Main events:

• CNB reduced interest rates to 4.75%!

• The Fed meeting in June did not bring anything new

• Year-on-year inflation in the US at 3.3% (finally slightly better numbers)

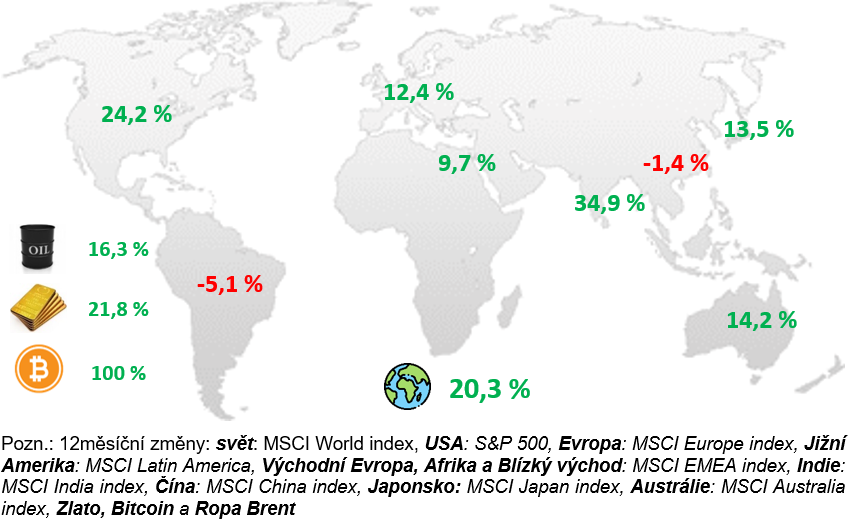

Change over 12 months of selected indices

Summary:

In June, stock indexes in the USA and India rose to new highs, the technology index NASDAQ 100 even gained over 6% in June. The indexes pulled up, similar to the last months, technology stocks, especially NVIDIA, which recently even became the largest company in the world for a short period of time.

On the other hand, stocks fell in China, by less than 2% and especially in Europe, where the MSCI Europe index fell by over 2% and was dragged down mainly by companies in France. The reason was the results of the European elections, after which Emmanuel Macron announced early parliamentary elections.

As for the results of year-on-year inflation in Europe, it remains at low levels of around 2.5% for May. However, the ECB signals that there will probably not be a significant reduction in interest rates by the end of the year, and rather we will only see one reduction.

On the contrary, the CNB continues to rely heavily on lowering interest rates, and at the last meeting on 27.6. then it cut rates from 5.25 to 4.75%. Rather, a decrease of only 0.25% was expected. The year-on-year inflation rate for the month of May came out at 2.6%, still within the tolerance zone of the CNB.

Inflation in the US has been on a downward trend for a long time, and the year-on-year rate for May came to 3.3%. Services are no longer growing as much as before, and inflation was once again pushed up by higher energy prices. This is positive news for the Fed and the financial markets. However, there was no change in rhetoric at the Fed meeting on June 12, and no significant tapering is still expected by the end of the year.

And how did the other assets do? Gold continues to hold close to the ATH, slightly below the level of USD 2400 per troy ounce, and central banks around the world continue to buy, including the CNB. Bitcoin is experiencing another correction and has fallen below the $60,000 mark. From the peaks, it is approximately 20%, which is nothing unusual for such an asset.

CR:

The year-on-year inflation rate for May remains within the tolerance zone and came out at the level of 2.6%. After jumping up to 2.9% in April, it was reduced again. Following the inflation results of recent months, the CNB reduced interest rates by another 0.5% point. Specifically, from 5.25 to the current 4.75%. A total of 5 out of 7 members of the bank board voted for the reduction.

Another significant reduction was quite surprising, as only a slight reduction to 5% was expected. However, the CNB continues to perceive pro-inflationary risks, especially in the context of the renewed rise in real estate prices, the related growing demand for mortgage loans and also as a result of the expected increase in real wages.

We have not yet received a new forecast regarding the reduction of interest rates, but for the time being the CNB does not expect that there will be another significant reduction in interest rates by the end of the year.

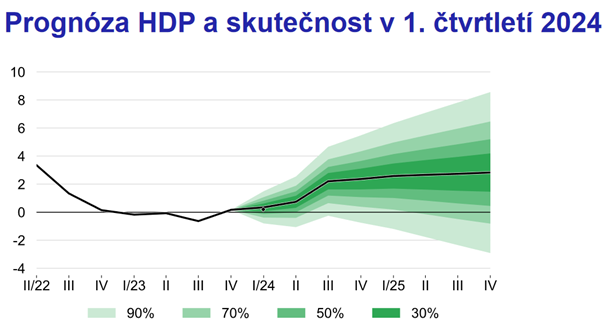

GDP in the first quarter grew by 0.3% quarter-on-quarter and by 0.2% year-on-year. Household consumption in particular contributed to the growth, and the CNB continues to expect GDP growth for 2024 at a level of up to 1.5%.

Source: CNB, forecast as of May 2. 2024 and current Q1 data

Source: CNB, forecast as of May 2. 2024 and current Q1 data

USA:

The year-on-year inflation rate for May came out again in the US at the level of 3.3%, as expected. It confirms the downward trend and there are no more surprising numbers like in the first quarter of this year. There is thus no further acceleration of inflation.

Services are no longer growing as much as before, and inflation was once again pushed up by higher energy prices. This is positive news for the Fed and the financial markets.

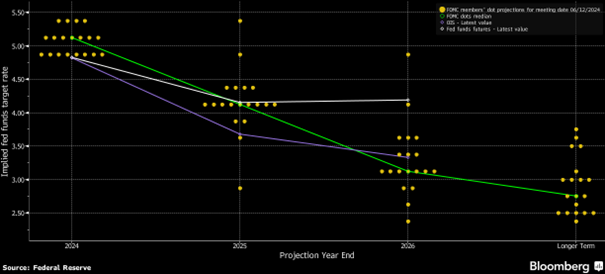

However, there was no change in rhetoric at the Fed meeting on June 12, and no significant tapering is still expected by the end of the year. According to the new prediction of Fed members, there should be at most one reduction in interest rates by the end of the year. For the year 2025, rates are expected to drop to only around 4%.

Fed members’ predictions for interest rate cuts

In the month of June, there was also a slight decrease in the yields of medium-term and long-term US government bonds. Indices hit new highs with the NASDAQ 100 surpassing the $20,000 level and the S&P 500 surpassing the $5,600 mark. It is not about any important milestones, but more of an interesting information on what levels the indices are currently at.

The S&P 500 index gained 3.5% in June, the NASDAQ 100 gained over 6% again.

Europe:

The year-on-year inflation rate for the month of May in Europe remains at the expected 2.6%, which means that it is only a slight increase.

At the end of June, the head of the ECB, Lagarde, announced that they would be careful with further interest rate cuts, and therefore only one, at most, two further interest rate cuts are expected by the end of the year. The ECB probably doesn’t want to cut rates by too big a % compared to the Fed, because that would then have the effect of weakening the euro against the dollar.

Elections to the European Parliament also took place in June, where there was an unexpected change of MEPs, especially in France and Germany. As a result of the election results, French President Emmanuel Macron announced early parliamentary elections, and during July we will know their results and the new composition of the parliament.

As a result, the European index MSCI Europe fell by several % and finally ended the month of June with only a slight loss of over 2%. But it was mainly pulled down by shares in France, where overall the French index depreciated by up to 10% in June!