Main events:

• Fall of the government in Germany and France

• President of South Korea declared martial law

• Bitcoin surpassed the 100,000 USD mark

Summary:

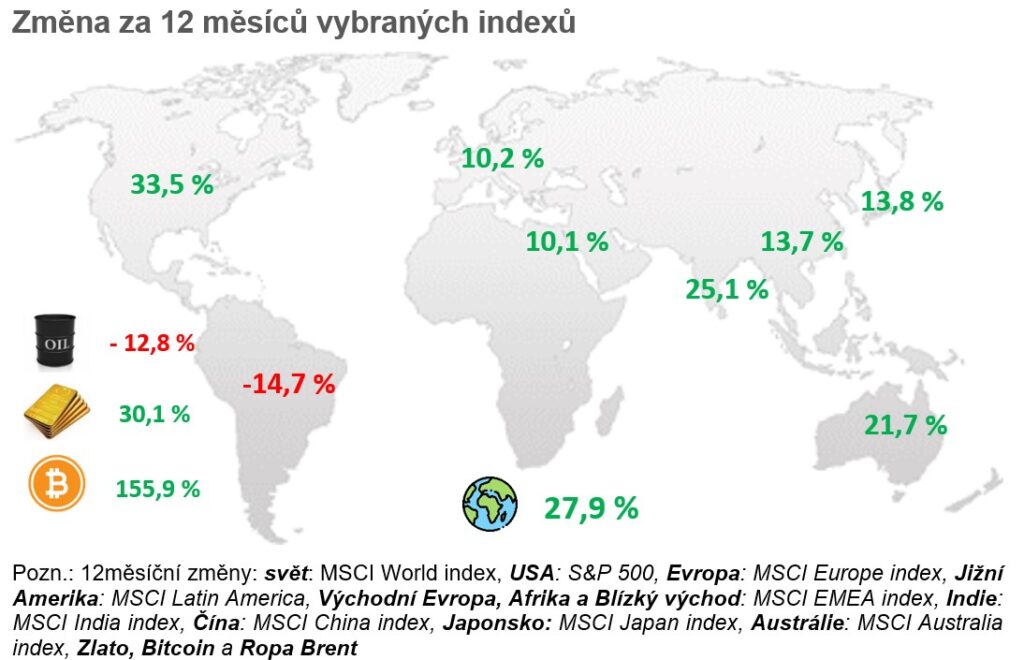

After Trump’s election as president, American stocks and other assets such as bitcoin increased in value until the end of November. In the USA, it seems that the political situation is resolved and we partly know what to expect in the future.

However, in Europe, one government after another is starting to fall, first it was the German government led by Chancellor Olaf Scholz at the beginning of November, where early elections were then announced for February. At the beginning of December, the government in France also fell, and in the United Kingdom, signatures are reportedly being collected for a vote of no confidence in the government.

But all this is a mild version compared to the situation in South Korea, where President Yoon Suk-yeol announced the declaration of martial law in an extraordinary televised address on Tuesday, December 3. The reason was due to the alleged sympathizing of the opposition party with North Korea.

South Korea is indeed a presidential republic and the president has the right to do so, but the parliament then began to vote on the abolition of martial law. During the vote, soldiers entered the parliament, helicopters landed on the roof, and tanks were driving through the city.

Later, the army left the parliament and stated that martial law in the country would remain in effect until it was abolished by the president. During the night, the president relented and revoked the martial law, which was subsequently confirmed by the government. And the president will now be investigated for high treason. South Korean stocks, however, barely reacted to this and it is a situation that nobody expected.

But let’s move on to macroeconomic numbers, where the year-on-year inflation rate in the USA came in slightly above expectations for October at 2.6%. However, it is still within the tolerance band of the American central bank.

Unemployment in the USA for November surprisingly grew to 4.2% and is expected to slightly increase to 4.3% by the end of the year.

For now, the Fed continues to signal that it will reduce interest rates only gradually by 0.25% for the next few meetings. However, they currently plan to keep interest rates long-term in the range of 3.5 to 3.7%. More information will be revealed at the December meeting.

The year-on-year inflation rate for October in our country came out again at an elevated level of up to 2.8%. The growth was driven by more expensive food and especially services, specifically water and sewage. As long as inflation remains below 3%, the ČNB will not be concerned and will likely proceed with further interest rate cuts in December.

As for the results of year-on-year inflation in Europe, it remained exactly at the 2% mark in Europe for the month of October. Only a slight increase above 2% is expected for the coming months. The next ECB meeting will also take place in mid-December.

And how did other assets fare? The price of oil slightly decreased and remains below 70 USD per barrel. Gold continued to decline to 2550 USD per troy ounce after Trump’s election, but then rose again by the end of the month.

