Highlights:

- US inflation accelerates (will we even see a rate cut this year?)

- More conflict in the Middle East

- ECB likely to cut interest rates before the Fed!

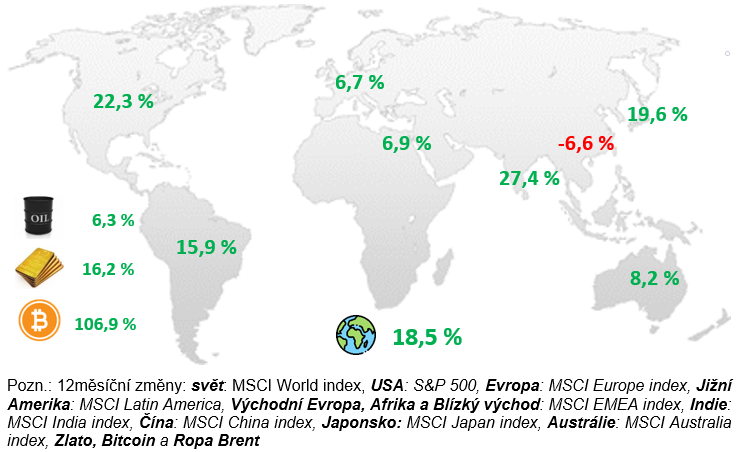

12-month change in selected indices

Comment:

Equity markets in both the US and Europe fell for the first time in a long time in April. China, on the other hand, has started to do well, gaining 6.6% for April and is also in positive numbers overall since the beginning of the year.

Inflation in both Europe and the Czech Republic continues to decline and is within the central banks’ inflation band. The same cannot be said for inflation in the US, which has even been accelerating in recent months.

Inflation in the US, although at low levels, has been on an upward trend and the annual inflation data for March came in at 3.5%. It is still not taming it below the targeted 3%.

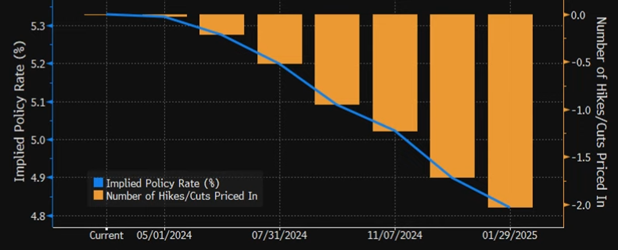

Jerome Powell and other Fed members stressed after the inflation data that they will be extremely cautious with rate cuts and only one to two rate cuts at most are already expected by the end of the year! This is a big change from the last meeting in March when at least 3 rate cuts were expected by the end of the year.

Then, following the inflation data, yields on US Treasuries have been rising over the past months and this was probably one of the reasons for the slight decline in equities in April. Possible threats of a 2nd wave of inflation and scenarios from the 1970s are even starting to emerge. Here, the Fed managed to bring inflation down after the 1st oil crisis due to the 1973 Yom Kippur War, but then it started to rise again, reaching levels of over 15% by the end of the 1970s. One of the reasons for this was the 2nd oil crisis after the Iranian Revolution in 1978-1979, when the price of a barrel of oil reached USD 40.

Today, inflation is being driven up mainly by services, while commodity and energy prices are pushing it down. If commodity prices, especially oil, were to rise, then we could see another wave of inflation similar to that of the 1970s.

Once again, it is Iran that is sticking its neck out in the Middle East and taking on its neighbours, especially Israel. But for the time being, there has been only one attack by Iran and a smaller retaliatory attack by Israel, and the conflict does not seem to be escalating any further.

And how have other assets besides stocks fared? Gold continued to perform well, reaching new highs in April, reaching a price of USD 2,450 per troy ounce. But then it also started to fall slightly, as did equities or bonds. Since the beginning of the year, gold has gained less than 12%.

Bitcoin has had a long-awaited halving, which has not had much effect on the price. Even for the month of April, a correction came in on Bitcoin and it dropped by about 15%, falling below $60,000 by the end of the month. However, the decline was probably driven by the macroeconomic situation, higher inflation and the related decline in the stock markets. Investors in the newly launched US ETFs in February also picked up gains to a greater extent.

