Main events:

• The S&P 500 index fell from its peaks by over 20%!

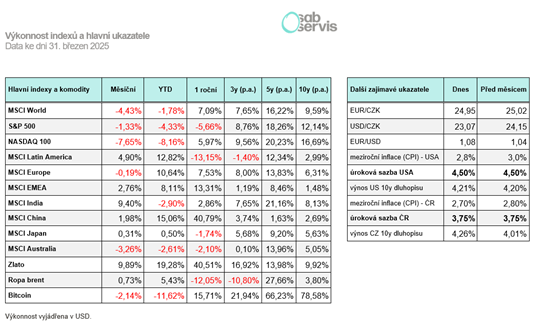

• Trade wars continue in a big way

• Both ČNB and Fed kept interest rates at original levels

Summary of the current situation:

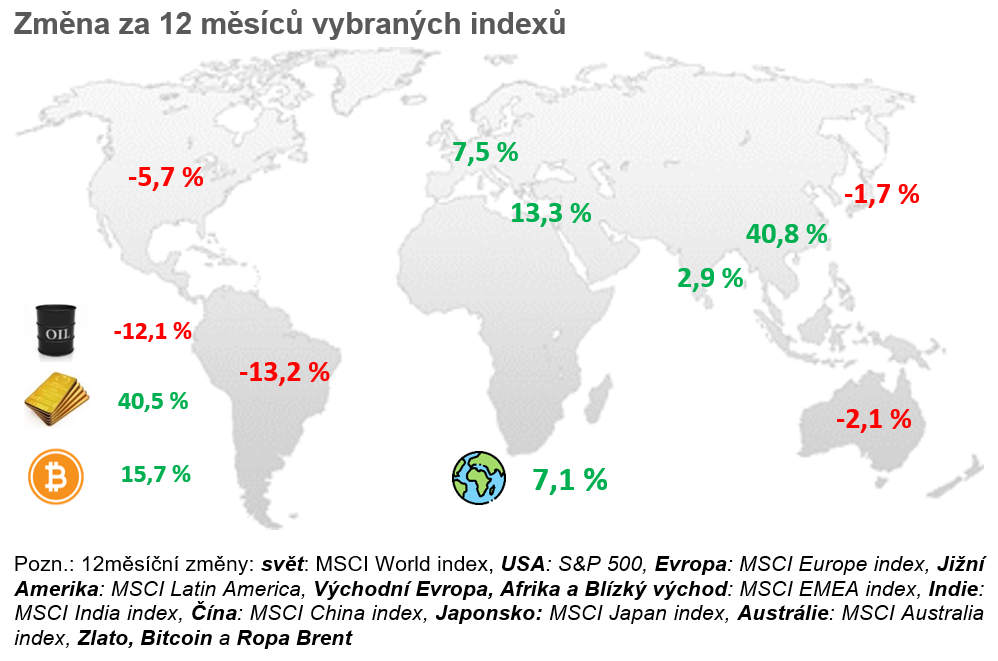

On Thursday, 3.4. 2025, the S&P 500 index fell by 5% in just one day, and the next day it fell by 6%. We last saw such large drops during COVID, and historically the S&P 500 index has only fallen this quickly by 10% in just 2 days four times.

Currently, the S&P 500 index is 15 to 20% below the peaks from February, and tech stocks also fell significantly, for example, Apple by 10% in a single day, and overall the NASDAQ 100 index is also over 20% below its peaks. But stocks fell more or less worldwide, both in Europe and Asia.

And the reason for these declines was once again Trump and the newly introduced so-called reciprocal tariffs, which he announced at a press conference on Wednesday, 2.4. 2025.

In short, tariffs were introduced against countries with which the USA has a negative trade balance. This means that tariffs are imposed on countries that import more into the USA than the USA exports to them. These include China or the European Union, for example.

According to Trump’s administration, this is a bad situation for the USA, and they want to impose tariffs on these countries.

