Commentary on financial market developments – March 2023

Investing

Highlights:

- Bank failures in Europe and the US

- Banks tighten credit conditions

- Gold price rises

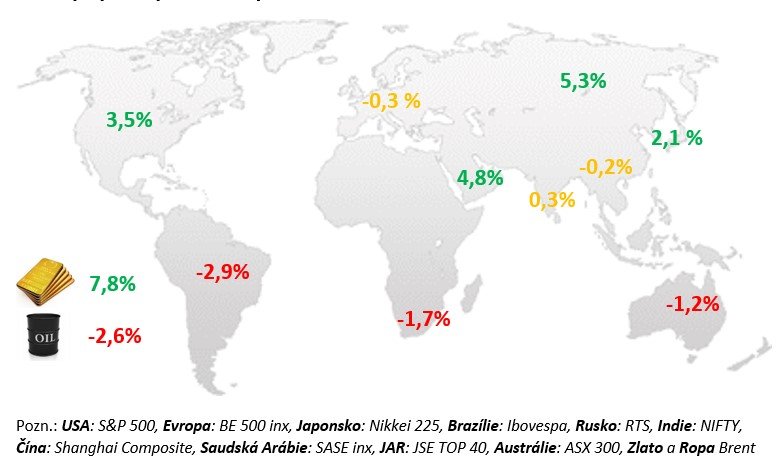

Changes in selected stock indices and commodities:

Commentary:

The month of March was marked by the bankruptcy of two smaller US banks and the European bank Credit Suisse, which caused a sell-off in bank stocks. Concerns about the credit crunch were also reflected in the non-financial sectors, especially in Europe. Towards the end of the month, however, stocks were helped by lower inflation data and expectations of an early end to monetary tightening, as well as policymakers’ statements on the health of banks. European stocks closed March in negative territory while US ones ended in positive territory, helped greatly by technology and telecoms. Financials, on the other hand, fell significantly. Government bond prices rose in the US and the euro area. Central European government bonds, including Czech ones, also benefited. The koruna weakened above 24.00 per euro during March, but eventually returned to the 23.50 area. The CNB kept the repo rate at 7% at the end of the month, but warned of the risk of wage-inflationary pressures.

US:

In March, markets were surprised by the failure of two US banks, which triggered a sell-off in the banking sector while dispelling expectations of a faster pace of monetary tightening thanks to strong market data. At its mid-March 2023 meeting, despite very strong macroeconomic data and Powell admitting during the first half of March that a reacceleration of the pace of tightening back to half a percent may be necessary, the Fed raised rates only a quarter percentage point into the 4.75%-5% range thanks to the bankruptcy of the banks in question. However, it should be stressed that in these two cases it was more a failure of risk management, i.e. the weakness of the banking sector as a whole cannot be inferred. After a technical recession in the first half of 2022, the US economy returned to black growth numbers in its second half. Real retail sales have started this year well and are only 0.6% lower year-on-year despite high inflation, which is currently a success. Most of the credit for this goes to the labour market, which is the strongest it has been in 50 years. In February, the unemployment rate reached 3.6%, still at its lowest level since 1969. Job creation continues apace. In February 2023, the US economy created 265k new private sector jobs, again above expectations. Core inflation added 0.3% month-on-month in February, meaning that core prices have risen 1.2% in the last three months and 2.2% in the last six months. Market services price growth remains particularly strong, rising 1.5% in the last quarter and 2.9% in the last six months.

EU:

The first February data from the major European economies (Germany, France and Spain) were weak, but given falling energy prices this was not unusual and the situation may soon turn around. Despite high inflation, retail sales were buoyant thanks to the labour market. The unemployment rate remained at historic lows in early 2023 (identical at 6.6% in both January and February), with Germany still the lowest of the major countries (2.9% in February) and Spain the highest (12.8%). What was a bit of unpleasant news for the ECB is the fact that labour costs rose at their fastest ever pace in Q4. High inflation has thus started to feed through into wages. In the dominant service sector, the situation in the euro area improved significantly further at the end of Q1 this year. In addition, the financial services, real estate, travel and tourism sectors continued to recover. While input prices in industry declined for the first time since July 2022 thanks to falling energy prices, rising wages are reflected in the service sector. Headline inflation, thanks to energy prices, fell to 6.9% in March. At its meeting in March, the ECB raised rates by 50 bps to 3%, despite the problems in the banking sector. However, the mention of raising rates at a substantial and steady pace in the coming months, which was there a month ago, has dropped out of the minutes. The implication is that the bank failures introduced a degree of uncertainty and some ECB members even wanted to stop raising rates.

CR:

Strong wage growth early this year and continued month-on-month price increases do not support the CNB’s rhetoric that rates are high enough. GDP growth in Q4 2022 came in much better than market and CNB expectations, according to the second estimate. On household confidence, the situation improved markedly early in the year, although it is still consistent with the fact that we have high inflation and households are generally cautious. Czech consumer inflation added 0.6% in February compared to January, while core inflation added 0.7% month-on-month. In the last three months, core inflation has added almost 2% and is therefore far from the CNB’s 2% inflation target, which the CNB promises to meet as early as Q1 2024. For inflation to average 2.3% in Q1 2024, as the CNB expects, it would have to average 0.2% per month from February 2023 to March 2024. However, such an average rate was last seen in early 2021. Nevertheless, at the CNB meeting on 29 March, there was again no change in the monetary policy settings. However, the presentation of the situation report was now for the first time dominated by upside risks to inflation, among which the CNB included faster wage growth, more expansionary fiscal policy and the threat of inflation expectations losing their anchoring. The only downside risk to inflation mentioned was a stronger-than-forecasted slowdown in domestic consumer and investment demand, although it is not at all clear where this would come from. If the CNB is hoping that the Fed or the ECB will do the job of tightening and slowing the economy for it, it may be in for a long wait.