Highlights:

- Decline in stock markets

- EU interest rates near highs

- U.S. government shutdown averted

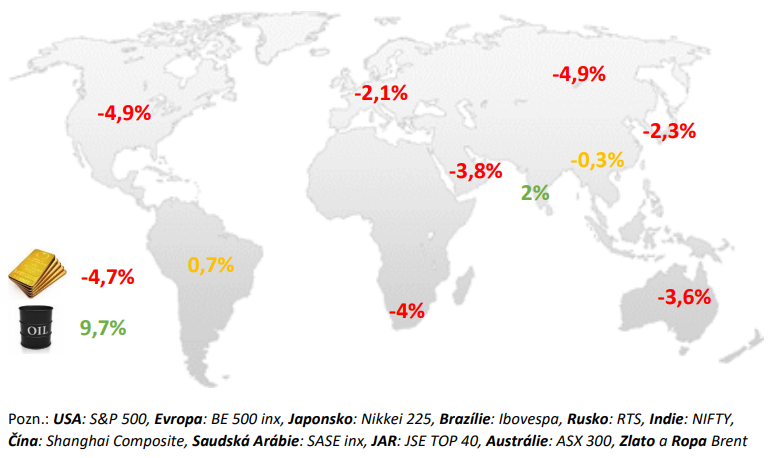

Changes in selected stock indices and commodities:

Commentary:

During the month of September, the US S&P 500 stock index fell 4.9% as the US Federal Reserve surprised markets with its outlook for higher rates in the coming years, as did other central banks. US equities were not helped by strikes by US unions for auto workers or the risk of government paralysis due to the inability to pass a budget (shutdown). The energy sector, on the other hand, has prospered thanks to the rise in the oil price. The Stoxx Europe 600 fell by 1.7% as the ECB also signalled a late end to high interest rates. After last months bad data from China, economic data improved. Czech stocks (+0.6%) benefited from a bet on the removal of the windfall profits tax. Government bond prices in the US, Germany and the Czech Republic fell in September. News from the Czech economy was rather favourable for bonds. At its meeting at the end of September, the Bank Board left the repo rate unchanged at 7% and gave no clear signals on the possibility of future interest rate cuts.

US:

Monthly data released during September 2023 were good. So far we are seeing a soft landing in the data for the economy. The labor market has slowed, but not significantly enough to begin to see unemployment rise significantly. Household and industrial consumption continued to grow modestly. Growth in the U.S. economy remained positive again in Q2, with the annualized quarter-over-quarter growth rate at an estimated +2.1% (which was down 0.3% from the first estimate). Real retail sales continued to grow in Q3 (up 0.3% m-o-m in July and down a slight 0.1% m-o-m in August). The continued strength of the labour market, which is still the strongest it has been in 50 years, is a continuing contributor to this year’s good performance, although its cooling can already be seen in the figures. Job creation has continued, although there has been a noticeable slowdown. In the last 3 months to August, the economy created an average of 140k jobs per month, which is well below the average of the second half of last year (317k per month) and the first half of this year (204k). Moreover, wage growth remains relatively fast. Core inflation slowed to +0.1% m/m in August, its lowest reading since November 2020. This slowdown came after two previous months of 0.2% growth rates. The Fed left rates unchanged in September (in the 5.25%-5.5% range), but made two changes in the new forecast. First, it moved up the peak of rates this year (to the 5.5%-5.75% band) and second, it again extended the period for which rates will remain high. Whereas in the June forecast, individual Fed members thought rates would be at 4.6% in 2024 (vs. 4.3% in the March forecast), by September the median of their expectations was already at 5.1%. In other words, the Fed is signaling to the markets that this cycle will not be in a fast up, fast down style, but that higher rates will stay on it for a long time and there is still room for potential upward corrections.

