Main events:

- European economy on the brink of recession

- The impending reduction of interest rates in the Czech Republic

- Declining yields on US government bonds

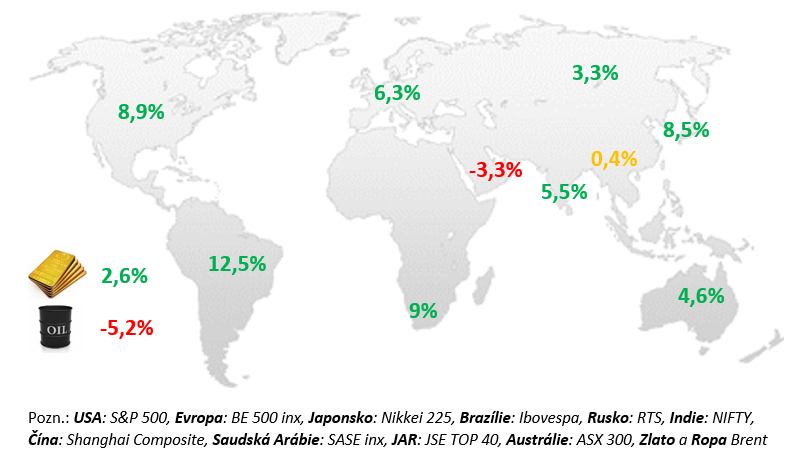

Changes in selected stock indices and commodities:

Comment:

The American stock index S&P 500 gained 8.9% in November. Favorable economic data was also released in the US. Technology and real estate stocks reported double-digit gains in both regions, while the energy sector, on the other hand, finished in the red. Company results continue to surprise very positively in the US (82% of profits), while in Europe it is only 55% of profits. Western European (+6.4%) and Central European markets (+4.9%) were weaker. Further declines in inflation in the US and Europe led to expectations of earlier interest rate cuts and purchases of risky assets. Prices of Czech government bonds rose in November, which was helped by developments on global markets. Domestic factors were mixed. Inflation rose from 6.9% to 8.5% in October, which was not surprising. This was a fluctuation caused by the introduction of a cost-saving tariff for electricity at the end of last year, and already in November inflation should return to the region of 7%. But the nervousness was caused by the news about the January increase in the regulated component of the electricity price. The CNB fears that price uncertainty may lead to an increase in inflationary expectations in the Czech economy.

USA:

According to the second estimate, the growth of the American economy in the third quarter was 0.3% faster than according to the first estimate. Its quarter-on-quarter growth rate reached +5.2%, the most since Q4 2021. The continued credit for the good development of retail sales goes to the labor market, which is still very strong by historical standards, although we are already seeing some signs of cooling. For example, we see further growth in the unemployment rate, which rose by 0.1% to 3.9% in October, which is a noticeable increase from the July low (3.5%). Job creation also slowed. After 246,000 jobs were created in the private sector in September. places, in October it was only 99 thousand. However, on average for the last quarter and the last six months, this indicator is stable, around 150 thousand. per month, which is only slightly below the standard rate of 2011-2019 (average of 190,000 per month). At the same time, it slows down wage growth. After accelerating to 0.3% month-on-month in September, core inflation slowed again to 0.2% month-on-month in October. It therefore added 0.6% over the last 3 months, which is still a dynamic slightly above the FED’s target. The worse news for the US central bank, however, is that after the deceleration in the previous months, we are observing a re-acceleration in the growth rate of market services prices, which was +1% in the 3 months to October (vs. +0.7% in the 3 months to August). This is mainly a result of the growth of service prices in the hospitality and accommodation sector (+1.5%), healthcare (+1.4%) and transport (+1.2%). The American central bank left interest rates unchanged for the second time in a row in November (in the range of 5.25-5.5%). During November, she, like the bankers from the ECB, devoted herself to convincing the markets that the fight against inflation is not over. In Powell’s words: “It was premature to say with confidence that we had already reached a sufficiently restrictive stance”.

