Main events:

• NVIDIA beat expectations and is keeping stock markets afloat

• Impacts of the government shutdown in the USA

• Bitcoin fell from its peaks by as much as 35% to 80,000 USD

Summary of the current situation:

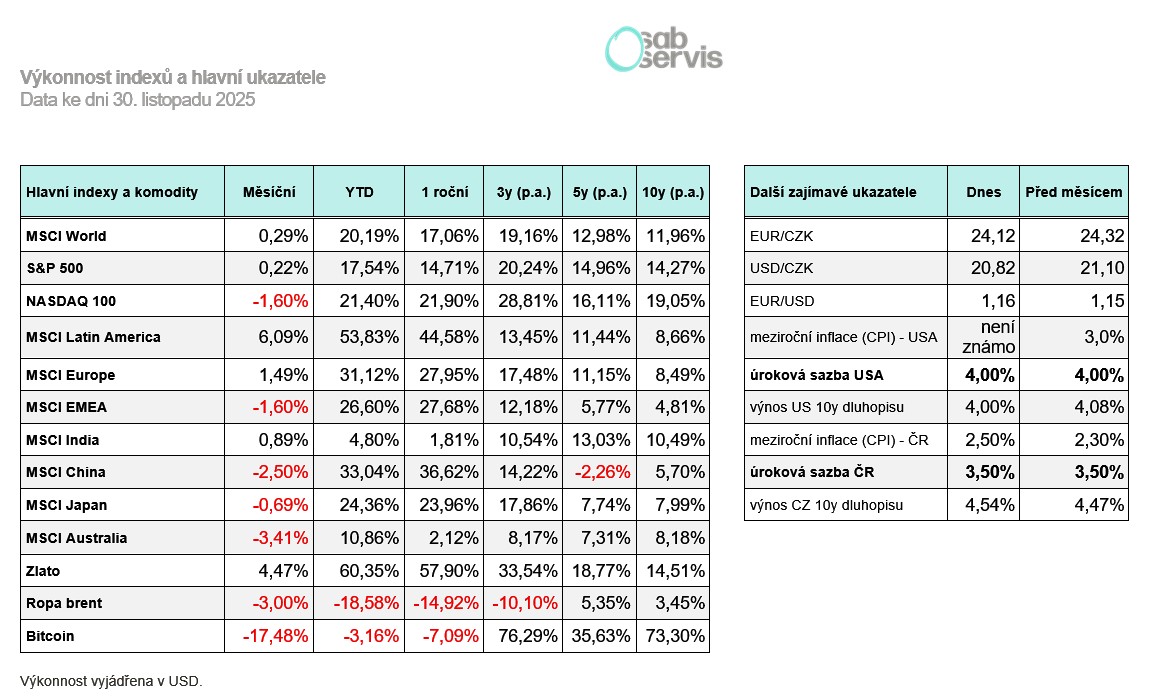

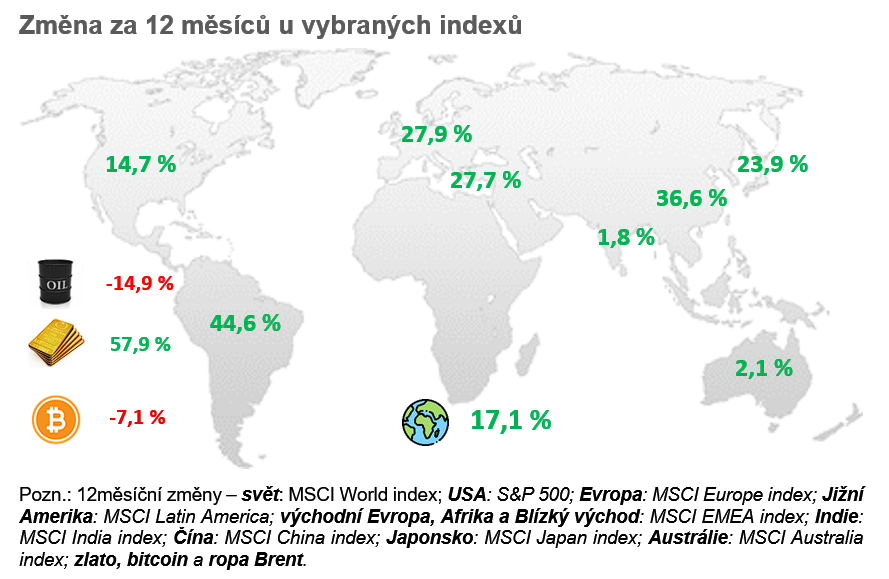

Equities as represented by the S&P 500 index experienced a mild correction of approximately 7% in November. Technology stocks declined a bit more and the NASDAQ 100 lost over 10%. The likely reasons were concerns about the end of the AI boom and broader fears of a stock market bubble.