Specifically, the following tariffs were introduced:

China 34%

EU 20%

United Kingdom 10%

Switzerland 31%

Japan 24%

In addition, a blanket tariff of 10% was introduced against all countries, and logically the previous tariffs imposed on the import of aluminum and steel or tariffs on the import of cars to the USA at a rate of 25% still apply.

But to summarize the introduction of tariffs. Affected countries like China or the European Union will logically retaliate and introduce counter-tariffs. Perhaps even on the import of services.

And according to most economists, the calculation by Trump’s administration of the height of tariffs imposed on other countries is based on completely illogical assumptions and does not make any sense. Therefore, no one really understands why and on what basis these tariffs are being introduced.

As for the introduced tariffs, the impact on the economy is almost impossible to predict.

1) Either inflation will rise precisely as a result of the price increase due to the introduced tariffs, and the Fed will be forced to raise interest rates again. This will be negative for the economy and stock markets.

2) Or it is possible that although the price of goods will rise, consumption will decrease, and as a result, prices will fall, and GDP will decline. As a result, the US economy may enter a recession, and the Fed will be forced to lower interest rates. This, in turn, will kickstart the economy again and also improve the servicing of national debt.

This could also be one of Trump’s main goals, to cause a recession and ease the repayment of American debt. But it is more likely to provoke a recession, and investors and stock markets are pricing this in, which is why they are also falling.

And how did other assets fare? Gold continued to rise in March and grew almost to $3200 per troy ounce. However, under the influence of sell-offs in the stock markets, it also declined and ended up at around $3000.

Bitcoin is surprisingly holding up, ending March positively, and recent events did not affect its price much. This is quite interesting because in recent years it had a high correlation with stock indices, but now while the S&P 500 index fell by 10% in 2 days, Bitcoin barely dropped.

Analyst recommendations from SAB service:

How do we, as the analytical team, view the current declines and situation? Although these are very rapid declines, and the situation may further escalate with the introduction of counter-tariffs, we still believe it is a good opportunity for long-term investors to invest.

Whether as part of a regular investment or possibly to increase the regular investment a bit this month or buy with funds prepared for this purpose. Stock markets may continue to fall in the coming months, but the trade war may also quickly de-escalate, and stocks may return to a growth trajectory.

Of course, no one knows, and that is why it is ideal to buy gradually during declines and definitely not all at once.

Macro summary:

But let’s move on to macroeconomic figures, where the year-on-year inflation rate for February in the Czech Republic came out at 2.7%. A slight decline to 2% levels is expected by the end of the year.

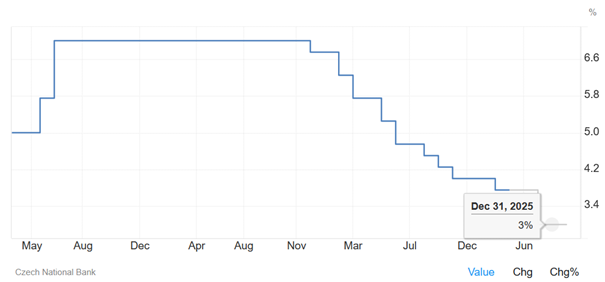

On 26.3. 2025, another meeting of the ČNB was held, which kept interest rates at 3.75%. All 7 members of the bank board voted to keep them unchanged. By the end of the year, the ČNB plans to lower interest rates to 3%.

The year-on-year inflation rate in the USA for February came out as expected at 2.8%. However, a slight increase over 3% is expected in the coming months, partly due to rising prices of new cars.

Unemployment in the USA remained at 4.1% in February, and it does not yet signal problems in the economy. A slight increase to 4.4% is expected in the coming months.

Regarding the year-on-year inflation results in Europe, it came out as expected at 2.3% for February in Europe. A decline back to 2% levels is expected in the coming months.

Czech Republic:

The year-on-year inflation rate for February in the Czech Republic came out at 2.7% and is expected to decline slightly to 2% levels by the end of the year.

