Highlights:

- CNB officially ends intervention regime

- ECB continues to raise rates

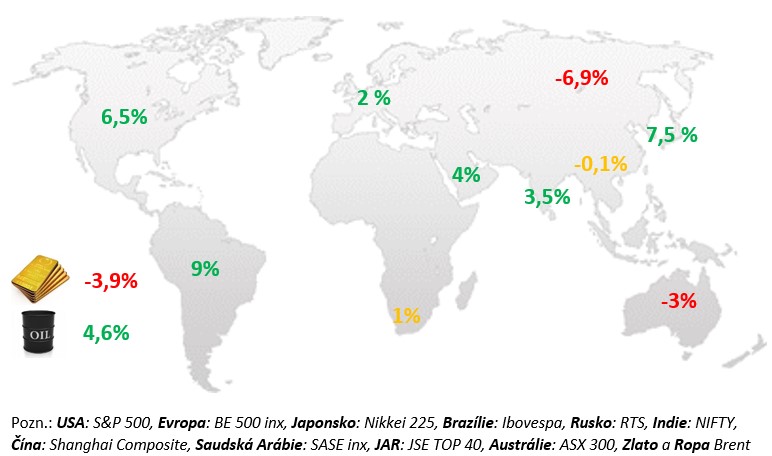

- Tightening credit conditions in the corporate bond market Changes in selected stock indices and commodities:

Commentary on financial market developments:

Stocks continued to rise during July on the back of upbeat data, corporate earnings and the assumption of easier monetary policy. The more than 3% rise in US and 2% rise in Western European equities in July was positively influenced by falling inflation, decent GDP growth in the US, a bet on a pause in monetary tightening, Q2 corporate results above market expectations and government stimulus in China. Energy and financial stocks rose strongly, which also caused Central European equities to outperform (+6.2%). In Europe, real estate titles reacted much better than in the US, while telecoms reacted much worse. The Czech Republic was the strongest performer in Central Europe (+6.7%), mainly driven by banking titles. Government bond prices in both the US and Germany fell slightly on average in July. In contrast, Czech government bond prices rose. This was helped by inflation, which fell to 9.7% in June, the first single-digit level since last January. Inflation is set to fall further during the summer months. The CNB kept the repo rate at 7% in early August. The CNB’s new forecast, like the one in May, works with a decline in interest rates from Q3 this year. But the Bank Board is keeping a cautious approach, with the debate on rate cuts coming in the autumn at the earliest. At the same time, the CNB formally ended the foreign exchange intervention regime announced last May. The move led to the depreciation of the koruna above CZK 24 per euro in early August.

USA:

The US S&P 500 index rose 6.5% for July with all sectors ending in the black. The positive development in the markets was mainly driven by technology titles as well as cyclical sectors. Consumer goods or industrial titles and basic materials, all these sectors had double-digit gains during the last month. The clear winner this year, however, is the Nasdaq technology index, which has appreciated by more than 30% since the beginning of the year. Thanks to the strong economy, the Fed raised its benchmark interest rate again in July to a range of 5.25%-5.5%, its highest level in 22 years. In the post-meeting minutes, the Fed reported that inflation remains “elevated,” job creation has been “robust” in recent months, and that economic activity continues to “expand at a moderate pace.” For the next meeting, the Fed then announced that it would be closely monitoring and evaluating the data and that it would make decisions accordingly. The US economy grew at a 2.4% pace in the second quarter. Monthly data released during July 2023 was again strong. The labor market, while still the strongest in 50 years, is still thriving, but there are already early signs of it cooling in the numbers. Rapid job creation also continues. In the last 3 months to June, the economy created an average of 200k jobs per month. Wage growth remains relatively fast, although slowing here too. Core inflation slowed to 0.2% m-o-m in June, its lowest level this year.

EU:

During July, the main event in the Eurozone was the ECB meeting, which took place at the end of the month. The ECB raised interest rates by 0.25% to 3.75% as expected. However, at a subsequent press conference, the ECB refused to signal a further interest rate hike at the next meeting, which will be held in mid-September. The ECB’s September decision will depend on economic data. It is expected that the ECB could raise interest rates to 4%, which should also be the last rate hike in this cycle. A turn towards interest rate cuts could occur at the end of 2024. The EU economy grew in the second quarter, but leading indicators point to significant economic weakness in the coming months. However, core inflation is not slowing down much for the time being. According to preliminary information, the quarter-on-quarter growth rate of GDP reached a pace of 0.3% in the 2nd quarter of 2023, which meant that the economy grew by 0.6% year-on-year. Spain did particularly well, whose economy grew by 0.4% quarter-on-quarter, as well as France, which, after growing by 0.1% quarter-on-quarter in the 4th quarter of last year and in the 1st quarter of this year, added 0.5% quarter-on-quarter in the second quarter. Germany (-3.6%) and Italy (-4.7%) are the most significant contributors to the year-on-year rate of decline, while Spanish sales (+7.3%) are a positive surprise. The unemployment rate remained at historical lows throughout the first quarter of 2023, and it was no different during the second quarter, when the average value of the unemployment rate reached 6.4%. Among large countries, the lowest unemployment rate is still in Germany (it reached 2.9% in May), while the highest is in Spain (12.7%). To the displeasure of the ECB, quite understandably given the state of the labor market, wages continue to rise. According to preliminary data, seasonally adjusted core inflation increased by 0.44% month-on-month in July.

CR:

Monthly data published during July in the Czech Republic were generally good as well. According to the first estimate, GDP growth in the second quarter reached 0.1% quarter-on-quarter. The CZSO reported that domestic demand contributed to quarterly growth, while household final consumption expenditure stagnated. In July, the confidence of companies did not deteriorate further after the previous two months of decline, when according to the CZSO, it remained practically unchanged compared to June. This shows that household demand is holding up well despite still high inflation. This is mainly thanks to the labor market, thanks to which wages rose in the first quarter and where full employment prevails. Czech consumer inflation in its core component added 0.5% in June, which is significantly more than June core inflation used to be in the pre-pandemic years. For the entire first half of the year, core inflation added 2.5%, and inflationary pressures are still visible beneath the surface. For example, prices in hotels and restaurants also grew at a quarterly rate of 2.5% in the second quarter. The annual pace of core inflation slowed to 7.5%. After the CNB’s June meeting, rates remained unchanged. At the same time, a fresh forecast from the CNB workshop was published, which in the basic scenario is again working with a drop in interest rates starting in the 3rd quarter of this year, similar to the previous forecast from the beginning of May. However, the Banking Council is taking a cautious line, suggesting that market bets on a rate cut in this year’s final quarter may not materialize. In the minutes of the meeting from July, a discrepancy was evident between those BR members who perceive the risk stemming from a tight labor market as significant (Procházka, Kubelková, Holub) and the rest who are not so worried about the labor market as a potential generator of inflationary pressures. At its last meeting, the Banking Council announced the end of the foreign exchange intervention regime it had been practicing since May 2022. The koruna subsequently weakened to the region of CZK 24.20 per euro in response to this announcement.

High interest rates, weak economic growth and tightening of credit conditions have an impact especially on companies with a low rating, on more indebted companies, for which the costs of debt servicing/refinancing have significantly increased. The number of defaults has been increasing for several months and the pressure on companies’ fundamentals will probably continue in the coming quarters. This translates into an increase in the number of downgrades in this segment and will probably result in a further increase in default rates. On the other hand, investment grade companies remain relatively resilient for now. That is why we again strongly warn about investments in risky bonds and other assets.