Main events:

- Stock market correction

- Weakening Chinese economy

- Continued increase in ECB interest rates

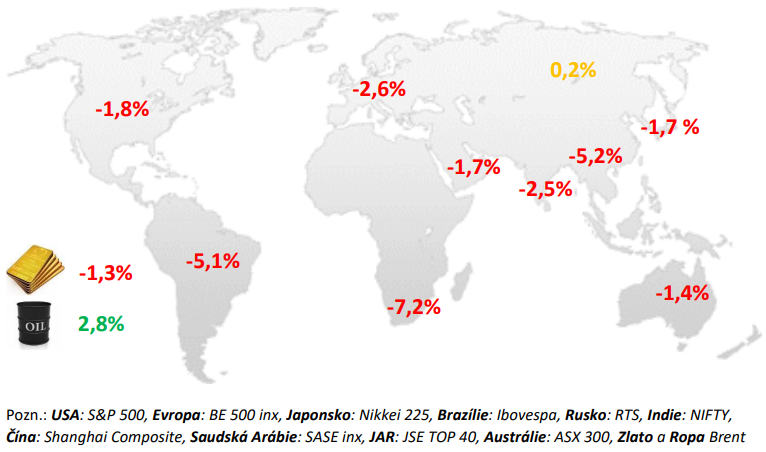

Changes in selected stock indices and commodities:

Commentary on developments in the financial markets:

In response to increased risk related to China’s property market, weaker economic data releases there and high interest rates, volatility rose and equity markets corrected in August. Shares also fell due to concerns about a longer period of higher interest rates. The American S&P 500 weakened by 1.8% and the European BE 500 by 2.6%. Energy stocks held their value in the US and Europe thanks to higher oil prices. In the US, defensive utilities were the weakest stocks, in Europe, the basic materials sector and car companies, due to exposure to China. Central European shares lost 4.8% as a drop in Poland (-7.6%) and a slight decline in the Czech Republic (-1.4%) greatly outweighed growth in Hungary (+4.5%), which was among the markets to exceptions. US government bond prices fell in August, German bonds saw a slight increase. August was a weaker month for Czech government bonds. The price of oil continued to rise during July. It went from the $70 per barrel mark at the end of June to $10 higher at the end of July. The reason was mainly the continued relatively strong economic growth and the market’s growing belief that the US economy will avoid recession. Another factor was Saudi Arabia’s decision to extend the period of cut production (by a million barrels per day) until at least the end of September and the end-of-month agreement between OPEC and Russia to cut output. The price rose to 85 dollars per barrel.

USA:

Monthly data released during August 2023 was mixed. The US economy is still growing, the labor market is cooling, but only slowly for now. The Fed is keeping the door open to further rate hikes. Overall, data released on US GDP growth in the second quarter supports a picture of a still strong US economy, despite the Fed’s rate hike. Real retail sales, after rising during the first quarter, remained at a positive growth rate in the second quarter and into the early part of the third quarter. The labor market, which is still the strongest in 50 years, is responsible for the fact that sales are only 0.1% lower year-on-year, although the first signs of its cooling can already be traced in the numbers. Core PCE inflation slowed to +0.2% month-on-month in June, which was its lowest value this year. Having reached +0.5% month-to-month in January and +0.33% monthly average in the following 4 months with minimal volatility, it has added more than 2% in the first half of the year. The good news is that the price growth of market services slowed further in recent months, reaching +0.8% in the last quarter (it was still +1.3% in the first half of the year). Whether this is permanent disinflation or not cannot be said yet. The tight labor market and the gigantic budget deficit suggest that it is not. The US Federal Reserve did not meet in August. Let’s recall that in July, after the previous short pause in June, it raised rates to the highest value in 22 years (to the range of 5.25-5.5%). In its post-meeting minutes, the Fed said inflation remains “elevated,” job creation has been “robust” in recent months and economic activity continues to “grow at a modest pace.” Looking ahead to the next meeting, the Fed said it will carefully monitor and evaluate the data and make decisions based on it. The president of the Boston Fed, Susan Collins, then admitted during August that rates may still have to rise. And the door to further rate hikes was similarly left ajar by Fed President Jay Powell at the regular meeting in Jackson Hole. restrictive policy for as long as necessary to ensure that inflation is consistently close to the inflation target’.