Investors therefore waited for NVIDIA’s earnings, which once again beat expectations and rescued the stock markets – and the AI boom, it seems, continues. Stocks thus gradually rose toward the end of the month and the S&P 500 index is close to new highs.

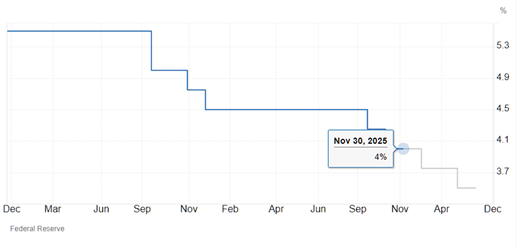

However, attention is now on the December Fed meeting, where interest rates will likely continue to be cut, down to 3.75%.

And how did other assets perform? After a small correction to 4,000 USD, gold started rising again and is now trading above 4,200 USD.

Bitcoin went through a fairly large drop in November, from 110,000 USD down to 80,000 USD. It fell more than stock markets and at one point was as much as 35% below its peaks. The declines were related, among other things, to a major outflow of capital from U.S. bitcoin ETFs. Bitcoin is currently hovering around 90,000 USD.

Macro summary:

The year-on-year inflation rate for October in the Czech Republic came in at 2.5%, which is another slight increase compared with September.

The year-on-year inflation data for October in the USA were officially canceled. The reason was the so‑called government shutdown, during which officials in October did not collect sufficient data on the prices of goods and services. We therefore have to wait for the November figures, which could be all the more surprising.

The latest unemployment data we have are for September, and they were not released until November 20, i.e. with a 6‑week delay, again due to the government shutdown. The unemployment rate rose slightly to 4.4%, and by the end of the year a further increase to 4.6% is expected.

As for year-on-year inflation in Europe, the October figure once again came in at 2.1%, in line with expectations.

We also received new data on GDP growth in the EU for Q3. Year-on-year, GDP grew by 1.6%, and quarter-on-quarter by 0.4%. This is not a particularly strong improvement, but there is growth. For next year, growth is expected to reach 1.3 to 1.5%.

Czech Republic:

The year-on-year inflation rate for October in the Czech Republic came in at 2.5%, which is another slight increase compared with September.

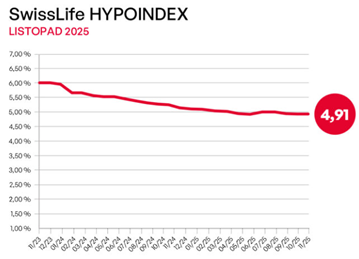

If we look at the average rate of completed mortgages, it stood at a stable 4.91% in November. However, long-term yields on Czech government bonds have been rising in recent months.

Source: hypoindex.cz

Specifically, 10‑year yields have risen to as high as 4.5% and 5‑year yields to 4%. It is therefore likely that further reductions in mortgage interest rates will probably not occur next year.

USA:

The year-on-year inflation data for October in the USA were officially canceled. The reason was the so‑called government shutdown, during which officials in October did not collect sufficient data on the prices of goods and services. We therefore have to wait for the November figures, which could be all the more surprising.

The latest unemployment data we have are for September, and they were not released until November 20, i.e. with a 6‑week delay, again due to the government shutdown. The unemployment rate rose slightly to 4.4%, and by the end of the year a further increase to 4.6% is expected.

Forecast of the interest rate in the USA

Source: www.www.tradingeconomics.org

The key event will be the Fed meeting to be held in the first half of December. The majority expectation is that the Fed will cut interest rates to 3.75%. For 2026, a further overall reduction to 3.5% is expected.

The S&P 500 index is currently at 6,850 USD and ended November with a modest gain of 0.22%.

Europe:

As for year-on-year inflation in Europe, the October figure once again came in at 2.1%, in line with expectations.

We also received new data on EU GDP growth for Q3. Year-on-year, GDP grew by 1.6%, and quarter-on-quarter by 0.4%. This is not a particularly strong improvement, but there is growth. For next year, growth is expected to reach 1.3 to 1.5%.

European indices continued to rise in November; for example, MSCI Europe gained as much as 1.49% in USD terms.