Main events:

• Art of the Deal between the USA and the EU

• The Fed again left interest rates at 4.5%

• Surprising unemployment figures in the USA (NFP)

Summary of the current situation:

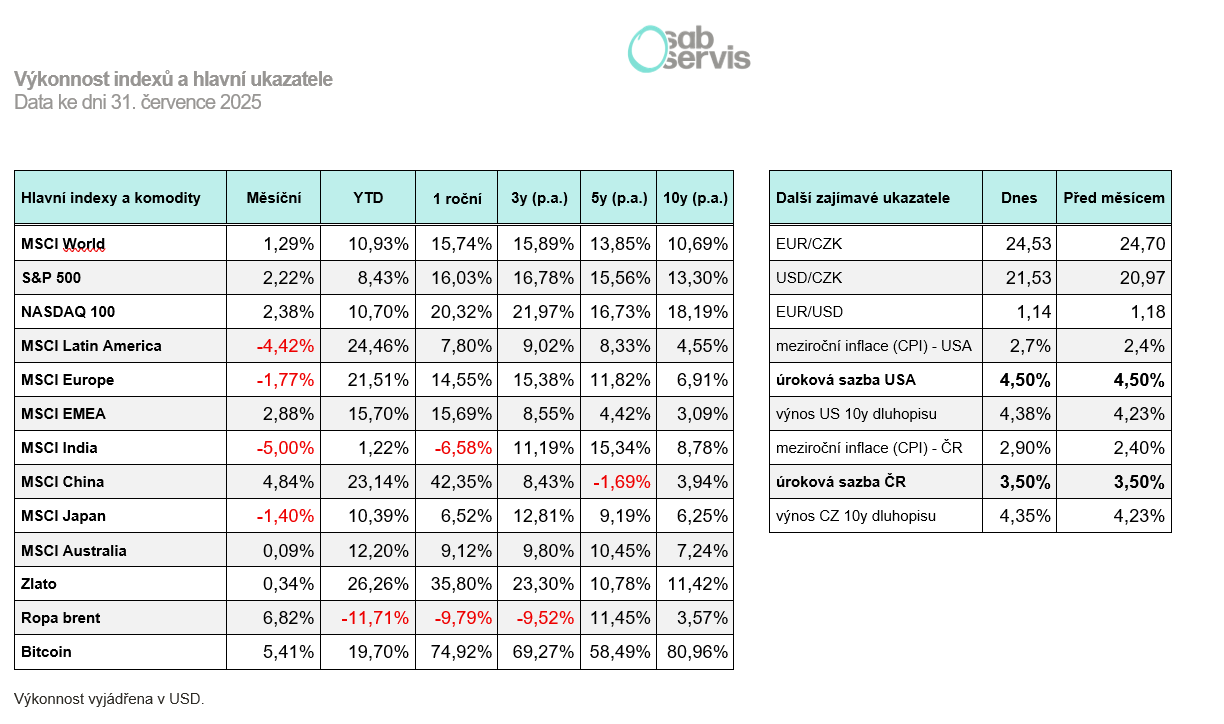

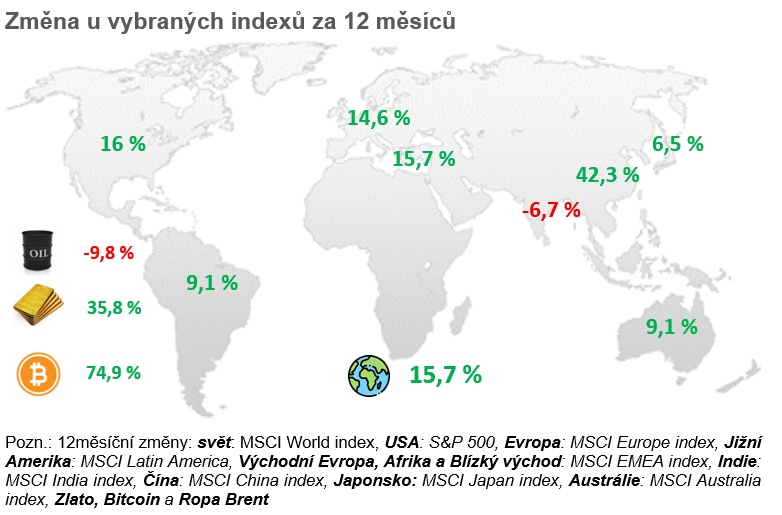

In July, stocks rose again and the S&P 500 index gained over 2% in dollar terms. The main themes of the month were earnings season and also tariffs and newly emerging trade agreements between the USA and countries around the world.

Earnings season has so far brought positive numbers for most companies, especially technology firms, and continues to drive stock prices higher.

Trade agreements between the USA and other countries around the world are gradually being concluded. For example, the agreement between the USA and the EU, where both sides ultimately agreed on imposing tariffs on the EU of 15% on imports of goods into the USA.