EU:

Macroeconomic data for the month of November are weak. Both industry and retail fell. However, early indicators already indicate a stabilization of the situation. Inflation continues to slow. According to the first estimate, the quarter-on-quarter GDP growth rate of the eurozone reached -0.1% in the 3rd quarter of 2023, which meant that the economy grew by 0.1% year-on-year. According to the second estimate, which some countries already published at the end of November, the best result of the large economies was Spain +0.3% quarter-on-quarter, followed by Italy +0.1% quarter-on-quarter. According to the second estimate, the French economy did not grow by 0.1%, but in the same range decreased. The German economy shrank by 0.1%. The labor market remains strong. The unemployment rate in the third quarter reached historically low values (a historic low of 6.4% in August and 6.5% in September). The lowest unemployment rate among large countries is still in Germany (3%), the highest in Spain (where it reached 12% in September). To the displeasure of the ECB, quite understandably given the state of the labor market, wages continue to rise relatively quickly. Industrial production fell sharply during the third quarter, being 1.8% lower in September than at the end of the second quarter. The biggest credit for this result goes to Germany, whose industry fell by 2.5% in the third quarter, but neither did industrial production in France -0.3% quarter-on-quarter or in Italy -0.8% quarter-on-quarter. In contrast, production in Spain surprisingly grew by +1.2% quarter-on-quarter. Year-on-year, all large countries are in the red, with the exception of France (+0.8%). Seasonally adjusted November core inflation fell -0.15% month-on-month for the first time since April 2021, meaning it added just 0.1% over the past 3 months and 1.15% over the past half-year. The year-on-year pace of total inflation reached 2.4% in November, the core still remained quite high, although it also fell to 3.6%. It seems that the weakening of the economy is reflected in the development of prices. The ECB did not meet in November. The next meeting is December 14, 2023. Statements by central bankers during November were largely aimed at markets expecting an early start to rate cuts. Both Christine Lagarde and Isabela Schnabel, for example, said that the last “mile” in the disinflation process is still ahead of us, that it will be a difficult phase and that the disinflation process will be interrupted in the near term as the measures that have so far dampened the rise in energy prices expire.

CR:

Monthly data released during November was once again weak. Industrial production, after registering a modest growth of +0.3% quarter-on-quarter during the second quarter, fell sharply in the third. Both industry and retail are weak, leading indicators do not indicate an early reversal of the trend. The CNB is worried about the January revaluation and has not cut rates yet. According to the second estimate, the GDP growth rate in the third quarter reached -0.5% quarter-on-quarter and -0.7% year-on-year. Year-on-year sales are 2.3% lower (but for cars, for example, 3.2% higher). The unemployment rate remains the lowest in the EU. Czech consumer inflation in its core component reached -0.15% over the last 3 months (until October). This is a quarterly pace, on the one hand, significantly lower than in the same 3 months of 2021 (2.5%) or 2022 (2.4%), but also a pace consistent with the pace of those 3 months in 2020, when the economy began to struggle with by meeting the inflation target. The typical quarterly value of the growth of the core price level in the months of August to October in the years 2007-2019, when we did not have a problem with inflation, was -0.3%. So it still looks like core inflation will be higher next year (3.5%) rather than 2%. After the CNB meeting at the beginning of November, the rates remained unchanged, although for the first time in a long time a pair of BR members voted for their decrease by 0.25%. However, the majority of the board was against it, mainly due to the risks of the new forecast. The forecast called for a rate cut, but the bank board assessed the risks as “significant and moving in a pro-inflationary direction.” The Banking Council perceives both the risk from the labor market: “The pro-inflationary risk is mainly the threat of losing the anchoring of inflationary expectations, which could be reflected in increased wage demands and also in a more significant revaluation at the beginning of next year.”, and from fiscal policy: “The pro-inflationary risk is even the possible longer effect of expansionary fiscal policy”.

You can find the current commentary for November 2023 in the client version here: November 2023 – client version

Or in pdf format here: November 2023 – PDF client version