Main events:

• S&P 500 at new highs

• Fed kept interest rates at 4.5%

• Trump’s “One Big Beautiful Bill Act” is approved

Summary of the current situation:

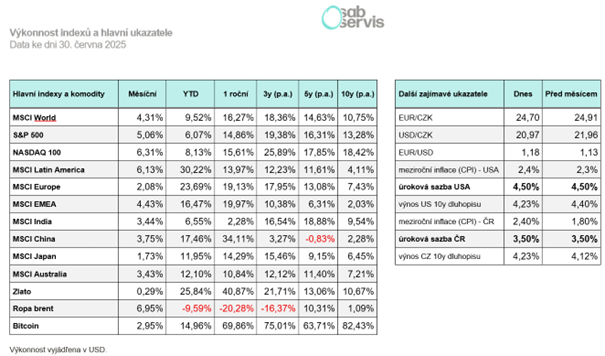

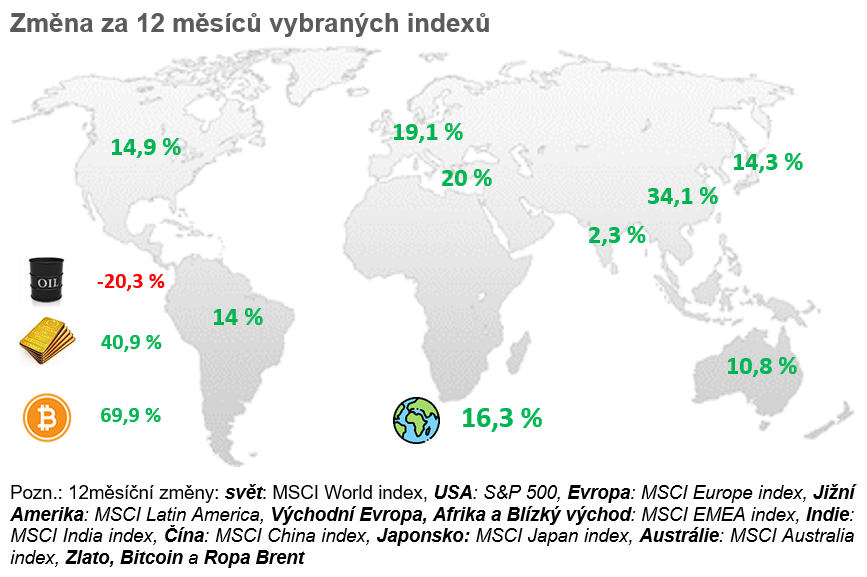

In June, stocks rose again, and the S&P 500 index gained up to 5% in dollar terms. In less than 4 months, it returned to its highs and continues to grow.

But for us, koruna investors, the index is still up to 10% below its peaks. How is this possible? It is due to the significant weakening of the US dollar against the koruna and also against the euro or other currencies.

More or less since the beginning of the year, the dollar has weakened by up to 15%, and from 24.5 USD/CZK, we are now at 20.9 USD/CZK. Such movements do occur, and the koruna has been moving in a range between 20 to 25 USD/CZK over the last 10 years.

But the question is, why did the US dollar weaken so much against other currencies? It is very likely due to Trump’s law called the “One Big Beautiful Bill Act,” abbreviated as OBBBA, which was approved by the House of Representatives and the Senate at the beginning of July and is thus coming into effect.

What exactly is it about? It is a comprehensive package of new laws, some of which Trump had long promised in his presidential campaign and is now trying to implement.

The law introduces the biggest tax cuts in US history, aimed at increasing wages, net family incomes, and overall supporting economic growth. Furthermore, Trump plans to increase spending on defense, oil extraction, and conversely reduce incentives within clean energy. Besides, there is a threat of increasing taxes on dividends for foreign investors, or he will soon want to reduce the promised corporate tax from 21% to 15%.

But why did the dollar weaken because of this, or why did yields on long-term bonds rise?

