Main events:

• The Fed finally cut interest rates!

• The CNB continues to cut interest rates to 4.25%

• China supports the economy and stock markets with everything possible

Summary:

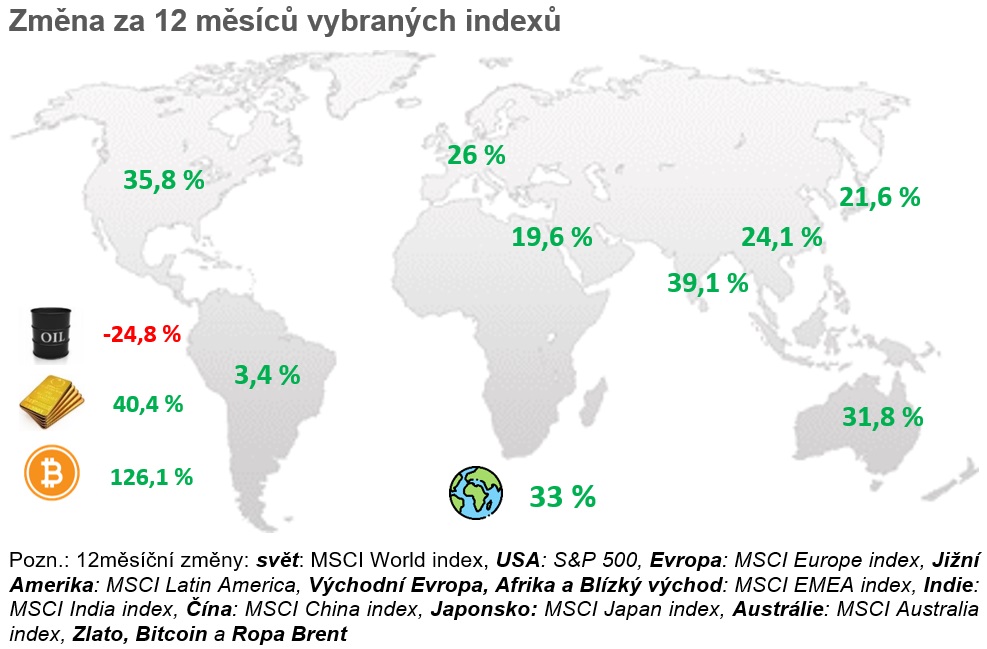

Throughout September, there were many claims and predictions that indexes fall in September and there is a high chance it would be a losing month. Indexes did drop a bit at the beginning of September, but since then they have been rising, and the Fed meeting also supported this growth.

This meeting was held on September 18, 2024, and for the first time since the end of the rate-hiking cycle, the Fed cut rates by 0.5%. The so-called Fed funds rate thus fell from 5.5 to 5%. Members of the American central bank took this more drastic reduction also due to rising unemployment and increased recession expectations.

However, the unemployment rate in the USA surprisingly came in at 4.1% for September, thus halting the growth trend.

The year-on-year inflation rate for August came in at 2.2% in the Czech Republic. And at the end of September, specifically on September 25, 2024, a CNB meeting took place, which slightly reduced interest rates from 4.50 to 4.25%.

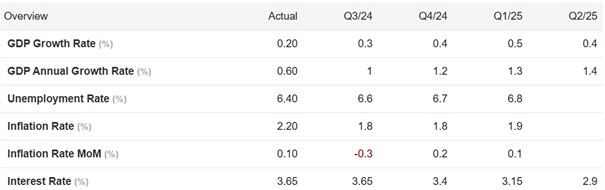

Regarding year-on-year inflation results in Europe, it reached 2.2% for August, and for September, it is expected to drop even to 1.8%. In September, there was also an ECB meeting, which, similar to the Fed, cut interest rates more drastically. Specifically, from 4.25 to 3.65%.

Worth mentioning is the worsening situation in the Middle East, where Iran again attacked Israel with rockets. Israel will not let this go unchallenged and will likely conduct a retaliatory attack on Iran, which may further escalate the situation. However, stock markets have so far reacted only with a slight decline and do not expect escalation.

And after a long time, almost unbelievably, stock indexes in China are also rising. For September, the Hang Seng and other indexes added over 20% and continue to grow. However, it is important to keep in mind that stock indexes had previously fallen by tens of percent and over a ten-year horizon, Chinese stocks have provided investors with a return of only 3.5% p.a.

Why have investors found the courage to invest in Chinese stocks again and why are they doing well? It is due to a combination of support from the CCP and the Chinese central bank. Whether it was a reduction in interest rates, required minimum reserves, or it is also planned that the CCP itself will purchase Chinese stocks on the stock exchange through banks, thus pushing their price up.

