Highlights:

- Israel’s conflict with Hamas

- The upcoming interest rate cut in the Czech Republic

- Weak economy in the EU

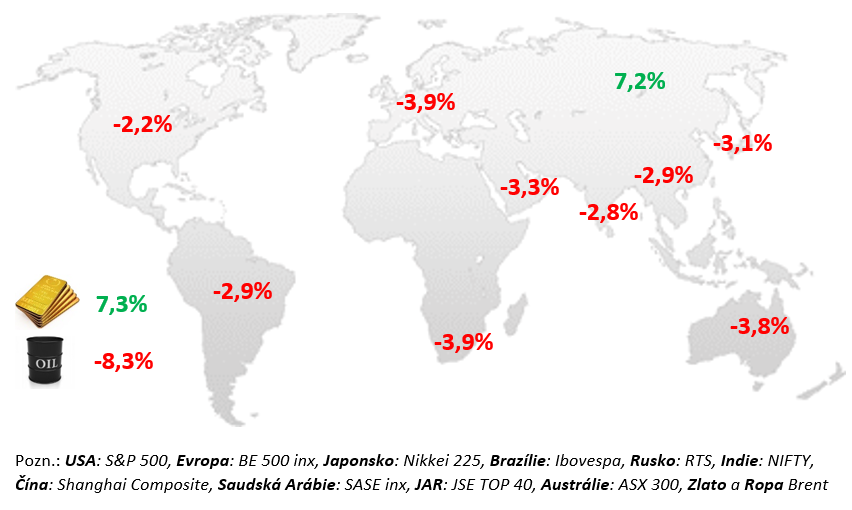

Changes in selected stock indices and commodities:

Commentary:

In November, the CNB left interest rates unchanged, but it is only a matter of time before it lowers them for the first time as inflation gradually falls. Global equities were held down by high interest rates, some corporate results and the conflict in Israel. Following the Hamas attack on Israel in early October and as Israel began preparing a ground invasion of Gaza, the price of oil in volatile trading climbed to $90 a barrel in the first half of the month. Eventually, when it became clear that supplies from the region were not yet threatened by the war, the price returned to within sight of $80 per barrel. The conflict between Palestinian Hamas and Israel has had relatively little impact on financial markets so far, as it has managed to remain local. Meanwhile, alternative store of value such as gold and bitcoin are benefiting from the rise in geopolitical risk, with their value rising 28% during the month to $34,600, the highest since May last year. The US S&P 500 lost a further 2.2% for October on concerns about the impact of sustained high interest rates. The still resilient US economy and geopolitical risks are contributing to tight monetary policy. Corporate results surprised positively again in the US, but the new earnings season started rather negatively in Europe (-3.7%). Companies are not benefiting from the economic slowdown, wage inflation, volatile commodities and high debt costs. However, the Central European CECE EUR index jumped by 9.6%, mainly due to the rally in Poland (+12.2%) following the parliamentary election result.

USA:

Monthly data released during October 2023 was strong. The growth of the US economy surprisingly accelerated in the third quarter, when its annualized quarter-on-quarter growth rate reached 4.9% according to the first estimate, the most since the 4th quarter of 2021. The household savings rate also fell significantly (3% in sight), which is about 2 % lower than the pre-pandemic standard. Contrary to expectations, better data from the labor market came as well. The labor market, which is still the strongest it has been in 50 years, is permanently responsible for this year’s good sales development. In the last 3 months until September, the economy created an average of 195 thousand places per month, which is still significantly below the average of the second half of last year (317 thousand per month), but already basically on the average of the first half of this year (204 thousand per month). The good news is that wage growth is slowing down and will not further push up inflation. Core inflation accelerated to 0.3% month-on-month in September, which was its fastest pace since May this year. It therefore added 0.6% over the last three months, which is still a dynamic slightly above the FED’s target. However, the excellent news for the US central bank is the significant deceleration in the growth rate of market services prices. While in the first quarter market services grew by 1.7% quarter-on-quarter and in the second by 0.6% quarter-on-quarter, in the third this pace was even negative -0.1%. Such a development is quite surprising in light of the strength of the labor market, but whether it is sustainable remains to be seen. The American central bank left rates unchanged for the second time in a row (in the range of 5.25-5.5%). However, the Fed said that in light of stronger GDP growth, a strong labor market and household demand, it may “still have some work to do” to meet its inflation target. In addition, he noted that the growth in revenues in September had tightened the conditions, but it is not certain how long this growth will last. However, the hawk immediately moderated the news by saying that given the level of rates, he can now afford to wait and observe the economy and will not be in a hurry. Which the market interpreted as the end of the cycle of tightening monetary conditions.