On 26.3. 2025, another meeting of the ČNB was also held, which kept interest rates at 3.75%. All 7 members of the bank board voted to keep them unchanged.

Interest rate set by ČNB and its forecast

Source: tradingeconomics.com

However, the ČNB still expects to proceed with further reductions to 3% levels by the end of the year.

GDP for 2024 grew by 1%, which is certainly better than the 0.4% decline we saw in 2023. For 2025, GDP is expected to grow by up to 2% according to the ČNB forecast. However, all predictions change if the newly introduced tariffs by the USA are actually applied.

The impact will likely be very negative, with GDP falling and unemployment rising.

USA:

The year-on-year inflation rate in the USA for February came out as expected at 2.8%. However, a slight increase over 3% is expected in the coming months, partly due to rising prices of new cars.

Unemployment in the USA remained at 4.1% in February, and it does not yet signal problems in the economy. A slight increase to 4.4% is expected in the coming months.

As for the introduced tariffs, the impact on the economy is almost impossible to predict. This will be negative for the economy and stock markets.

1) Either inflation will rise precisely as a result of the price increase due to the introduced tariffs, and the Fed will be forced to raise interest rates again.

2) Or it is possible that although the price of goods will rise, consumption will decrease, and as a result, prices will fall, and GDP will decline. As a result, the US economy may enter a recession, and the Fed will be forced to lower interest rates. This, in turn, will kickstart the economy again and also improve the servicing of national debt.

This could also be one of the main goals of Trump, to cause a recession and ease the repayment of American debt.

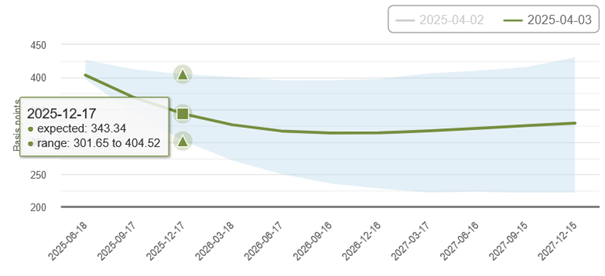

Fed’s forecast regarding interest rate cuts

Source: www.atlantafed.org

Investors are quite quickly starting to price in interest rate cuts, and bond yields have fallen, and by the end of the year, it is now expected that the Fed will proceed to cut interest rates to 3.5%. This would mean approximately 3 to 4 cuts.

The S&P 500 index is currently 15 to 20% below its peaks, and the technology index NASDAQ 100 also experienced over a 20% decline (as of 5.4. 2025).

Europe:

Regarding the year-on-year inflation results in Europe, it came out as expected at 2.3% for February in Europe. A decline back to 2% levels is expected in the coming months.

In Germany, under the leadership of the new Chancellor Friedrich Merz, a massive infrastructure spending package (up to 500 billion EUR) was pushed through, and spending on armaments was increased from 2 to 3.5% of GDP.

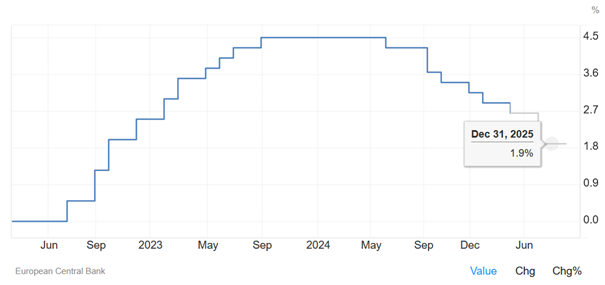

The ECB, at a meeting on 6.3. 2025, proceeded to further reduce interest rates to 2.65% and expects a drop to 1.9% by the end of the year.

Interest rate set by ECB and its forecast

Source: tradingeconomics.com

European stocks, unlike American ones, held up and delivered positive returns of over 10% since the beginning of the year! However, large sell-offs did not spare them either, and they ended up roughly at zero since the beginning of the year (as of 5.4. 2025).