US:

The year-on-year inflation rate for March came in above expectations at 3.5% in the US, still failing to tame it below the targeted 3%. Even since the beginning of the year, its growth has been accelerating again. And for the past several months the same pattern has been repeated, with energy prices falling but inflation being driven up mainly by services, which is not a positive signal.

Jerome Powell and other Fed members stressed after the inflation data that they will be extremely cautious with rate cuts and only one or two rate cuts at most are already expected before the end of the year! Which is a big change from the last meeting in March when at least 3 interest rate cuts were expected by the end of the year.

Number of expected Fed interest rate cuts by the end of 2024

Source. Bloomberg

In the wake of the latest inflation data, the 10-year US Treasury bond continues to rise to 4.7%, up from just 3.8% at the start of February, which is certainly not a positive signal for equity markets.

And we could see it in the decline of the stock markets as well, where the S&P 500 index has written off 4.1% for April and even fell as much as 6% in mid-April, which is a bit of a correction after a longer period of growth.

Europe:

The year-on-year inflation rate for the month of March actually came in at 2.4% in the European Union, keeping on a gradual downward trend. Thus, as in the US, services are driving most of the growth, and in turn falling energy prices are pushing inflation down.

The difference with the US in recent months is that in Europe inflation has continued to fall and has moved into the ECB’s inflation band, but in the US inflation is starting to rise again and is at 3.5%. While inflation was higher in Europe than in the US a year ago, it is now better at coming down. But one of the reasons may be the stagnant real GDP growth in Europe, while in the US real GDP is growing at over 2%.

Although the ECB has not yet cut interest rates at its April meeting, a few members have already voted for a cut. At the post-meeting press conference afterwards, it was said that the first cut could come as early as June or July.

While higher inflation data in the US pulled down US stocks in particular, in the current interconnected world, European stocks also fell in April. It was a little less so, as the MSCI Europe index wrote off less than 2.5%.

CR:

The annual inflation rate for March was again just 2%, still within the CNB’s tolerance band. This may again be due to the decline and stagnation in GDP as well as consumers’ reluctance to spend.

The CNB’s view at future meetings should therefore be more focused on getting the economy moving again and achieving real GDP growth (based on the CNB’s February 2024 forecast).

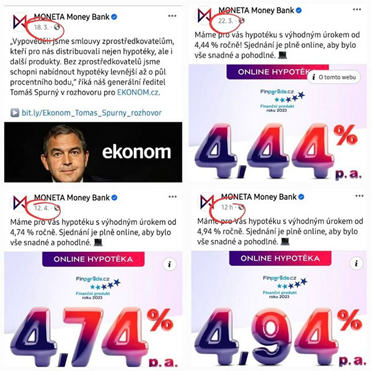

Apart from the inflation data and the expected unemployment data, which is steady at 3.8% for March, not much happened in April. The only thing worth mentioning is the drama surrounding Moneta, which definitely cut out external sales in March and wants to focus more on online mortgage arranging, using its own advisors to the maximum extent possible.

But at a time when the CNB is cutting interest rates at every meeting, Moneta has been raising the rate on mortgages since March!

Moneta and its mortgage rate increases

Source.LinkedIn

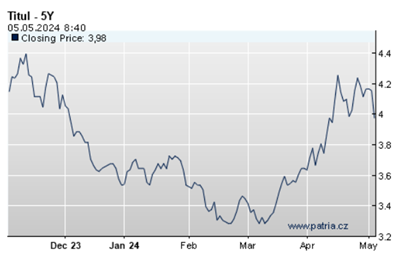

At first glance, it looks like Moneta’s cost of sales is rising and they have to translate that into higher mortgage rates, which probably won’t bring them many new clients. But the truth may be elsewhere, as yields on medium and long-term government bonds have been rising since March. The 5y bond yield, or the 5y interest rate swaps that the bank hedges with during the fixing, is particularly important for banks in the 5y fixing.

Development of the Czech Republic’s 5y interest rate swap

Source. Patria

While the CNB is cutting interest rates and banks are responding almost immediately by cutting interest on savings accounts, the reduction in mortgage rates may be more gradual and, even with the recent rise in bond yields, it may take longer for mortgage prices to fall.