Commentary on financial markets – January 2023

Investments Highlights:

- Strong New Year growth in the markets

- Signs of falling inflation

- China’s economic recovery

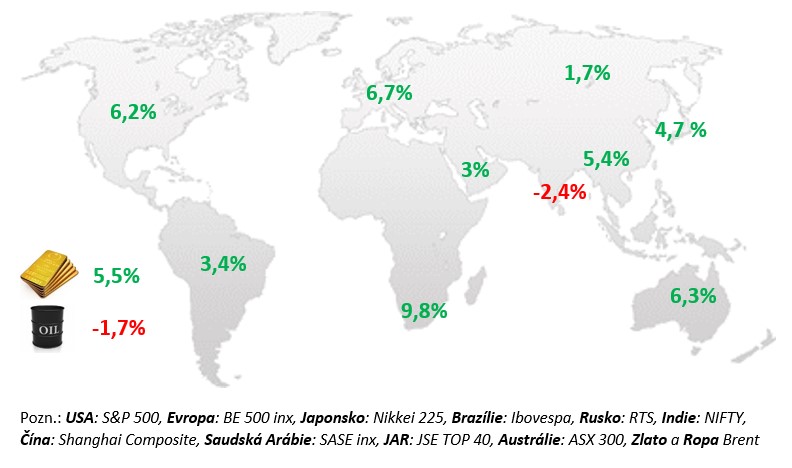

Changes in selected stock indices and commodities:

Commentary:

This year started very positively as gas and oil prices continued to fall, good economic data was reported, China’s economic recovery was underway, and last but not least, signs of falling inflation are coming. The US S&P 500 index ended January with a gain of 6.2% and the broad European index with a gain of 6.7%. The technology-focused Nasdaq 100 jumped up 10.7% after big falls last year. US stocks were also helped by the first company results for the fourth quarter of last year, with 68% beating analysts’ expectations. Selected European companies that have also already reported had better earnings 55% of the time. The Central European index rose 8%, mainly driven by stocks in the Czech Republic +10.6% and Poland +6.2%. Banks in the region benefited from high interest income, while in Poland the decision on mortgage rates also helped. Government bond prices rose in January in both the euro area and the US. Expectations of a slowdown in the pace of interest rate hikes by the US Fed and a fall in energy prices on global markets, which should drag inflation down, especially in the case of Europe, were influential. Central European markets, including koruna bonds and the koruna exchange rate, also benefited from this environment. Solid results from Tesla, including a positive outlook for this year, helped the entire consumer staples sector +15%. Other top performing sectors in January were telecoms +14.2%, real estate titles +9.9% and technology +9.3%, helped by the prospect of an end to interest rate hikes. Annual inflation in the euro area fell from 9.2% to 8.5% in January, thanks to energy and fuel prices. Inflation in the euro area is expected to moderate further this year. There are positive economic signals coming from China, as economic activity in China already rebounded from the bottom at the end of last year and further growth in sentiment suggests a continuation of positive developments at the start of this year. The easing of covide restrictions is behind the turnaround and is most evident in services and consumer spending. On the other hand, the situation in the Chinese property sector remains poor despite massive support from the government.

US:

Monthly data released during January 2023 was weaker. Real retail sales fell significantly in both November and December 2022, down 1.1% month-on-month in each of the two months. December’s decline was across categories, and the year-over-year pace came in at -0.4%, but this is a very good result when looking at inflation not seen in decades. Most of the credit for this goes to the labor market. In December, the unemployment rate hit 3.5%, the lowest since the pandemic began, and rapid job creation also continued, with the US economy creating 641k new private sector jobs in October-December. The number of job vacancies remains very high. Whereas before the pandemic this figure was around 6-7 million, it is now above 10 million and even surpassed 11 million in December. Given the circumstances, industrial production has done quite well over the past year, adding around 4% for the year as a whole. Core inflation added 0.3% m-o-m in December, which was another slowdown in momentum from what we saw a few months ago. Thanks mainly to a sharp decline in used car prices, cumulative inflation thus slowed to 0.7% over the last quarter and 1.8% over the last six months. In both cases, that’s the lowest since the spring of 2021. But the services sector (excluding energy), which is important to the Fed, continues to grow quite rapidly. It was up 0.5% in October, 0.4% in November and 0.5% in December. At its meeting in early February 2023, the Fed slowed down again in its monetary policy drive, raising rates by just 0.25 bp to a range of 4.50%-4.75%. Although in the minutes after the meeting, it hinted that it was not over yet but there were already dovish phrases at the press conference: ‘I can say for the first time that the disinflationary process has begun’.