But who benefits from this agreement? Has Trump achieved his victory according to the book The Art of the Deal? It’s definitely not clear-cut. For Europe, reducing the originally announced 30% to just 15% can be seen as a success. Even so, these tariffs are significantly higher than they were a year ago.

In addition, the EU committed to purchasing energy commodities from the USA through 2028 in an amount of up to USD 750 billion and also to USD 600 billion of investments by European companies in the USA. However, this will definitely not be that simple, because the EU cannot just order European companies to build their factories in the USA or to buy energy from there.

It can be said that the agreement is rather advantageous for the USA, at least from a political perspective. However, as a result, the tariffs imposed on the EU will most likely be paid by the American consumer anyway, which will probably trigger higher inflation in the USA in the future.

And how did other assets perform? Gold is holding around USD 3,350 per troy ounce, and bitcoin managed to hit new highs, reaching as high as USD 120,500.

Macro summary:

But let’s move on to the macroeconomic figures, where the year-on-year inflation rate for June in the Czech Republic came in at 2.9%. The increase is mainly due to rising food prices and services.

The year-on-year inflation rate in the USA for June came in above expectations, specifically at 2.7%. The reason was rising housing costs and very likely the impact of tariffs has already fed through. It is estimated that they caused an increase of 0.1 to 0.2%.

Unemployment for June in the USA came in at 4.1% and for now does not signal problems in the economy. The unpleasant news was the data on the number of newly created jobs NFP (non-farm payrolls).

There was a surprise here – as of August 1, 2025, 73,000 newly created jobs were recorded instead of the expected 110,000. At the same time, there was a revision of up to 90% concerning newly created jobs for previous months. Equity markets reacted to this news with a decline of 2 to 3%, but rose again the following week.

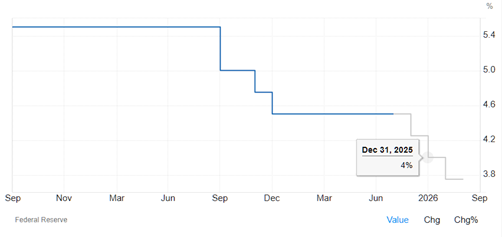

On July 30, 2025, the Fed meeting was held, at which the Fed kept interest rates at the current level of 4.5%. By the end of the year, however, it signals one to two rate cuts.

As for the results of year-on-year inflation in Europe, for the month of June it came in at 2% in line with expectations.

At its meeting on July 24, 2025, the ECB also left interest rates unchanged at 2.15% after a longer period. One more cut to 1.9% is expected by year-end.

Czech Republic:

The year-on-year inflation rate for June in the Czech Republic came in at 2.9%. The increase is mainly due to rising food prices and services.

The CNB meeting will take place in the first half of August, where interest rates are expected to remain unchanged at 3.5%. This is also due to slightly rising inflation.

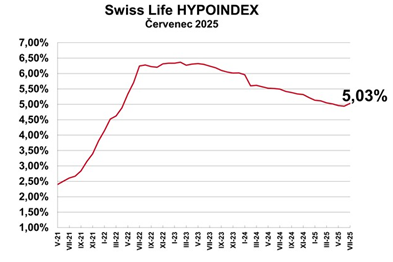

As for property prices and mortgage rates, the average interest rate in July rose again above the 5% threshold.

The growth is probably driven by the continuously rising yields on 5-year Czech government bonds. There has been a gradual increase to as much as 3.85%.

USA:

The year-on-year inflation rate in the USA for June came in above expectations, specifically at 2.7%. The reason was rising housing costs and very likely the impact of tariffs has already fed through. It is estimated that they caused an increase of 0.1 to 0.2%.

Unemployment for June in the USA came in at 4.1% and for now does not signal problems in the economy. The unpleasant news was the data on the number of newly created jobs NFP (non-farm payrolls).

There was a surprise here – as of August 1, 2025, 73,000 newly created jobs were recorded instead of the expected 110,000. At the same time, there was a revision of up to 90% concerning newly created jobs for previous months. Equity markets reacted to this news with a decline of 2 to 3%, but rose again the following week.

On July 30, 2025, the Fed meeting was held, at which the Fed kept interest rates at the current level of 4.5%.

US interest rate forecast

Source: www.tradingeconomics.org

For the next September meeting, there is currently as much as a 60% chance of a rate cut. Another cut should then occur by the end of the year, taking rates to 4%.

Even now, at the last meeting, there were voices from some Fed members who voted for a cut. It’s a bit like waiting for Godot, because further rate cuts have been talked about since the beginning of the year.

The S&P 500 index is currently at USD 6,330 and is up over 2% for July.

Europe:

As for the results of year-on-year inflation in Europe, for the month of June it came in at 2% in line with expectations.

At its meeting on July 24, 2025, the ECB also left interest rates unchanged at 2.15% after a longer period. One more cut to 1.9% is expected by year-end.

European indices experienced a slight decline in July. For example, MSCI Europe fell by just under 2%. Nevertheless, in dollar terms it still posts a return of up to 21% thanks to the EUR/USD exchange rate.