EU:

The economy in the EU grew in the second quarter, but leading indicators, especially for companies, indicate significant economic weakness in the coming months. The question is whether or to what extent they can be trusted. The dynamics of core inflation remain high. According to preliminary information, the quarter-on-quarter growth rate of GDP reached +0.3% in the 2nd quarter of 2023, which means that the economy grew by 0.6% year-on-year. Spain, whose economy grew by 0.4% quarter-on-quarter, did particularly well, as did France, which added 0.5% quarter-on-quarter in the second quarter. After two previous quarters of slight decline, the German economy stagnated in the second quarter of this year, the Italian economy fell by 0.3% after a strong first quarter. Finally, retail sales in the second quarter, despite the -0.2% month-on-month decrease in June, rose by a total of 0.4% quarter-on-quarter. Germany +1.9% quarter-on-quarter and France +1.9% quarter-on-quarter contributed the most to this among large economies. Italy was negative by -0.7% quarter-on-quarter and Spain -1.1% quarter-on-quarter. Year-on-year, retail sales were down 1.4% at the end of the second quarter, which is an excellent result given the circumstances of high inflation. This is due to the strong labor market. The unemployment rate was near historic lows throughout the first half of 2023. The average value reached 6.5%. In June and July, the unemployment rate fell to a historic low of 6.4%. The lowest unemployment rate among large countries is still in Germany at 2.9%, while the highest is in Spain at 11.6%. To the displeasure of the ECB, quite understandably given the state of the labor market, wages continue to rise. The year-on-year pace of total and core inflation reached +5.3% in August. The ECB did not meet in August, in July it increased rates by another 0.25% to the highest value since 2001 (ie the deposit rate to 3.75%). There was also a “promise” from Lagarde that the ECB would continue to monitor the data and make decisions based on it. The post-meeting press was relatively more dovish than at past meetings, where the ECB repeatedly argued that there was only one way for rates to go, and that was up. At the July meeting, on the other hand, Lagarde said that at the September meeting, rates could go up or remain unchanged. The decision on the further direction of rates will not be easy, as the signals are different.

CR:

Inflation fell to 8.8% in July. In August, it was 8.5%, while the milder drop in year-on-year inflation was related to the rise in fuel prices. The updated data for the 2nd quarter confirmed a quarter-on-quarter GDP growth of 0.1%, and after a long time, household consumption also showed quarter-on-quarter growth. Slightly stronger household consumption, as well as the persistence of the koruna above the level of CZK 24 per euro, will allow the CNB to maintain its negative stance on the issue of an early interest rate cut. Household demand is improving, wages continue to grow relatively quickly. According to the second estimate, GDP growth in the second quarter reached +0.1% quarter-on-quarter. According to the structure published in August, in addition to fixed investments, the aforementioned household demand also contributed to the growth, which increased quarter-on-quarter for the first time since the end of 2021, namely by 0.3%. The unemployment rate in the Czech Republic is the lowest in the EU. Thanks to this, strong wage growth continues. Interestingly, wages in industry rose by 9.1% year-on-year in June, and in construction by 9.9%, with only a minimal drop in employment. For the entire economy, wages increased by 7.7% year-on-year in the 2nd quarter of 2023. Czech consumer inflation in its core component added 0.97% in July, and 1.6% in the last three months. Even though the beginning of summer is under the influence of the usual seasonality associated with holiday prices, the cumulative inflation for June and July, which amounted to +1.5%, is significantly stronger than it was in times when the Czech economy had no problem meeting the inflation target. To give you an idea, the average inflation for June and July in 2007-2019 was just +0.5%. At the CNB meeting in August, rates remained unchanged. No one voted for rate hikes. However, in the minutes of the meeting, there was concern again about “wage development and the labor market, which the Bank Board described as continuing to be very overheated and generating a whole range of pro-inflationary risks.” in the third quarter of this year” and said that its members “agree that the risk of monetary policy being too tight is clearly lower than the risk of monetary policy being too tight in the sense of premature easing”. In other words, the CNB wants to keep rates at 7% for a longer period of time.