And how did other assets perform? Oil continues to decline further, down to -7.3% for September. Gold surprisingly reached new highs again, currently at over 2680 USD per troy ounce. Bitcoin managed to recover from the August correction and is currently holding in the range between 60 and 65,000 USD.

Czech Republic:

The year-on-year inflation rate for August remains within the tolerance band and came in again at 2.2%. Inflation is thus no longer the main topic within the Czech Republic.

A more important topic is the expected GDP growth rate or the growth of the average nominal wage. It grew by 7.2% for the 2nd quarter, while the CNB predicted its growth at 6.5%.

At the end of September, specifically on September 25, 2024, a CNB meeting took place, which slightly reduced interest rates from 4.50 to 4.25%.

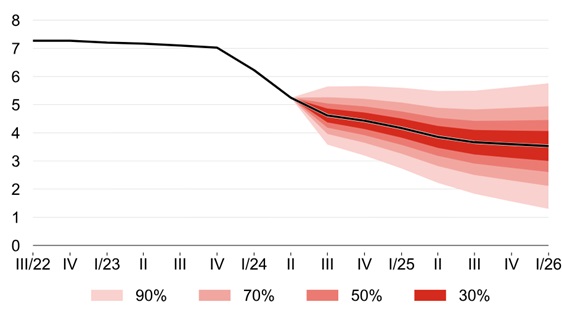

CNB forecast regarding interest rate cuts

Source: CNB.cz

At the same time, according to the CNB’s prediction, a rate drop to around 3.5% is expected for 2025. This is thus a gradual rate reduction, and we probably will not see zero or similarly low interest rates in the near future.

Worth mentioning is the decline in yields of 5-year Czech government bonds, which currently bring 3.3% annually. This rate is especially important for banks and 5-year mortgage fixations, and the interest rate the bank offers on loans should depend on it. So far, this has not fully translated into lower mortgage rates, but hopefully, it will succeed in the coming months.

USA:

Inflation in the USA confirms a definitively declining trend, with the year-on-year rate for August coming in at just 2.5%. Services and real estate prices are no longer driving growth, and it seems that inflation is indeed under control.

Therefore, the Fed and investors are increasingly focusing their attention on unemployment data. The unemployment rate for September was surprisingly only 4.1%, and fortunately, the growth trend halted after July’s 4.3%.

On September 18, 2024, a Fed meeting took place, which, for the first time since the end of the rate-hiking cycle, cut rates by 0.5%. The so-called Fed funds rate thus fell from 5.5 to 5%. Members of the American central bank took this more drastic reduction also due to recent rising unemployment and increased recession expectations.

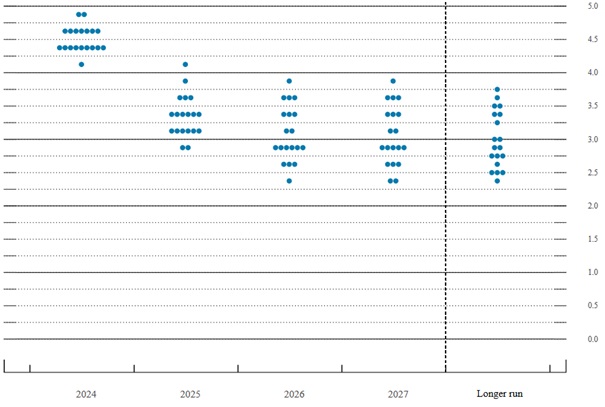

Fed forecast regarding interest rate cuts

Source: federalreserve.gov

At the same time, according to the Fed’s forecast, it is still expected that by the end of the year, the interest rate in the USA could be slightly above 4% and in 2025, it should be reduced to a level between 3 and 3.5%. Again, the Fed does not expect to reduce rates to the levels seen over the last 10 to 15 years.

The S&P 500 index, after dropping at the beginning of September, eventually gained 2.1%, while the NASDAQ 100 gained 3.4%. The S&P 500 index thus reaches new highs at the level of 5,800 USD.

Europe:

The year-on-year inflation rate for July in Europe remains at the expected 2.2%, and inflation numbers once again confirm that the episode of high inflation is over. For September, a further drop in inflation to just 1.8% is expected.

In September, there was also an ECB meeting, which, similar to the Fed, cut interest rates more drastically. Specifically, from 4.25 to 3.65%.

Expected macroeconomic indicators for the Eurozone

Source: tradingeconomics.com

For the future, the ECB expects to gradually continue reducing interest rates, and by 2025, they should be below 3%. In the long term, the ECB wants to keep interest rates approximately at 2.5%.

While most central banks are already cutting interest rates, the Bank of England (BoE) has so far kept rates at 5% and currently holds them the highest among the larger central banks. Similar to the Fed, but it already signals further reductions, while the BoE still does not fully believe that the era of high inflation is over.

The European MSCI Europe index grew only slightly by 0.4% for September.