EU:

The eurozone economy is more resilient than it seemed and monetary policy is tightening further. The first estimate of the GDP growth rate in Q4 2022 confirmed that the economy is still not falling into the recession that many had predicted due to rising energy prices and inflation in general. Of the major economies, Spain’s economy grew the fastest in 4Q22 (+0.2% q-o-q), followed by France (+0.1% q-o-q) and Germany, which contracted by (-0.2% q-o-q). Soft data released during January pointed to a stabilizing situation and that the economy is likely to be able to avoid major problems in Q1 2023. Unemployment is lowest in Germany (3%) and highest in Spain (12.5%). Wage growth remains relatively subdued. Industrial production grew by 2.4% year-on-year. In manufacturing alone, output was even 3.5% higher year-on-year. This is an excellent result in view of past developments, leading indicators and the energy crisis. Expectations at the beginning of 2023 were thus at the level of December 2008 (and thus, of course, above the covid’s historical low of April 2020). In the dominant services sector, the situation in the euro area also improved further in January. At its meeting on 2/2/2023, the ECB raised rates by 50 bps to 2.5% and indicated that at least two more hikes are on the way. Lagarde spoke in a very hawkish voice at the press conference, saying that inflation is still “very high”, that “demand pressures are very much alive” and that we certainly won’t see the last of the tightening in March.

CR:

The economy in the Czech Republic is still doing surprisingly well, having not experienced any major downturn even in Q4 last year. Monthly data are also quite optimistic. GDP growth in the fourth quarter was much better than both market and CNB expectations, according to the first estimate. In fact, the CNB had forecasted in its November forecast that the annual rate would reach -0.7% in Q4, suggesting that it was counting on a quarter-on-quarter decline in the economy of around 1.5%. The CZSO reported that the quarter-on-quarter decline was mainly due to lower household demand, which is not that surprising given the household survey. Rather, what is surprising is how the economy has coped with the shocks of 2022. The overall real GDP growth of 2.5% compared to 2021 is a positive result. Unemployment is still very low and wages are still rising. Czech consumer inflation stagnated in December after a 1.2% m-o-m rise in November, mainly due to a 10.6% m-o-m fall in fuel prices. There was no change in the CNB’s monetary policy settings at its meeting on 2 February. The new forecast brought higher expected inflation for this year (10.6%) and a return to 2.1% in 2024, all with wage growth in market sectors forecast at more than 9% and only a very slight contraction in the economy (-0.3% of GDP in 2023) and minimal unemployment growth. In other words, the CNB is saying that inflation will disappear on its own by next year without further monetary tightening.

Conservative investment isntruments linked to CNB repo rates are still very popular with clients, where yields are currently in the range of 6 – 6.25%, combined with regular investments in riskier titles where there have been discounts to buy after downturns, either in selected equity titles or bond funds with interesting yields to maturity. Macroeconomists predict that interest rates should remain unchanged during the first half of the year, but could already start to fall slowly in the second half of the year, leaving investors looking for other options to park their funds in order to maintain their returns on inveticals. Perhaps for this reason, now could be an interesting time to get into select bond funds where future returns are very interesting. At the same time, we recommend being very cautious in selecting specific bonds and offering pofidery issues in the market which can be very tempting with the yields and commissions offered but with a huge risk of bankruptcy.