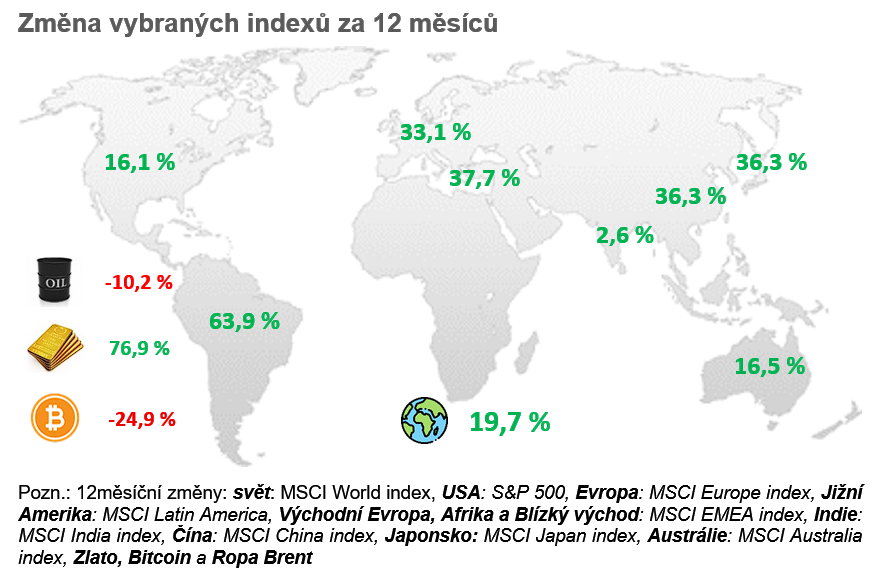

The beginning of the year was marked by continued growth in stock prices, and especially in precious metals. This was despite the US attack on Venezuela or Trump’s attempts to acquire Greenland. Neither event, however, shook investor confidence, and stocks did not fall significantly.

Earnings season is also underway, where the key figures were primarily those of large technology companies. Whether it was Microsoft, Google, or Amazon, demand for their cloud services is more or less rising, and so they increased investments in building new data centers. Investors are concerned about the profitability of these investments, and the shares fell after the results.

In recent months, concerns have been appearing more and more about artificial intelligence replacing the old large software companies such as Microsoft, Adobe, SAP, and others. Some of these companies have fallen by tens of percent, and along with them many other technology companies.

However, the S&P 500 index rose in January, and we therefore cannot speak of any major declines in equity markets. How is that possible? Don’t big tech companies make up a significant part of the index, and if they are not doing well, shouldn’t the index fall as a whole?

The reason the index is not falling at a similar pace is the so-called sector rotation that has been taking place since the beginning of the year. Specifically, a sector rotation from growth technology companies into defensive ones, mainly from the energy and consumer defensive sectors.

These are classic stable companies like Coca Cola, Procter & Gamble, and others. The question, however, is whether this is only a temporary phenomenon, or whether we will observe this trend throughout the year.

And how did other assets perform? Utter wildness occurred in precious metals, where the price of gold rose from 4,500 to 5,500 USD since the beginning of the year. This was followed by a rapid drop back to 4,500, and we are now at levels around 5,000 USD.

Silver achieved an even larger increase, rising from 70 up to 120. It then fell by more than 30% in a single day (the largest one-day drop in history), and we are now at values around 77 USD. The rise in gold is driven mainly by purchases by central banks and fears of a major crisis. Silver, however, is driven primarily by speculative capital, which was also evident from the sharp decline.

Bitcoin, on the other hand, has continued to fall since the beginning of the year and at one point even touched the 60,000 USD mark. That means almost a 50% decline from the peaks. We are therefore probably in the declining phase of Bitcoin’s 4-year cycle. In past cycles, Bitcoin commonly fell by as much as 80%; we are still far from those drops now, and there is certainly room for further declines.

On the other hand, from a long-term perspective, our SAB servis analyst team already perceives today’s Bitcoin price as an opportunity to add to a position or to make a first entry.