EU:

Inflation in the EU continues to slow down, the economy is weakening, but the ECB is not going to cut rates. According to the first estimate, the quarter-on-quarter GDP growth rate of the eurozone reached -0.1% in the 3rd quarter of 2023, which meant that the economy grew by 0.1% year-on-year. The best result of the large economies was achieved by Spain +0.3% quarter-on-quarter, followed by France +0.1%, the Italian economy just stagnated, the German economy decreased by 0.1%. However, the labor market remains strong. The unemployment rate was near historical lows during the entire first half of 2023, when its average value reached 6.5%. Even during the second half of the year, the labor market remains in excellent condition. The unemployment rate fell to a historic low of 6.4% in August. The unemployment rate is still the lowest among large countries in Germany (3%), the highest in Spain. To the displeasure of the ECB, quite understandably given the state of the labor market, wages continue to rise rapidly. After seasonal adjustment, core inflation in October reached 0.1% quarter-on-quarter and only 0.6% over the past three months, which in annualized terms is no longer far from the ECB’s two percent target. The year-on-year rate of headline inflation reached 2.9% in October, while core inflation remained high (4.2%), even though its rate is the lowest since July 2022. The weakening of the economy seems to be reflected in price developments. At its meeting in Athens in October, the ECB left rates unchanged, i.e. at the highest historical value ever (deposit rate: 4%). Lagarde said she “can’t rule out” another rate hike and that any talk of cutting them is “totally premature”. Even so, the tone of the press conference was rather dovish, with the ECB president adding that “growth will remain weak” and “the impact of high interest rates continues to spread through the economy.”

CR:

The monthly data published during October in the Czech Republic was weak. GDP growth disappointed again and inflation slowed significantly, but the CNB is not cutting rates for the time being. According to the first estimate, GDP growth in the third quarter reached a surprisingly weak -0.3% quarter-on-quarter (-0.6% year-on-year). The unemployment rate remains the lowest in the EU. Czech consumer inflation in its core component reached 0.5% over the last three months (until September). This is a quarterly pace, on the one hand, significantly lower than in the same three months of 2021 (2.8%) or 2022 (2.9%), but also a pace consistent with the pace of those three months in 2020, when the economy began to struggle with by meeting the inflation target. So it continues to look like core inflation will remain persistently higher next year and will be around 3.5-4% rather than 2%. At the CNB meeting in early November, rates remained unchanged, although for the first time in a long time, a pair of BR members voted for their decrease by 0.25%. However, the majority of the Banking Council was against it, mainly due to the risks of the new forecast (which called for a rate cut). “The Banking Council assessed the risks as significant and moving in a pro-inflationary direction.” The Banking Council perceives both the risk from the labor market (“the pro-inflationary risk is mainly the threat of losing the anchoring of inflationary expectations, which could be reflected in increased wage demands and also in a more significant revaluation at the beginning of the next of the year”), as well as from fiscal policy (“a pro-inflationary risk is also the possible prolonged effect of an expansionary fiscal policy”). The first drop in rates may not come until next year, when it becomes clear how significant the January revaluation really was. Such a scenario is supported by the mention that “the macroeconomic costs of keeping rates at their current level longer compared to the basic scenario would be low if pro-inflationary risks are not met” and that “the trajectory of interest rates will most likely be higher in the coming quarters compared to the basic scenario of the forecast “.