Main events:

- Positive data from the markets

- Falling inflation

- Base interest rates in the Czech Republic still unchanged

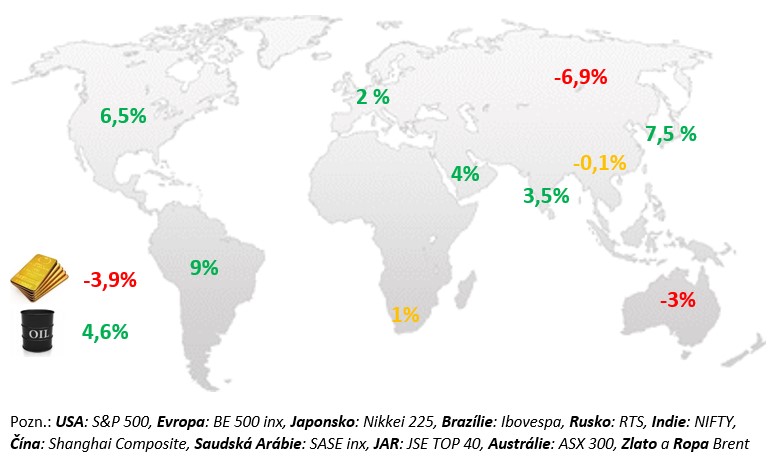

Changes in selected stock indices and commodities:

Comment:

In June, the value of stocks increased thanks to positive data from the economies and monetary policy of the FED and China. The main US stock index S&P 500 rose by 6.5% in June. Lower-than-expected inflation was published in the US and Europe, and as a result, the FED did not raise interest rates further, while the ECB increased rates, but economic data and the easing of China’s monetary policy outweighed the development of European shares to the plus side. In the US, retail sales also rose again for the first time since January. Due to the monetary policy outlook, June was marked by a slight decline in government bond prices in Germany and the USA. On the contrary, the prices of crown government bonds rose. Signals of the easing of inflationary risks in the Czech economy had a favorable impact on the domestic market. These signals are visible not only in the development of inflation itself, but also in the structure of GDP. It reports a continued decline in household consumption. The CNB left rates unchanged in June, and the August forecast may confirm the scope for their decline.

USA:

Data released in June in the US was again strong. Real retail sales started this year relatively well. In the first quarter, they added 0.5% quarter-on-quarter in real terms, which was positive, and this was subsequently reflected in the strong domestic demand published in the GDP growth estimates for the first quarter. At the beginning of the second quarter, sales stagnated and then added 0.2% month-on-month in May. The biggest credit for this was the labor market, which is still the strongest in 50 years, but the first signs of cooling have already begun to show slowly in the numbers, although so far only cosmetic. The unemployment rate rose to 3.7% in May, up 0.3% from April, but still one of the lowest we’ve seen since 1969. The labor market is also cooling only cosmetically. The American central bank promises further tightening of monetary policy in the second half of the year. Growth in the US economy slowed in the first quarter, but remained positive. While the annualized pace reached 2.6% in the 4th quarter of 2022, it is 1.3% in the first quarter of 2023 according to the second estimate. The rapid creation of jobs also continues. In the last 3 months until May, the American economy created an average of 230 thousand places per month. In other words, both the quarterly and semi-annual dynamics show that core inflation is growing at a rate between 4% and 5% rather than at a rate close to the Fed’s target. The good news is that market service price growth has slowed further in recent months.

EU:

The ECB remains in hawkish mode, mainly due to rapid growth in nominal labor costs. According to the final data, the quarter-on-quarter GDP growth rate reached -0.1% in the 1st quarter of 2023 (the original estimate was +0.1% quarter-on-quarter), and the economy grew by 1% year-on-year. The unemployment rate remained at historic lows throughout the first quarter of 2023, and the same was true during the second quarter. In April, the unemployment rate reached 6.5%, and it was the same in May. The unemployment rate is still the lowest among large countries in Germany (it reached 2.9% in May), the highest in Spain (12.7%). But the ECB is still watching wages rise, and not entirely enthusiastically given the state of the labor market. Inflation dynamics remain high. According to preliminary data, seasonally adjusted core inflation increased by 0.3% month-on-month in June. 0.9% in the last 3 months and even more than 2.4% in the last six months. With wages continuing to grow at 4.3% in Q1 (which was the highest on record), and with unemployment at historically low levels, inflation cannot be expected to just disappear on its own. In June, the ECB raised rates by another 0.25% to 4%, the highest since 2001. There was also a promise from Lagarde that this was not the end. According to her, the ECB still has a long way to go to restore price stability, and it is very likely that rates will rise again at the next meeting at the end of July, unless there are materially different macroeconomic data in the meantime. Given that the ECB does not expect inflation to end before 2025 in its latest forecast, this hawkish message is probably not surprising. The president of the Bundesbank even said in June that it would be a big mistake to stop tightening policy even if inflation slows further in the coming months.

CR:

Monthly data released during June was weak. The Czech economy is gradually weakening, but the labor market remains tight with low unemployment and pressure on wages. The surprising slowdown in core inflation in the last 3 months is probably only temporary. According to the second estimate, GDP growth in the first quarter was worse than the first estimate. Industrial production fell by 0.3% in the first quarter. Czech consumer inflation in its core component slowed down surprisingly quickly in recent months. Core inflation, after growing by 0.8% and 0.7% month-on-month in January and February, added only 0.2%, 0.2% and 0.1% in the next three months, which in year-on-year terms meant its decline to 8, 6%