Macro summary:

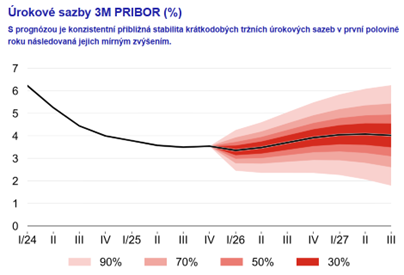

At the beginning of February, specifically on 5 February, another CNB meeting took place, and it again decided to keep interest rates unchanged at 3.5%. All 7 members of the Bank Board voted to keep rates unchanged.

According to the new forecast, interest rates are expected to be rather stable going forward, with a renewed gradual increase toward the end of 2026.

The year-on-year inflation rate in the Czech Republic came in at 2.1% for December, and for now it does not look like it will rise.

A Fed meeting also took place, and specifically on 28 January 2026 the central bank kept interest rates unchanged at 3.75%. Any further cuts could come no earlier than mid-year, and for now two cuts are expected for the whole of 2026.

Another surprise was Trump’s proposal of a new Fed chair; specifically, Kevin Warsh will likely assume the role in May. Among other things, he was a member of the Board of Governors during the great financial crisis and therefore has extensive experience. His appointment is, however, quite surprising because he is more of an advocate of slower interest-rate cuts, unlike Donald Trump.

December unemployment data in the US ultimately came in at 4.4%, and for now it does not look like the labor market situation is deteriorating.

The year-on-year inflation rate for December in the US again came in at 2.7%, and a further decline is still expected.

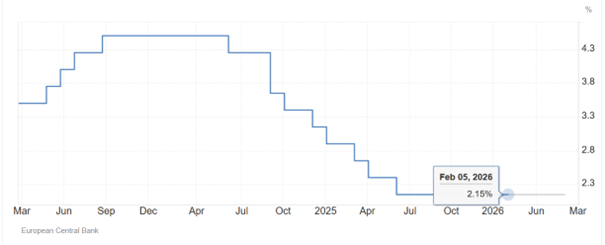

The ECB kept interest rates at 2.15% at its February meeting, and it still looks like we have reached the so-called terminal interest rate in the euro area.

As for the year-on-year inflation results in Europe, for December it came in at 2%, in line with expectations.

Czech Republic:

The year-on-year inflation rate in the Czech Republic came in at 2.1% for December, and for now it does not look like it will rise again.

At the beginning of February, specifically on 5 February, another CNB meeting took place, and it again decided to keep interest rates unchanged at 3.5%. All 7 members of the Bank Board voted to keep rates unchanged.

Source: cnb.cz

According to the new forecast, interest rates are expected to be rather stable going forward, with a renewed gradual increase toward the end of 2026.

The average interest rate agreed on mortgages is still slightly below 5%, and further decreases are rather not expected.

USA:

The year-on-year inflation rate for December again came in at 2.7% in the US, and going forward a further decline is rather expected.

December unemployment data in the US ultimately came in at 4.4%, and for now it does not look like the labor market situation is deteriorating.

A Fed meeting also took place, and specifically on 28 January 2026 the central bank kept interest rates unchanged at 3.75%. Any further cuts could come no earlier than mid-year, and for now two cuts are expected for the whole of 2026.

US interest rate forecast

Source: www.www.tradingeconomics.org

Another surprise was Trump’s proposal of a new Fed chair; specifically, Kevin Warsh will likely assume the role in May. He was among the members of the Board of Governors during the great financial crisis and therefore has extensive experience. His appointment is quite surprising, because he is an advocate of slower interest-rate cuts, unlike Donald Trump.

The S&P 500 index closed above the 7000 USD mark for the first time and posted a modest gain of 1.43% for January.

Europe:

The ECB kept interest rates at 2.15% at its February meeting, and it still thus looks like we have reached the so-called terminal interest rate in the euro area.

As for the year-on-year inflation results in Europe, for December it came in at 2%, in line with expectations.

EU interest rate forecast

Source: www.www.tradingeconomics.org

European indices continue to rise, and for January the MSCI Europe index in USD terms is up 4.46%.