It is predicted that the law will undoubtedly cause higher US indebtedness for the coming years, with deficits expected to be as high as an incredible 8% of GDP, similar to the COVID period, which is certainly not insignificant, and the debt should rise from the current 120% of GDP to 130% of GDP.

This is definitely not a positive signal for investors and overall for the US dollar, which is likely to continue weakening.

At the same time, the validity of the postponed tariffs from April was delayed again, and they should come into effect against states around the world at the beginning of August. However, the US has already negotiated agreements with some countries, and a final agreement with the European Union is also expected.

And how did other assets perform? Gold is holding at levels around 3,300 USD per troy ounce, and bitcoin in the range between 100,000 to 110,000 USD.

Macro summary:

But let’s move on to macroeconomic figures, where the year-on-year inflation rate for May in the Czech Republic again came out above 2%, specifically at 2.4%.

The year-on-year inflation rate in the US for May was slightly below expectations, specifically at 2.4%.

Unemployment for May remains at 4.2% in the US, and so far, it does not signal problems in the economy.

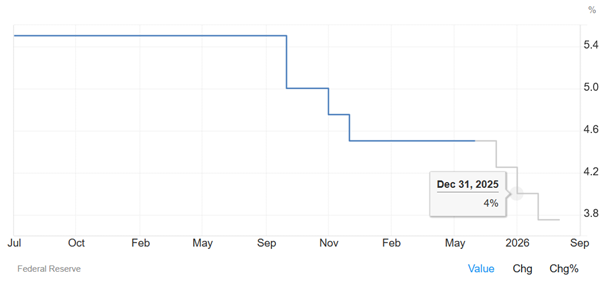

On June 18, 2025, another Fed meeting was held, but the Fed again kept interest rates at the existing level of 4.5%. One or two interest rate cuts are still expected by the end of the year.

As for the results of year-on-year inflation in Europe, it came out for May at 1.9% in line with expectations.

Czech Republic:

The year-on-year inflation rate for May in the Czech Republic again came out above 2%, specifically at 2.4%.

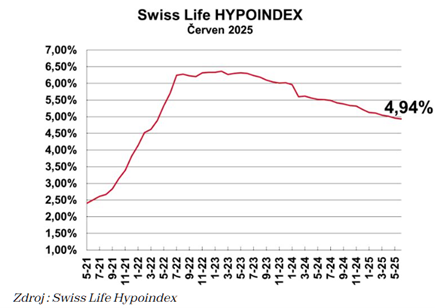

However, demand for real estate is again at a higher level, and their prices continue to rise even in the first quarter of this year.

USA:

The year-on-year inflation rate in the US for May was slightly below expectations, specifically at 2.4%.

Unemployment for May remains at 4.2% in the US, and so far, it does not signal problems in the economy.

On June 18, 2025, another Fed meeting was held, but the Fed again kept interest rates at the existing level of 4.5%. One or two interest rate cuts are still expected by the end of the year.

US Interest Rate Prediction

Source: www.www.tradingeconomics.org

Inflation is at lower levels, and unemployment is stable, but the Fed is not rushing into lowering interest rates. This is also due to the new Trump law, which is more or less anti-inflationary.

The S&P 500 index is currently at 6,280 USD, and for June, it is gaining over 4% appreciation.

Europe:

As for the results of year-on-year inflation in Europe, it came out for May at 1.9% in line with expectations.

At the end of June at the NATO summit in The Hague (June 24-25, 2025), member states agreed on an overall increase in defense spending.

A total of 5% of GDP – by 2035, each member state will achieve a combination of:

• 3.5% of GDP on “core defense”: soldiers, weapons, maintenance, etc.,

• 1.5% of GDP on broader security investments: infrastructure, cybersecurity, defense industry.

For European industry, this is a positive signal and can overall help kick-start the currently non-growing economy.

European indices across regions continued to rise in JUNE, surpassing new highs, and since the beginning of the year, for example, MSCI Europe is gaining up to 24% in dollar terms.