Investments

Highlights:

– The ending energy crisis in Europe

– Interest rates at their likely peaks

– Positive Q1 earnings season

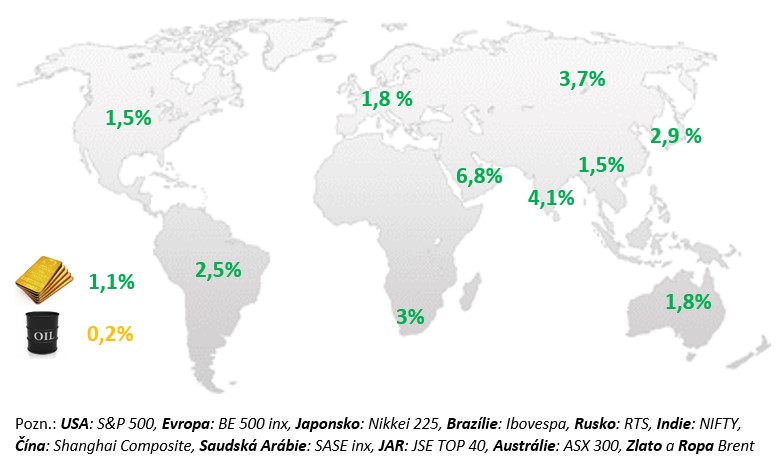

Changes in selected stock indices and commodities:

Commentary:

In April, companies from Europe and the US reported positive earnings, jump-starting equity gains. At the same time, fears of a banking crisis eased as there were no more bank collapses. US stocks gained 1.5%, led by telecoms and the consumer staples and energy sectors. Some economic data was weaker and industrial titles, for example, lost ground. In Western Europe (+1.8%), real estate and healthcare titles led the way, but the basic materials sector ended in the red. April was marked by minimal movements in government bond prices in both the US and the Eurozone. The prevailing expectation in the markets is that interest rates of the major central banks (Fed, ECB) have already peaked and should not rise substantially further. At most, only minor “cosmetic” changes are expected. In the case of Czech government bonds, prices rose slightly in April, especially at longer maturities.

USA:

Monthly data released during April 2023 were generally strong. Real retail sales have started this year relatively well. In fact, they added 0.5% q-o-q in real terms in Q1, which was positive and then mirrored the strong domestic demand published in the first estimate of Q1 GDP growth. Most of the credit for this goes to the labour market, which is the strongest it has been in 50 years. Rapid job creation continues. The US economy created 189k new private sector jobs in March 2023, again above expectations, and 808k in Q1. In March, the unemployment rate reached 3.5%, which remains at the lowest level we have seen since 1969. The US economy grew in the first quarter, thanks, among other things, to strong household demand. Meanwhile, the labour market remains tight but there has been limited seepage into wages. Core inflation added 0.3% month-on-month in March, as in February, meaning that the core price level has risen by 1.2% in the last three months and 2% in the last six months. Both the quarterly and semi-annual dynamics show that core inflation is rising at a rate between 4.5% and 5% rather than at a pace close to the US central bank’s target. Market services price inflation remains particularly strong, reaching 1.3% in the last quarter and 2.8% in the last half-year. The Fed is next expected to meet in May. At its last meeting in mid-March 2023, despite very strong macroeconomic data, and despite Powell admitting during the first half of March that a re-acceleration of the pace of tightening back to half-percentage point increments might be necessary, the Fed raised rates only a quarter percentage point into the 4.75%-5% range. The reason was that the failure of the US Silicon Valley Bank in mid-March spooked the Fed – several FOMC members, according to minutes released in April, even wanted to stop tightening policy to buy time to assess whether the SVB collapse had caused an exuberant tightening of the credit channel. But equally, the minutes said that several FOMC members would have considered raising rates by half a percentage point if not for the problem in the banking sector.

EU:

The quarter-on-quarter GDP growth rate reached a small positive result (+0.1% q-o-q) in Q1 2023 according to the first data, while the economy grew by +1.3% y-o-y. Among the large economies, Italy and Spain grew fastest (+0.5% q-o-q), followed by France (+0.2%). The largest Eurozone economy, Germany, was only stagnant. Despite high inflation, retail sales are doing relatively well. This is due to a labour market where the unemployment rate remained at historic lows in early 2023. It ended at 6.6% in January and February, and 6.5% in March. Germany still has the lowest inflation of the major countries (2.8% in March), while Spain has the highest (12.8%). The unpleasant news for the ECB is that nominal labour costs rose at their fastest ever pace in Q4. In the economy as a whole, by 5.7% year-on-year, and even by 6.2% in services. High inflation has thus probably started to feed through into wages. According to preliminary data, seasonally adjusted core inflation added 0.6% m-o-m in April and 1.52% in the last 3 months. In annualized terms, this is even faster than the 5.6% year-on-year core inflation in April. Headline inflation was 7%. The ECB did not meet in April. The minutes of the March meeting, published during April and describing a meeting held just after the collapse of Silicon Valley Bank, at which the ECB raised rates by half a percentage point, show that concerns about persistent inflation were stronger than about potential problems in the banking sector. Then, during April, several central bankers said that investors were underestimating the scale of the ECB’s rate hike, and that the ECB would keep raising rates for longer, or, as Pierre Wunsch, governor of the Bank of Belgium, put it, “until wage developments moderate, even if that means going to 4%”.

CR:

The CNB is still failing to curb high inflation and has started to threaten further rate hikes, as the economy is not slowing down sufficiently according to their expectations. According to the first estimate, GDP growth in the first quarter was better than both market expectations of -0.1% q-o-q and the CNB’s expectations of +0.1% q-o-q. In its statement, the CZSO wrote that quarter-on-quarter and year-on-year GDP growth was positively influenced mainly by rising foreign demand and that household final consumption expenditure continued to be negatively affected. Equally important, employment had risen by 1.4% year-on-year, confirming that the labour market had been almost unaffected by the monetary tightening. Monthly data released during April were mixed. Industrial production fell by 3% month-on-month at the beginning of this year, down 1.4% year-on-year. However, the very high rate of wage growth shows that nothing negative is happening in industry. After rising nearly 10% y/y in the fourth quarter, industrial wages added 12% in January and 10.8% in February. The number of employees fell by only one per cent year-on-year. Even worse from the CNB’s point of view is wage growth in the construction sector, where it reached 15% in January and 14.1% in February, while employment fell by 1.7%. Given how sensitive the construction industry is to interest rates, there should be dramatic layoffs in the construction industry at this time, not rapid wage increases. Unemployment is still very low and the lowest in the EU. The CNB meeting on 3 May did not change rates, but it was essentially a hawkish vote. First, three BR members voted for a rate hike, some even for a rate hike of more than a quarter percentage point. This is indeed a marked change from past meetings, where only Holub was in favour of a rise. Second, at the press conference, Ales Michl threatened the government with further rate hikes if the GER did not present corrective measures. It is thus quite possible that the vote for higher rates in June will already turn out in favour of an increase. Given the persistently high interest rates, companies still have expensive financing and more problems may surface, which is why we are warning about risky bond issues or other securities and investments.