EU:

Data released in the EU during September was weak. The economy is weakening according to leading indicators, and inflation was surprisingly low at the end of Q3. However, the ECB is not going down with rates right away. From the initial plan of a quick rate hike followed by a quick cut, it looks like a longer period of rate hikes again. The quarter-on-quarter GDP growth rate reached a pace of +0.1% in Q2 2023 according to the second estimate, which meant that the economy grew by 0.5% year-on-year. Spain in particular performed well, with its economy growing by 0.5% q-o-q, but also France, which also added 0.5% q-o-q in Q2. The German economy stagnated in Q2 after two previous quarters of slight contraction, while the Italian economy contracted by 0.4% after a strong Q1. Retail sales, after adding 0.3% q-o-q in Q1 and 0.8% q-o-q in Q2, fell by 0.3% q-o-q at the beginning of Q3. The annual growth rate was -1% in July. However, the labour market remains strong. The unemployment rate was near historical lows throughout the first half of 2023. It averaged 6.5%. In June and July, the unemployment rate fell to a historic low of 6.4%. The unemployment rate is still the lowest of the major countries in Germany (holding at 2.9% since April), and the highest in Spain (where it reached 11.6% in July). Wages continue to rise rapidly, to the ECB’s displeasure, but quite understandably given the state of the labour market. The index of negotiated wages tracked by the ECB added 4.3% year-on-year in both Q1 and Q2, its highest ever rate of increase. Inflation was surprisingly low in September. In fact, core inflation was an atypically low +0.2% m/m in September. Thus, seasonally-adjusted core inflation was +0.7% in the last three months, the slowest quarterly pace since November 2021. The year-on-year pace of headline and core inflation was 4.3% in September. The ECB raised rates by another 0.25% in September to an all-time high (i.e., the deposit rate to 4%). The ECB’s statement makes it sound like rates cannot be said to be at an all-time high, as the labor market is still too strong. Or if wage growth continues and inflation does not fall significantly, the ECB does not rule out another rate hike in December.

CR:

Monthly data released in the Czech Republic during September was mixed. On the one hand, weak industry and worse leading indicators, but on the other hand, further recovery in retail sales. Industrial production saw moderate growth during Q2, adding 0.4% q/q for the quarter thanks to +1.5% m/m growth in May and +0.9% m/m in June. Output then rose by 0.2% in the first half of the year and was up by less than 1% yoy at the end of the quarter. The start of Q3 was admittedly weak, with output falling by 2.6% m-o-m and 2.8% y-o-y, but this was due, in the words of the CZSO, to “electricity and gas production and distribution, where longer summer shutdowns have taken effect”. Meanwhile, the central bank is keeping rates at 7%. GDP growth in Q2 was 0% qoq and -0.6% yoy, according to final data. According to the structure already published in August, apart from fixed investment, household demand also contributed to growth, which grew by 0.3% q-o-q for the first time since the end of 2021. Inflation eased to 8.5% in August. Core inflation at 6% is even slightly below the CNB’s forecast, while wage growth remains below the central bank’s expectations. The unemployment rate remains the lowest in the EU. As a result, wage growth continues to be strong. At the CNB meeting in September, rates remained unchanged, with no one voting for a rate hike again. According to the minutes of the meeting, the Board left the back door open for a rate cut this year. This is because the Board expects “the trajectory of interest rates to be higher in the coming quarters compared to the current forecast”. Which is not inconsistent with the fact that the forecast calls for three more rate cuts this year – there could well be a token cut of a quarter percentage point. Equally, this ajar door can be seen in the talk of the risks from the slowdown in Germany or that developments since the last forecast are in line with it or (in the case of expected GDP growth for Q3) even worse (and therefore anti-inflationary). The Board does not think that the fight is over and won, and that it can start with a rate cut. For example, the Board sees the labour market as “tight” and expects “wage growth to turn positive in real terms in the coming quarters, which will support household consumption.” It also sees the “rapid decline in the savings rate to long-term normal levels and its impact on the possible acceleration of household consumption” as an inflationary risk. In other words, a rapid cut in rates threatens to cause accumulated savings to “roll into the economy like a wave”, with clear inflationary effects.