Bitcoin, after a short correction to 92,000 USD, continues its optimism and even surpassed the historic milestone of 100,000 USD on December 5!

Czech Republic:

The year-on-year inflation rate for October in our country came out again at an elevated level even up to 2.8%. The growth was driven by more expensive food and especially services, specifically water and sewage.

According to forecasts from the last ČNB meeting, this temporary increase in inflation due to rising food prices was expected. In addition, core inflation remains elevated, especially in the services category. Therefore, the bank board will approach further monetary policy easing very cautiously in the future, or may completely suspend rate cuts.

Tension in the labor market is slightly decreasing, but unemployment remains low. The growth of the average wage in the second quarter reached 6.5% and slowed compared to the first quarter. From a historical perspective, wage growth remains elevated.

The Czech economy continues to recover only gradually and according to preliminary estimates by the ČSÚ, GDP increased by 0.4% quarter-on-quarter in the third quarter and accelerated year-on-year growth to up to 1.3%.

Meanwhile, on Friday, December 6, 2024, a law allowing a time and value test for cryptocurrencies, similar to what we have for stocks and ETFs, was unanimously approved across the political spectrum in the Czech Republic.

The law should be effective from January/February and even retroactively, meaning if we have held cryptocurrencies since 2021, we will be able to sell them at a profit without having to pay taxes.

USA:

The year-on-year inflation rate in the USA came out again slightly above expectations for October at 2.6%. However, it is still within the tolerance band of the American central bank.

Unemployment in the USA for November surprisingly grew to 4.2% and is expected to slightly increase to 4.3% by the end of the year.

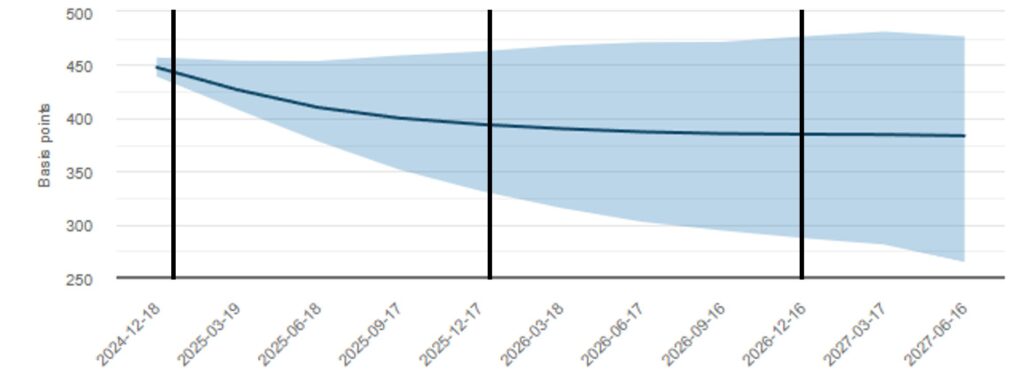

Forecast regarding the reduction of interest rates in the USA

Source: AtlantaFed

For now, the Fed continues to signal that it will reduce interest rates only gradually by 0.25% for the next few meetings. However, they currently plan to keep interest rates long-term in the range of 3.5 to 3.7%. More information will be revealed at the December meeting.

The S&P 500 index continued to rise in November, gaining even 5.85%. Similarly, the technology index NASDAQ 100 performed well and even more so the small caps represented by the Russell 2000 index.

Europe:

The year-on-year inflation rate for October in Europe remained exactly at the 2% mark. Only a slight increase above 2% is expected for the coming months. The next ECB meeting will also take place in mid-December.

More interesting events occurred in Germany, where the government of Chancellor Olaf Scholz fell at the beginning of November. Originally, his party SPD formed a coalition with the FDP and the Green Party and had a majority thanks to that.

However, they did not agree on economic policy issues and budget formation, and the FDP is leaving the government, so the coalition lost its majority. Therefore, early elections were announced, which will likely take place on February 23.

And the situation is not stable in France either, as one of the political parties expressed a vote of no confidence in the government on Wednesday, December 5. The opposition initiated the vote because Prime Minister Michel Barnier wanted to bypass the parliament after budget disputes for the next year. The opposition parties did not like it because he wanted to reduce expenses overall and work on reducing France’s debt.

Finally, with the connection of the National Rally and left-wing opposition parties, 331 deputies out of the total 574 voted against the government, and thus the government did not receive confidence. What happens next is a question, as the current government has only been in power for 3 months and elections were held recently.

European stocks grew in November, but in dollar terms, due to the strengthening of the dollar, the index slightly lost -1.66%.